Buy These 3 Small Cap Rockets With Big Potential

I have found that small cap stocks have provided the biggest outsized returns in my portfolio over the years. However, this sector has much higher volatility than my core long-term holdings which tend to be concentrated in large cap growth stocks going for reasonable valuations like Apple (NASDAQ: AAPL) and Gilead Sciences (NASDAQ: GILD). I expect these core investments to outperform the market over the next three to five years but not to deliver the multi-bag returns I frequently get from some of my better small cap selections. These types of solid long-term growth plays are core positions within my Blue Chip Gems portfolio.

I have found that small cap stocks have provided the biggest outsized returns in my portfolio over the years. However, this sector has much higher volatility than my core long-term holdings which tend to be concentrated in large cap growth stocks going for reasonable valuations like Apple (NASDAQ: AAPL) and Gilead Sciences (NASDAQ: GILD). I expect these core investments to outperform the market over the next three to five years but not to deliver the multi-bag returns I frequently get from some of my better small cap selections. These types of solid long-term growth plays are core positions within my Blue Chip Gems portfolio.

This passion for equities with less than a $2 billion market capitalization led me to launch the Small Cap Gems portfolio in mid-2014 whose 20 core holdings have already produced two triples with Avanir Pharmaceuticals (NASDAQ: AVNR) that was bought out by a larger Japanese pharma concern in December and Eagle Phamaceuticals (NASDAQ: EGRX) which is up more than 200% since being included in the portfolio and still moving up.

Small cap stocks receive less analyst coverage than their larger cap brethren and tend to have sharper swings, both up and down. It is very important to have a well-diversified portfolio of promising small cap stocks within one’s portfolio to mitigate volatility within this portion of my portfolio. I generally take stakes one-third as large as in my large cap growth picks.

Here are a couple of attractive stocks in the small cap arena I own that currently sell under $10 a share.

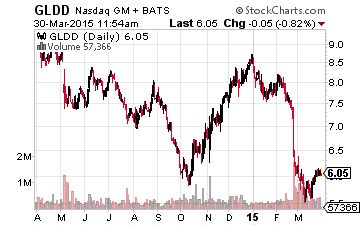

First up is Great Lakes Dredge & Dock (NASDAQ: GLDD). This company is the market leader in the niche space of dredging and the company has been around for more than 100 years, even though most investors have never heard of it given its minuscule market capitalization of under $400 million. Great Lakes operates just over 30 vessels of varying sorts worldwide, the vast majority in the United States where it is shielded to a good extent from foreign competition by the antiquated provisions of both the Jones and Dredging Acts.

Port dredging makes up some 30% of the company’s revenues and demand is being helped by the expansion of the Panama Canal which will allow much larger vessels to go through this critical waterway. This is triggering expansions at U.S. ports to deepen their facilities to accompany these bigger ships and a good portion of this effort is funded by the federal government.

The rest of the company’s workload consists of river and lake dredging, shipping channel maintenance and coastal protection such as rebuilding and bolstering beaches and coastal defenses of which the latter category is particularly strong now given the funds that were freed up and the focus on coastal defenses brought on by Superstorm Sandy.

Great Lakes was awarded the $140 million Suez Canal deepening project during the fourth quarter of 2014 and overseas demand will make up a growing portion of demand for dredging in coming years. The other main driver of growth for Great Lakes over the next few years is that the company is selling off slower growing non-core business and redeploying these proceeds into getting into the environmental remediation space which is a much, much bigger market than dredging and its other business lines. The stock sells at a piddling $6.00 a share but should go significantly higher as these efforts continue to bear fruit.

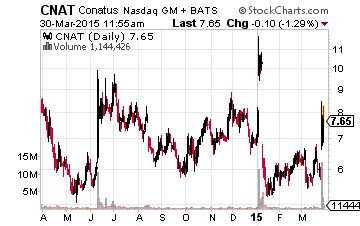

Next we have biotech Conatus Pharmaceuticals (NASDAQ: CNAT). Its stock was a big winner in a down market last week. A Phase II trial evaluating its lead drug candidate emricasan against nonalcoholic fatty liver disease (NAFLD), including a subset with nonalcoholic steatohepatitis (NASH) met its primary endpoint. If emricasan succeeds in Phase III trials for this possible lucrative treatment space, the shares are going to go substantially higher. It is also testing emricasan, which is a capese protese inhibitor, against several other liver afflictions in other trials. Even with the stock’s recent rally, the shares sell for less than $8.00 a piece and sport a tiny market capitalization of just $120 million of which about a third is in net cash. I could easily see this small biotech company being a buyout candidate for a larger player that wants to expand its offerings focused on the liver.

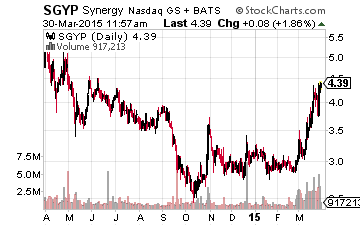

NOTE: Speaking of buyouts in the sector, small biotech Synergy Pharmaceuticals (NASDAQ: SGYP) has been on the move recently. I profiled this firm when the shares traded just under $3.00 a share in December of last year as one of two small biotechs under $5.00 that could break out in 2015 (see article here).

The stock is up nearly 50% since then to just under $4.50 a share but still could have significant further upside as it is rumored to be considering putting itself for sale. Cantor Fitzgerald recently opined that the shares could fetch $8.50 in an acquisition. The company has two promising drugs in late-stage development.

Disclosure: Long CNAT, EGRX, GLDD, and SGYP

For more on how I find these winners and how you can too, more

I like GLDD and CNAT.

Good picks!