Buy Walmart Stock For Steady Growth As Q4 Earnings Approach?

Image Source: Mike Mozart, Flickr

Walmart (WMT - Free Report) will give insight into the current state of consumer shopping behavior, with the omnichannel retailer set to release its Q4 results on Thursday, February 20.

Broadly speaking, inflationary pressures have started to ease following several rate cuts in 2024, but Walmart has kept a competitive advantage over Target (TGT - Free Report), which tends to offer premium goods at a higher cost. Furthermore, Walmart’s online expansion has put the company in a better position to compete with e-commerce titan Amazon (AMZN - Free Report).

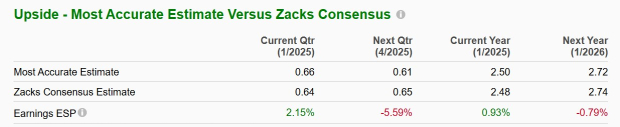

Walmart’s Q4 Expectations

Year over year, Walmart’s Q4 sales are thought to have increased 3% to $179.18 billion. On the bottom line, Q4 EPS is expected to be up 6% to $0.64. More intriguing, The Zacks ESP (Expected Surprise Prediction) indicates Walmart could surpass earnings expectations with the most up-to-date analyst revisions (Most Accurate Estimate) having Q4 EPS pegged at $0.66 and 2% above the Zacks Consensus.

Image Source: Zacks Investment Research

Notably, Walmart has reached or exceeded earnings expectations for 10 consecutive quarters with an average EPS surprise of 9.25% in its last four quarterly reports.

Image Source: Zacks Investment Research

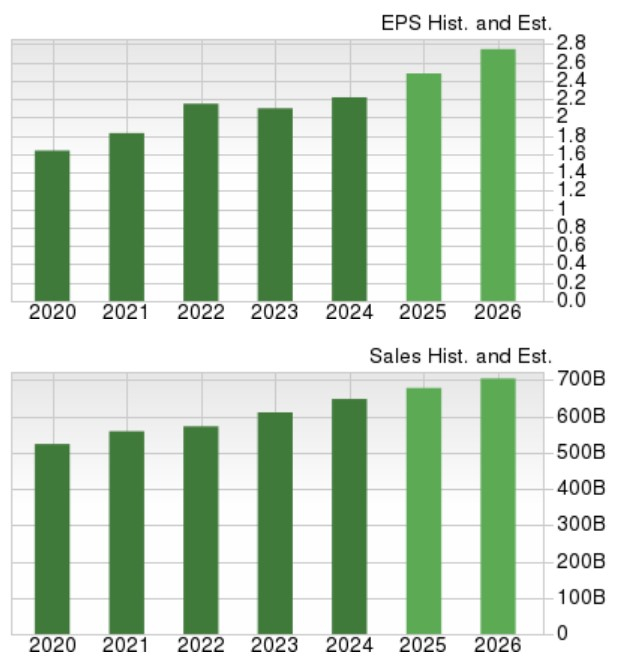

Tracking Walmart’s Outlook

Wrapping up its current fiscal year 2025, Walmart’s total sales are slated to increase 5% to $678.56 billion versus $648.13 billion in FY24. Based on Zacks estimates, Walmart’s top line is projected to expand another 4% in FY26 to $704.61 billion.

Even better, Walmart’s annual earnings are slotted to rise 12% to $2.48 per share, from EPS of $2.22 in FY24. Plus, Zacks projections call for Walmart’s EPS to expand another 11% in FY26 to $2.74.

Image Source: Zacks Investment Research

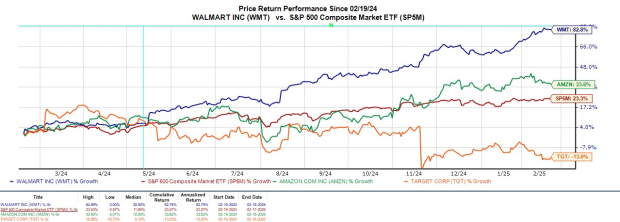

WMT Performance & Valuation

Pounding the question of whether it’s time to buy WMT for more upside, Walmart’s stock has already risen over +70% since its 3-1 stock split last February. Over the last year, WMT has impressively outperformed the broader market and Amazon’s +33%, with Target shares down a dismal -13%.

Image Source: Zacks Investment Research

Trading around $103, Walmart stock is at a 37.9X forward earnings multiple, a noticeable premium to the benchmark S&P 500’s 23X. WMT also trades well above Target’s 13.7X but is near Amazon’s 36.2X.

Image Source: Zacks Investment Research

Takeaway

Ahead of its Q4 report, Walmart’s stock sports a Zacks Rank #2 (Buy). To that point, Walmart’s EPS growth has started to justify its price-to-earnings premium to the broader market, especially with the Zacks ESP suggesting the company could exceed Q4 bottom line expectations.

More By This Author:

Buy Walmart Stock On Likely Q4 Earnings Beat And Ongoing Rally3 Momentum Energy Stocks To Focus On This Earnings Season

3 Stocks That Can Benefit From Valentine's Day Momentum: AMZN, M, VSCO

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more