Can Rolls-Royce Ride High On Seasonal Strength And Defence Wins

Image Source: Unsplash

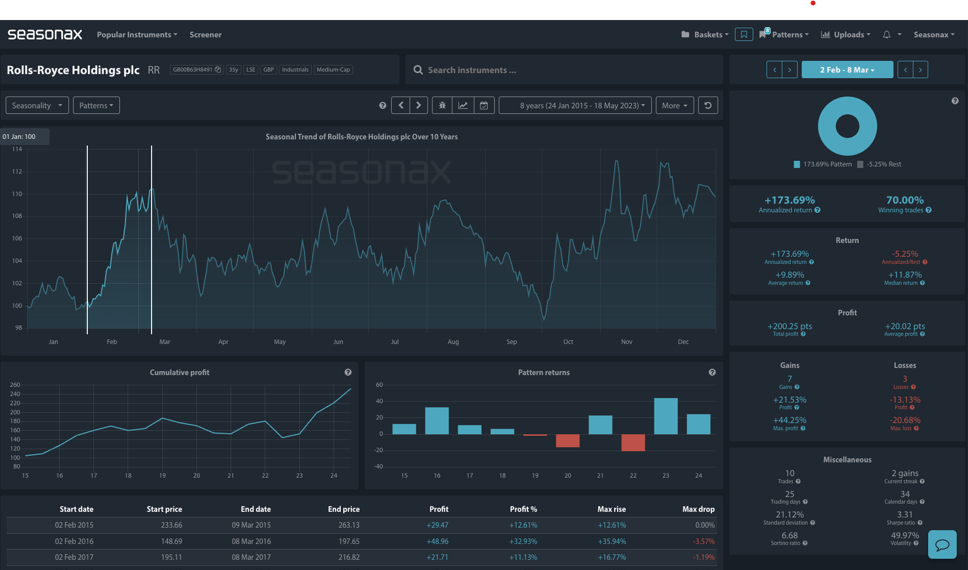

Instrument: Rolls-Royce Holdings plc

Average Pattern Move: +173.69% Annualized Return

Timeframe: February 2 – March 8

Winning Percentage: 70%

Market Analysis and Drivers

Rolls-Royce Holdings plc has received a significant boost with the UK government awarding a £9 billion ($11 billion) contract for the design and manufacture of nuclear reactors to power the nation’s submarine fleet. This long-term contract, named “Unity,” reinforces the Labour government’s commitment to national security and Britain’s nuclear deterrent, while also addressing calls to increase defence spending to 2.5% of GDP from the current 2.3%.

The contract is set to create over 1,000 new jobs and sustain 4,000 existing ones, particularly at Rolls-Royce’s submarine plant in Derby, which is expanding to meet growing demand from the Royal Navy and the AUKUS defence partnership involving the UK, US, and Australia. Defence Secretary John Healey emphasized the strategic importance of the deal, highlighting the government’s dedication to maintaining a robust defence posture in an increasingly volatile global environment.

(Click on image to enlarge)

Seasonal Data Analysis

Historical data reveals that Rolls-Royce shares exhibit exceptional performance during this period, with an impressive annualized return of +173.69% and a winning percentage of 70% over the last decade. The median return stands at +11.87%, while the average return is +9.89%, showcasing consistent upward momentum. The seasonal pattern underscores a strong positive trajectory, supported by a cumulative profit trend that highlights steady gains. Notably, the maximum profit recorded during this timeframe reached +44.25%, but there have been losses as large as 20.68% so, there are two way risks here. However, will the new contract support further upside in line with the seasonal bias for gains coming up?

Technical Perspective

From a technical standpoint, Rolls-Royce have been on a strong bull run since the start of 2013. Any pullbacks to 570 will form a potential re-test of the long term weekly trend line (marked below in red). Should that level break the 500 looks a key level at the 100 EMA on the weekly chart (marked below)

(Click on image to enlarge)

Trade risks

Geopolitical tensions and policy changes could impact defence spending and sentiment around Rolls-Royce’s contracts. Additionally, broader market volatility or shifts in interest rates may weigh on investor confidence.

More By This Author:

European Economic Outlook: January Data Expected To Mirror December's StrugglesHow Trump Can Boost Stocks, Lower Oil Prices, Bring Peace To Ukraine

What Impact Will Trump’s U.S. Administration Have On The USD?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more