Buyback Bonanza: 3 Companies Scooping Up Shares

Image Source: Pexels

Stock buybacks, or share repurchase programs, are commonly executed by companies to boost shareholder value.

A stock buyback occurs when a company purchases outstanding shares of its stock. In its simplest form, buybacks represent companies essentially re-investing in themselves.

In 2024, several companies – Apple (AAPL - Free Report), Marathon Petroleum (MPC - Free Report), and AutoNation (AN - Free Report) – have unveiled repurchase programs. Let’s take a closer look at each.

Apple

Apple recently reported quarterly results, bringing post-earnings fireworks. Concerning headline figures, the company posted a 1.3% beat relative to the Zacks Consensus EPS estimate and posted sales 1% ahead of expectations.

To the surprise of many, the tech titan announced the biggest buyback in corporate history totaling $110 billion. Reflecting further positivity, Apple also unveiled a 4% boost to its quarterly payout, reflecting the 12th consecutive year of higher payouts.

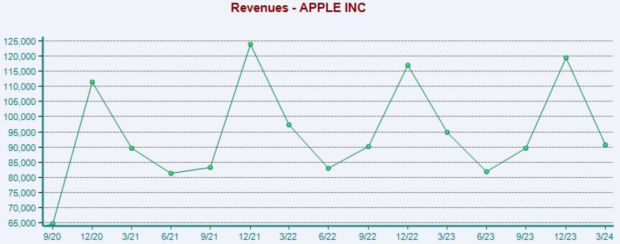

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Marathon Petroleum

MPC is also coming off a recent double beat, with the company posting a 10% surprise relative to the Zacks Consensus EPS estimate and reporting sales 6% ahead of the consensus. The company unveiled an additional $5 billion share buyback program.

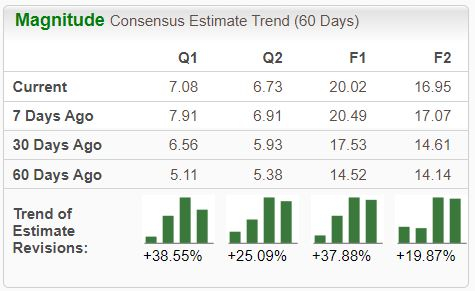

The company’s earnings outlook overall remains positive across the board, with some adjustments hitting the tape post-earnings.

Image Source: Zacks Investment Research

AutoNation

AutoNation shares have marginally outperformed the S&P 500 year-to-date, with its recent set of quarterly results boosting performance. The company recently unveiled an additional $1 billion share buyback program.

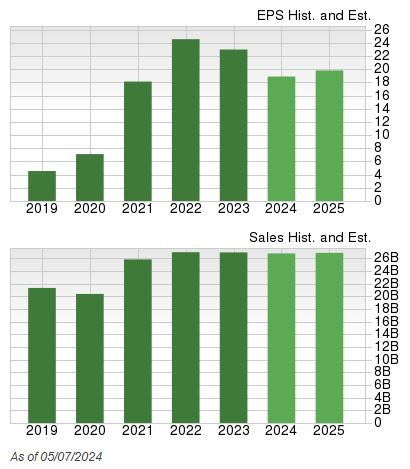

The company’s growth is forecasted to cool in its current fiscal year, with the $18.78 Zacks Consensus EPS estimate suggesting an 18% year-over-year decline on -0.2% lower sales. Growth is expected to resume modestly in FY25, as consensus expectations suggest a 5% recovery on 0.8% improved sales.

Image Source: Zacks Investment Research

Bottom Line

A common way that companies amplify shareholder value is through implementing share buybacks. They can provide a nice confidence boost for investors, indicating that the company is utilizing excess cash and can help put in a floor for shares.

And recently, all companies above – Apple, Marathon Petroleum, and AutoNation – unveiled additional or fresh buyback programs.

More By This Author:

Three Tech Stocks To Buy For Passive IncomeBear Of The Day: Starbucks

These 3 Companies Shattered Quarterly Records