Can O'Reilly Fix Your Portfolio?

Summary

- 100% technical buy signals.

- 17 new highs and up 11.56% in the last month.

- 38.81% gain in the last year.

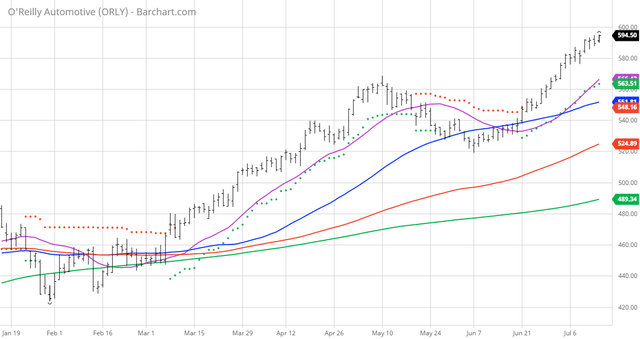

The Barchart Chart of the Day belongs to the automotive parts retailer O'Reilly Automotive (Nasdaq: ORLY). I sorted Barchart's All-Time High list first by the highest number of new highs in the last month, then used the Flipchart function to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 6/11 the stock gained 21.76%.

O'Reilly Automotive, Inc., together with its subsidiaries, operates as a retailer of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States. The company provides new and remanufactured automotive hard parts and maintenance items, such as alternators, batteries, brake system components, belts, chassis parts, driveline parts, engine parts, fuel pumps, hoses, starters, temperature control, water pumps, antifreeze, appearance products, engine additives, filters, fluids, lighting products, and oil and wiper blades; and accessories, including floor mats, seat covers, and truck accessories. Its stores offer auto body paint and related materials, automotive tools, and professional service provider service equipment. The company's stores also offer enhanced services and programs comprising used oil, oil filter, and battery recycling; battery, wiper, and bulb replacement; battery diagnostic testing; electrical and module testing; check engine light code extraction; loaner tool program; drum and rotor resurfacing; custom hydraulic hoses; and professional paint shop mixing and related materials. Its stores provide do-it-yourself and professional service provider customers a selection of products for domestic and imported automobiles, vans, and trucks. As of December 31, 2020, the company operated 5,616 stores. O'Reilly Automotive, Inc. was founded in 1957 and is headquartered in Springfield, Missouri.

Barchart technical indicators:

- 100% technical buy signals

- 42.72+ Weighted Alpha

- 38.81% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 11.56% in the last month

- Relative Strength Index 78.10%

- Technical support level at 586.64

- Recently traded at 595.83 with a 50 day moving average of 551.80

Fundamental factors:

- Market Cap $41.13 billion

- P/E 22.21

- Revenue expected to grow 4.90% this year and another 4.0% next year

- Earnings estimated to increase 10.60% this year, an additional 7.0% next year and continue to compound at an annual rate of 12.42% for the next 5 years

- Wall Street analysts issued 11 strong buy, 5 buy and 10 hold recommendations on the stock

- The individual investors following the stock on Motley Fool voted 344 to 29 that the stock will beat the market

- 15,730 investors are monitoring the stock on Seeking Alpha

Disclaimer: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more