Can Home Depot's (HD) Strategies Help Overcome Near-Term Woes?

The Home Depot Inc. (HD - Free Report) has been witnessing continued pressure in some big-ticket, discretionary categories, a trend which started in fourth-quarter fiscal 2022. Deflation of core commodity categories, particularly in lumber prices, has been affecting the top-line performance.

Home Depot reported dismal second-quarter fiscal 2023 results, with the top and bottom lines declining year over year. However, earnings and sales surpassed the Zacks Consensus Estimate. Results have been impacted by a more broad-based pressure across the business, driven by softened demand versus expectations.

The company’s fiscal second quarter comparable sales (comps) were impacted by continued deceleration across many departments and pressures in several big-ticket discretionary categories. Both DIY and pro customers were negative in the fiscal second quarter.

Soft Q2 Performance

Home Depot’s overall comps and the United States comps declined 2%. Comps were impacted by a decline in customer transactions, partly offset by a rise in average ticket. The company noted that all three U.S. divisions reported negative low-single-digit comps in the fiscal second quarter. Only six of the 14 merchandising categories reported positive comps, including building materials, outdoor garden, hardware, plumbing, tools and millwork.

While the company witnessed improvement in weather conditions from the prior quarter, pressures from soft sales in big-ticket discretionary categories continued to impact comps. Customer transactions declined 1.8% year over year, while the average ticket rose 0.1%. Sales per retail square foot were down 2.3%.

Excluding core commodities, comp average ticket was mainly impacted by inflation across several product categories and the demand for new and innovative products. Deflation from core commodity categories, primarily in lumber, negatively impacted the company’s average ticket growth by 160 basis points in the fiscal second quarter. Lumber prices declined significantly from the year-ago quarter’s levels. Negative lumber price offset by improvement in unit productivity had an 85-basis points impact on comps.

In second-quarter fiscal 2023, Home Depot recorded a 23.1% increase in interest expenses, mainly due to interest charged on its floating rate debt and a higher long-term debt position compared with the prior-year quarter’s figure. As of Jul 30, 2023, the company’s long-term debt of $40,754 million increased 3.8% year over year. Management expects interest expenses for fiscal 2023 to be $1.8 billion.

Driven by the continued soft trends in big-ticket, discretionary categories, Home Depot retained its bleak view for fiscal 2023 sales and earnings. Home Depot anticipates sales and comparable sales to decline 2-5% year over year in fiscal 2023. The operating margin rate is estimated at 14-14.3%. The company expects an effective tax rate of 24.5% in fiscal 2023. HD estimates earnings per share to move down 7-13% year over year in fiscal 2023.

Is Home Depot Well-Placed for the Long-Term?

Home Depot stands to capitalize on the benefits of the “One Home Depot” investment plan, which focuses on expanding supply-chain facilities, technology investments and enhancement to the digital experience. The interconnected retail strategy and underlying technology infrastructure have helped consistently boost web traffic for the past few quarters.

Enhanced search capabilities and improved Pro site experience, the more robust fulfillment capabilities have driven the company’s online conversions. The company’s strategy of providing an interconnected experience resonates well with customers, as around 50% of the online orders were fulfilled through stores in the fiscal second quarter.

Home Depot remains focused on expanding its business and is positioned to capture market share. The management noted that it witnessed improved customer engagement in the home improvement projects, particularly for small projects, in the fiscal second quarter.

In the future, the company will remain focused on navigating the unique and uncertain environment by operating with agility amid evolving consumer trends. It also expects to drive productivity and efficiency throughout the business. As a result, it expects to deliver on its previously announced $500 million in annualized cost savings in 2024.

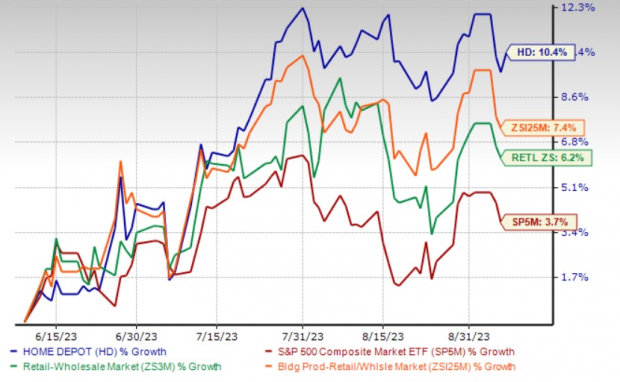

Shares of Home Depot have risen 10.4% in the past three months compared with the industry’s growth of 7.4%. The Zacks Rank #3 (Hold) stock’s performance also compared favorably compared with the Retail-Wholesale sector’s gain of 6.2% and the S&P 500’s growth of 3.7% in the same period.

Image Source: Zacks Investment Research

More By This Author:

3 Midstream Stocks To Gain Amid Energy Market Volatility

4 Industrial Services Stocks Countering Industry Headwinds

Buy These 3 Cheap Tech Stocks For Growth

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more