Calyxt, Inc.: Regulatory Hurdles Keep Us Cautious On This (Otherwise Exciting) IPO

Calyxt Inc. (Nasdaq: CLXT) filed an S-1/A with the Securities and Exchange Commission for its planned initial public offering.

The company intends to offer 6,060,606 shares at a marketed price range of $15 to $18. It has an additional 909,091 shares over-allotted for its underwriters.

The underwriters for the offering include Citigroup, Jefferies, Wells Fargo Securities, BMO Capital Markets and Ladenburg Thalmann.

If CLXT prices at the midpoint of its proposed range, it will have a market capitalization of $438.4M.

Business overview

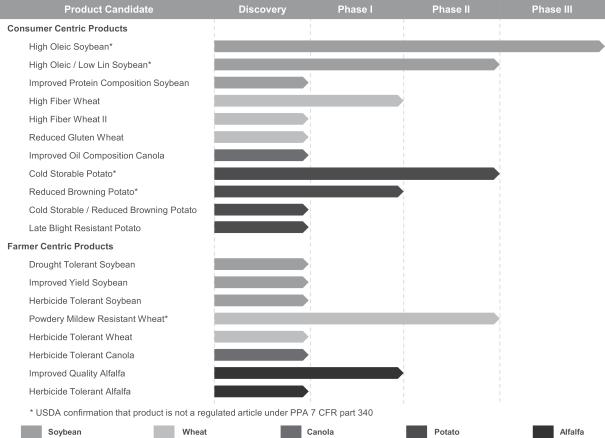

Calyxt Inc. was founded in 2010 and is based in Brighton, Minnesota. It was originally founded as a subsidiary of France-based Cellectics. The company is focused on developing GMOs that it characterizes as improved strains over their common agricultural counterparts.

The company's first product candidate, a high-oleic soybean to make oils with zero grams of trans fats and reduced amounts of saturated fats, is expected to be commercially released by the end of 2018.

(SEC Filings)

Management team overview

André Choulika is the chairman of the board of directors of Calyxt and has served in that role since Aug. 2010. Choulika is a co-founder of the parent company, Cellectis, and he has served as its chief executive officer since its founding in 1999 and as its chairman of the board since 2011. Choulki worked as a post-doctoral fellow at Boston Children's Hospital in the Division of Molecular Medicine from 1997 to 1999. He graduated with his Ph.D. in molecular virology from The Unversity of Paris VI and completed a research fellowship at the Harvard Medical School's Department of Genetics.

Federico A. Tripodi is the chief executive officer and has served in that role since May 2016. Tripodi has nearly two decades of experience in agricultural biotechnology and seeds. Before joining Calyxt, Tripodi was the general manager for Monsanto's sugar cane division for almost three years in Brazil. Before that, he held multiple roles at Monsanto company from 2001 to 2008. Tripodi holds an undergraduate degree in agronomic engineering from Buenos Aires University and a Master of Business Administration from Washington University.

Financial highlights and risks

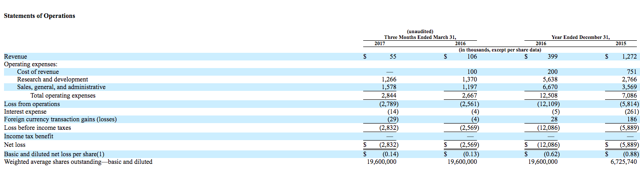

Calyxt reported revenues of $399,000 and $1,272,000 for the years ending on Dec. 31, 2016, and Dec. 31, 2015, respectively. It also reported revenues of $55,000 and $106,000 for the three months that ended on March 31, 2017, and March 31, 2016, respectively. The company posted net losses of $12,086,000 in 2016 and of $5,889,000 in 2015. For the first three months of 2017 and 2016, it reported net losses of $2,832,000 and $2,569,000, respectively.

(SEC Filings)

Among the company's risk factors, it reports that it has endured losses since its formation and that it may continue to see continued losses into the foreseeable future. Its first product will not be commercially available before the end of 2018, and the company has a limited operational history. Calyxt plans to use its proceeds to fund its research, commercialization activities, to provide working capital and for general corporate purposes.

Competitors

Calyxt notes that its industry is highly competitive. It faces competitors such as Monsanto Co. (MON), Dow Chemical Co. (DOW) and many specialty providers of seeds and other agricultural products.

Conclusion: Hold Off On An IPO Investment

Calyxt has a short operational history and faces multiple regulatory hurdles for its products.

It has posted consistent losses and does not anticipate the commercial release of its first product until the end of 2018.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more