Buying Twilio Stock During The Market Panic

The 2020 market selloff is creating both huge short-term risks and massive long-term opportunities for investors. It is important to manage your overall portfolio risk in a smart way during this period, but you also want to capitalize on the opportunity to buy high-quality growth stocks at attractive valuation levels. With this in mind, I have been buying Twilio (TWLO) stock during the market crash in recent weeks.

It is hard to know what will happen to the stock price in the next 1 to 3 months, but over the next 1 to 3 years there is a good chance that Twilio stock will deliver remarkably attractive returns from current levels.

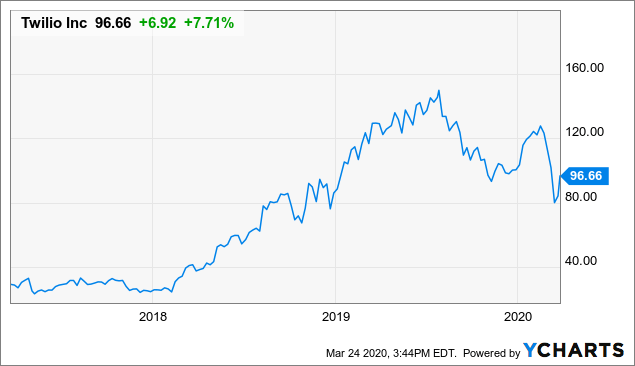

The Business And The Stock Price

Twilio made historical highs at $150 per share in June of last year, and the stock has retraced by over 35% from those levels. However, the company keeps firing on all cylinders and growing at full speed as of the most recent earnings report.

Like all other companies in the world, Twilio will be facing increased uncertainty in the near term, and the economic slowdown could have a material impact on the business. But the company is in a position of strength to benefit from growing demand for all kinds of online communications in the years ahead.

(Click on image to enlarge)

Data by YCharts

Twilio is a communication platform-as-a-service that developers can utilize to facilitate communication via text, voice, video, and email in 180 countries. When you send a voice message via WhatsApp, or when you get a notification from Uber, those services are powered by Twilio.

These kinds of communications are increasingly crucial for corporations in times of social distancing, and the current crisis will highlight the utmost importance of building strong relationships with customers and providing the best possible engagement experience via world-class communications tools.

According to data from Gartner, 30% of enterprises will embed communications into digital processes using APIs from CPaaS vendors in 2020, up from less than 5% in 2017. Gartner predicts end-user spending on CPaaS will grow at a compound annual growth rate of 49.6% to reach $4.63 billion by 2021.

Twilio has a reputation for quality and innovation, and the company offers scalable solutions that can be rapidly implemented on a global scale. As the company continues expanding its portfolio of solutions and entering new areas, Twilio is in a position of strength to profit from massive growth opportunities in the long term.

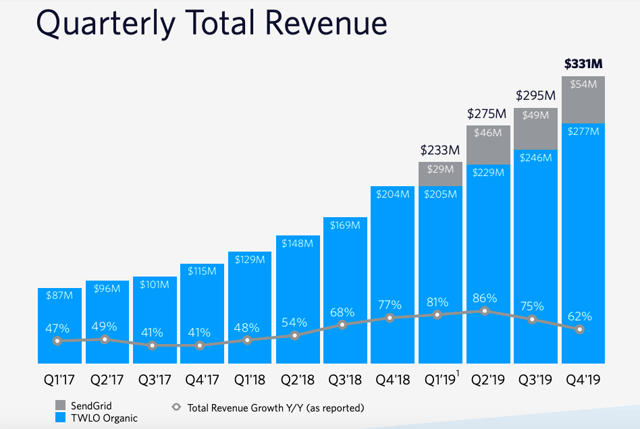

Firing On All Cylinders And Investing For Growth

Twilio is growing at full speed, with revenue increasing by 62% year over year and beating Wall Street expectations last quarter. But the company is aggressively investing for further growth, and this is hurting profitability.

Total revenue reached $331.2 million in the fourth quarter of 2019, up 62% from the fourth quarter of 2018 and 12% sequentially from the third quarter of 2019. Dollar-based net expansion rate was 124% during the period, showing that the company is not only retaining its customers but also increasingly monetizing those customers with more and better solutions.

(Click on image to enlarge)

Source: Twilio

Twilio's growth rates are truly outstanding, but management is expecting further losses in 2020 due to growth investments. In times of rising economic uncertainty and declining risk appetite on a global scale, investors tend to stay away from companies that are burning money.

However, Twilio is doing the right thing by prioritizing long-term growth opportunities above short-term earnings numbers.

In the words of founder and CEO Jeff Lawson:

As I'm sure you've noticed, we have an ambitious investment plan for 2020. While we could take a profit this year, I think, that would have been a wrong decision. With a generational opportunity to disrupt not just communications, but also customer engagement software, the right decision is to invest for long-term growth and market capture, and that's what we intend to do.

Twilio has over $1.8 billion in cash and liquid investments on its balance sheet, and the company has a business model supported by recurrent revenue. Even if growth slows down in the near term, Twilio has the financial resources to successfully sail through the storm.

