Buy This Retail Stock At A Bargain For Long-Term Growth?

Five Below, Inc. (FIVE) stock has tumbled in 2022 to extend its downturn from its August records. FIVE shares did pop on Monday and the discount retailer’s outlook remains strong as it carves out a rather unique lane in the highly-competitive retail market dominated by the giants.

Should investors consider buying Five Below stock ahead of its Q4 FY21 financial release on Wednesday, March 30?

Discount Niche

Five Below sells what it calls “trend-right, high-quality products loved by tweens, teens and beyond.” Five sells a range of products, for between $1 to $5—though some cost more—under categories such as sports, tech, candy, books, and others.

Five Below operates over 1,200 stores across 40 states. The discount retailer doesn’t compete directly against Dollar General since its offerings are more non-essential items geared to younger customers. Five Below’s ability to corner this area of the retail market helps it grow even as Amazon, Target, Walmart, and other titans gobble up more retail market share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Five Below’s bulked-up e-commerce offerings includes same-day delivery options and more. The company also continues to open new locations at an impressive clip. FIVE opened 52 new stores across 24 states during the third quarter alone. Five Below’s revenue climbed by between around 20% to 30% for seven-straight years until Covid, having posted even larger growth before that run.

FIVE did take a hit during the initial economic shutdown. But Five Below bounced back in the second half to post 6% sales growth last year. Most recently, the firm’s third quarter sales surged 27%, with comps up 15% and adjusted earnings 19% higher.

Looking ahead, Zacks estimates call for Five Below’s 2021 revenue to soar 46% from $1.96 billion to $2.86 billion to help lift its adjusted earnings by 133% to $4.95 a share. Its adjusted 2022 EPS are then projected to climb another 18% on 17% stronger revenue.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Five Below’s earnings estimates have remained largely unchanged recently to help FIVE grab a Zacks Rank #3 (Hold) at the moment. The company has, however, crushed our bottom-line estimates by an average of 22% in the trailing four quarters, including a 48% beat in Q3. Plus, 11 of the 12 brokerage recommendations Zacks has are “Strong Buys,” with the other at a “Buy.” Wall Street is also much higher on Five Below today vs. three months ago.

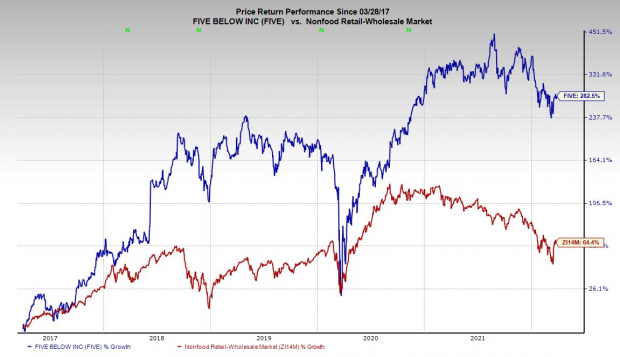

FIVE have climbed 275% in the last five years to destroy its industry’s 62% and the S&P 500’s 100%. Five Below shares have tumbled 30% since hitting new highs back in August, with FIVE down 20% in 2022. The stock did pop 1.8% to close regular trading hours Monday at $165 per share, which is 44% below FIVE’s current Zacks consensus price target of roughly $237 a share.

The downturn has Five Below trading at a discount to where it was prior to the initial covid selloff at 27.2X forward 12-month earnings. This also represents 25% value to its five-year median of 36.2X. All that said, investors might want to consider buying Five Below at these levels as a long-term addition.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more