Callaway Golf: This Top 2021 Pick Still Has Room To Run

As we kicked off the new year, we highlighted several stocks for our Top Picks of 2021 special report. One seemingly random name was Callaway Golf Company (NYSE: ELY). Sure, golf was a great socially distant activity during the pandemic but picking a niche golf brand to excel after the pandemic seemed out of the left field. Yet roughly halfway through 2021, ELY is up 41% year-to-date and as the rest of the broad market sold off this past week, the stock bucked the trend, turning in a weekly win of 9.2%. What can we learn from the ELY pick, and what does the company's success mean for the rest of the retail sector?

Callaway's first-quarter report drove --no pun intended – this week's bull gap after the company reported adjusted earnings of 62 cents per share on $651.62 million in revenue, both of which walloped analyst expectations of 32 cents per share on $561.55 million in revenue. More important than the blowout numbers, the company's post-earnings conference call revealed two macro trends that investors could use as clues for spotting the next ELY-type winner.

First, the brick-and-mortar TopGolf acquisition exceeded expectations, allowing Callaway to increase its financial projections. On the conference call, Callaway noted it has three more venues on track for opening in 2021 – bringing the year-to-date tally to eight. It's not outlandish to say you can replace "TopGolf" with any other brick-and-mortar venue generator from a similar retail company, like Dave & Busters (PLAY), or casinos. As long as a company's venues and stores are reopening, the waning stages of the pandemic has created an "unprecedented" demand for in-person spending.

That's looking toward the future. To stay alive the past year though, retailers like Callaway had to adapt to pandemic life. Per the conference call: "For the last year, the hero of the soft goods and apparel segment is certainly e-com. This is a channel that was significantly strengthened by investments we made prior to the pandemic as well as us continuing to this day." The broader takeaway investors should have here is to look for retail companies that have heavily invested in e-commerce BEFORE the pandemic forced their hand. In a way, Callaway's earnings report is a roadmap for investors in finding the next big winner on the charts.

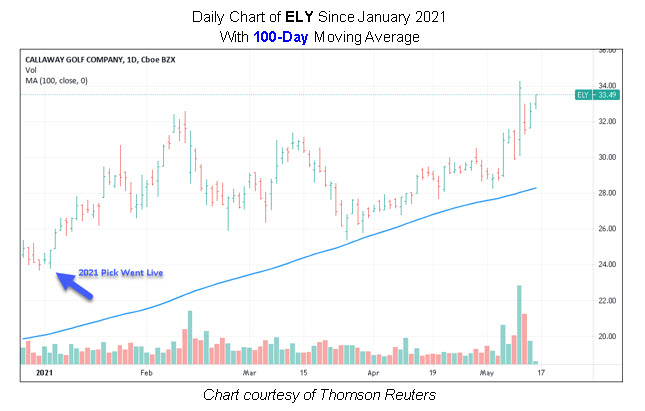

When we first named Callaway stock a top pick for 2021, Schaeffer's Senior Market Strategist Chris Prybal noted it had just formed a double-top formation that looked primed for a breakthrough, perhaps in the wake of a volatility event such as earnings. On the first trading day of 2021, a few days after our Top 21 report went live, Callaway stock closed at $24.28. On Tuesday, ELY hit a record high of $33.97 and crossed a $5 billion market cap. All the while, pullbacks in the last two months have found support at the shares' ascending 100-day moving average.

Prybal also cited an unwinding of pessimism among analysts and short sellers. Five months in, and those scales have yet to fully tip. Despite the avalanche of post-earnings bull notes earlier in the week, ELY's 12-month consensus price target of $36.20 was a slim premium to Friday's closing perch of $33.76. And among short sellers, short interest has begun to fall off in the last two reporting periods, yet the 10.95 million shares sold short still account for a healthy 11.6% of the stock's total available float. At ELY's average pace of trading, it would take shorts nearly six days to buy back their bearish bets; an ample amount of buying power that can unwind and fuel additional upside.

This pseudo-postmortem was not meant to just pat ourselves on the back. It's meant to show that when combined with fundamental and technical factors (a 3-tiered methodology we call Expectational Analysis®), sentiment becomes a powerful tool for analyzing stocks, sectors, or the overall market. It becomes especially potent during earnings season when one can sift through conference calls and pluck out pertinent information that may influence the next trading idea.