Buy These Defensive Stocks After Beating Earnings Expectations?: ACI, JNJ

Image Source: Pixabay

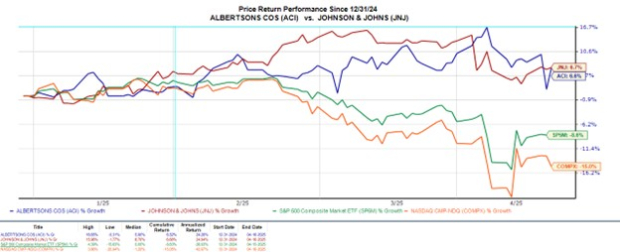

Johnson & Johnson (JNJ - Free Report) and Albertsons Companies' (ACI - Free Report) stock have provided a pleasant hedge against market volatility, with the S&P 500 and Nasdaq remaining near correction territory. Meanwhile, ACI and JNJ shares are up a respectable 6% year to date, respectively.

Furthermore, the pharmaceutical giant and grocery retailer were able to exceed their quarterly expectations on Wednesday, and investors may be wondering if it’s time to add positions in these defensive-performing stocks.

Image Source: Zacks Investment Research

Johnson & Johnson’s Q1 Results

Attributed to DARZALEX, a drug treatment for myeloma blood cancer, Johnson & Johnson’s Q1 sales rose 2% to $21.89 billion and eclipsed estimates of $21.61 billion. This marked Johnson & Johnson’s third straight quarter with sales of more than $3 billion, as DARZALEX had another quarter of 20% growth.

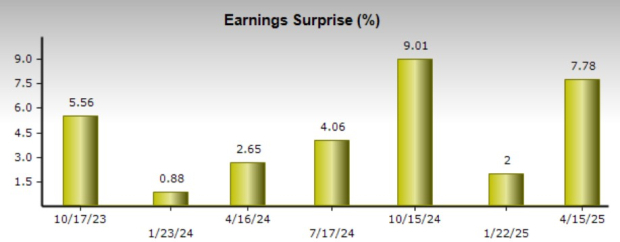

On the bottom line, Q1 earnings increased 2% to $2.77 per share, comfortably exceeding EPS expectations of $2.57 by 7.78%. Notably, Johnson & Johnson has continued a prolonged streak of passing the Zacks EPS consensus with an average earnings surprise of 5.71% in its last four quarterly reports.

Image Source: Zacks Investment Research

Albertsons’ Q4 Results

Reporting results for its fiscal fourth quarter, Albertsons' Q4 sales were up 2% to $18.79 billion, surpassing estimates of $18.62 billion. Digital platforms led to what CEO Vivek Sankaran cited as getting the company’s mojo back since the termination of the Kroger (KR Quick QuoteKR - Free Report) merger, with E-commerce sales spiking 24%. It’s noteworthy that Sankaran will be retiring at the end of the month and will be replaced by VP & COO Susan Morris.

Albertsons' Q4 EPS of $0.46 beat expectations of $0.40 despite falling from $0.54 a share in the comparative quarter. Albertsons has reached or exceeded the Zacks EPS Consensus in each of the last four quarters with an average earnings surprise of 7.21%.

Guidance & Outlook

Raising its top-line guidance, Johnson & Johnson now expects full-year sales at $91 billion-$91.8 billion, which came in above the current Zacks Consensus of $89.99 billion. Based on Zacks estimates, Johnson & Johnson’s sales are projected to rise another 4% in FY26 to $93.47 billion.

However, Johnson & Johnson did lower its FY25 EPS guidance to reflect the implications of tariff costs from a a range of $10.75-$10.95 to $10.50-$10.70. Still, this EPS outlook fell in line with estimates of $10.51 or 5% growth. Plus, Zacks' projections call for Johnson & Johnson's annual earnings to increase 4% in FY26 to $10.99.

Image Source: Zacks Investment Research

As for Albertsons, the grocer provided EPS guidance for its current FY26 in the range of $2.03-$2.16, which came in below expectations of $2.33 and would be a shaprer decline from earnings of $2.34 per share in FY25. That said, FY27 EPS is projected to rebound and rise 5% to $2.44 per share.

Albertsons' sales are expected to increase 3% in FY26 and are forecasted to expand another 1% in FY27 to $83.25 billion.

Image Source: Zacks Investment Research

Bottom Line

For now, Johnson & Johnson and Albertsons stock both land a Zacks Rank #3 (Hold). To that point, the defensive safety they can provide may continue thanks to the essentiality of their businesses, but there could certainly be better buying opportunities considering their somewhat underwhelming guidance.

More By This Author:

Earnings Preview: AT&T Q1 Earnings Expected To DeclineTSLA Q1 Earnings Preview: Can Energy Storage Offset Weak EV Sales?

Which Mag-7 Stock, Apple Or Nvidia, Should You Buy For Tariff Relief?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more