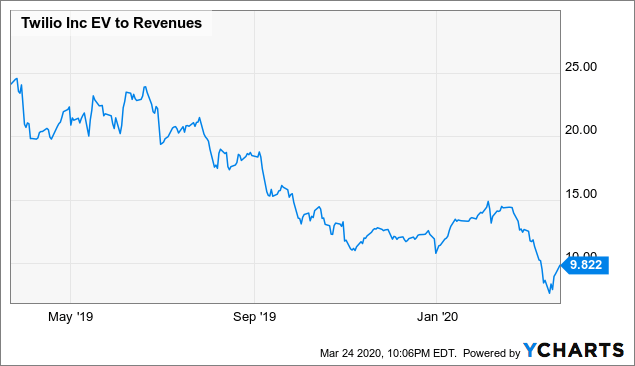

Valuation Is Coming Down

Over the past year, Twilio has delivered rock-solid revenue growth, while the stock price has been declining. As a result, the stock trades at an EV to Revenue ratio that is less than half the valuation levels from one year ago. Twilio is not cheap in comparison to the broad market, but it's not too expensive either in comparison to other high growth companies in the industry.

(Click on image to enlarge)

Data by YCharts

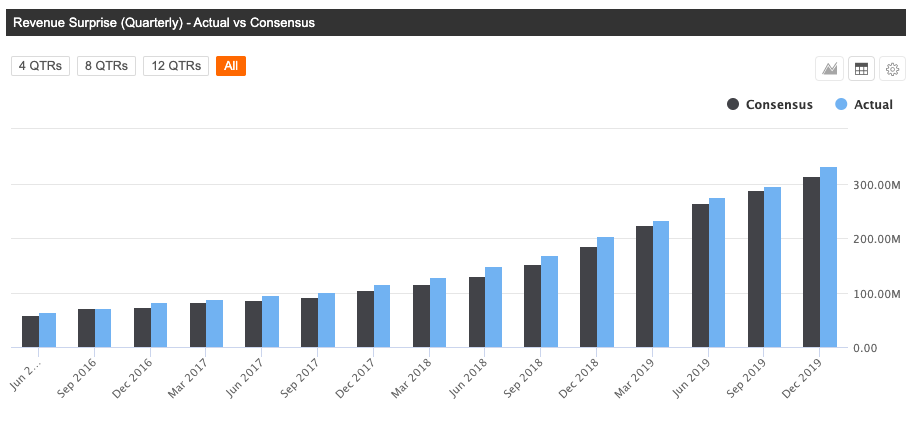

Importantly, the company has delivered revenue numbers above market expectations in each of the past 16 quarters. Past performance does not guarantee future returns, but it's good to know that management likes to under promise and overdeliver. To the extent that the past is a valid guide for the future, the stock could actually be much cheaper than what the numbers indicate if Twilio continues delivering revenue above expectations.

(Click on image to enlarge)

Source: Seeking Alpha

Risk And Reward Going Forward

High growth stocks such as Twilio can be particularly vulnerable to the downside in a bearish market environment such as the one we have been facing in recent weeks. In this kind of context, it is of utmost importance to acknowledge the massive volatility and to manage portfolio risk accordingly.

Personally, I was 50% in cash when the correction started in February, and I have slowly increased my long exposure to 70% as the market declined. This allows me to seize the opportunity to buy companies such as Twilio at attractive prices, while also keeping cash at hand in case things keep getting worse and prices continue going lower in the following weeks.

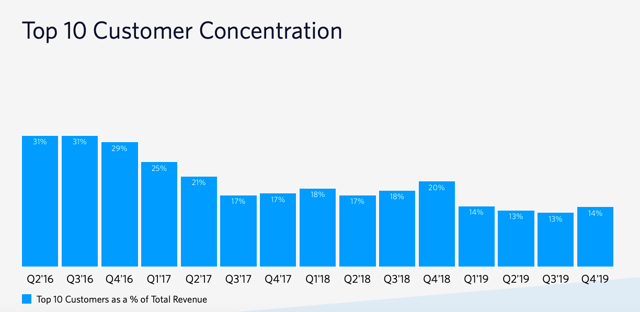

Regarding the company-specific factors, Twilio has considerable customer concentration among the big tech corporations. This allows the company to benefit from booming demand for all kinds of online services in the years ahead, like selling shovels during the gold rush.

However, this concentration can also have a negative impact on profit margins due to the negotiating power of those clients, and it's always a relevant factor to watch. That being acknowledged, it's also worth noting that management is doing a solid job at consistently diversifying its customer base.

(Click on image to enlarge)

Source: Twilio

In the near term, anything can happen to the stock market in general and to Twilio stock in particular during periods of rampant volatility. From a fundamental perspective, the business is not immune to a recession, but Twilio is well-positioned to go through challenging periods, and the company has what it takes to emerge from this crisis in a stronger than ever shape.

Short-term uncertainty usually creates buying opportunities for long-term investors with a strategic mindset, and Twilio stock looks like a compelling opportunity at current prices.

Disclosure: I am/we are long TWLO.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

moreComments

No Thumbs up yet!

No Thumbs up yet!