Buy The Surge In Netflix Stock After Record Subscriber Growth?

Image Source: Unsplash

Reporting strong Q4 results after market hours on Tuesday, Netflix (NFLX - Free Report) stock soared +9% in today's trading session.

Hitting a 52-week peak of $999 a share, NFLX had surged over 100 points before cooling off, with its previous closing price at $869.

Serving as a further catalyst to its impressive top and bottom line figures, Netflix was able to crush Wall Street’s expectations for subscriber growth.

Image Source: Zacks Investment Research

Netflix’s Strong Q4 Results

Netflix reported Q4 sales of $10.24 billion, topping estimates of $10.11 billion and spiking 16% from $8.83 billion in the comparative quarter. More impressive, Q4 earnings soared over 100% to $4.27 per share compared to EPS of $2.11 a year ago.

Exceeding Q4 expectations of $4.20 per share, Netflix has surpassed the Zacks EPS Consensus in each of its last four quarterly reports with an average earnings surprise of 7.17%.

The streaming king ended fiscal 2024 with total sales increasing 16% to $39 billion. Annual earnings climbed 65% to $19.83 per share versus EPS of $12.03 in 2023. Netflix also highlighted that its full-year operating income exceeded $10 billion for the first time as operating margins increased six points to 27%.

Image Source: Zacks Investment Research

Netflix Subscriber Growth

Attributed to its ad plan service which offers a lower price point for consumers, Netflix added a record-breaking 19 million subscribers during Q4.

Adding a mind-boggling 13 million more subscribers than anticipated, Netflix’s ad plan accounted for 55% of sign-ups in countries where the service is provided. Overall, Netflix's total subscribers have now topped 300 million.

Staying firmly ahead of competitors, the next closest streaming service would be Disney+ with Disney (DIS - Free Report) thought to have around 230 million total subscribers when including its Hulu and ESPN+ services.

Furthermore, Netflix remains the clear leader in original content, stating that during 2024 it had more number 1 shows in the weekly streaming top 10 than all other streamers combined.

Netflix’s Positive Guidance

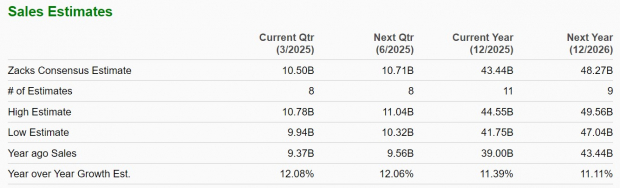

Raising its revenue guidance by $0.5B, Netflix now expects FY25 sales in the range of $43.5B-$44.5B. This came in above the current Zacks Consensus of $43.44B (Current Year Below) or 11% growth with Netflix’s forecast equating to 12-14% growth.

Based on Zacks estimates, Netflix’s top line is projected to expand another 11% in FY26 to $48.27 billion. Even better, Netflix is expected to post 18% EPS growth this year with annual earnings forecasted to increase another 19% in FY26 to a whopping $28.01 per share.

Image Source: Zacks Investment Research

Bottom Line

There was a lot to like about Netflix’s Q4 report, but for now, its stock lands a Zacks Rank #3 (Hold) after a very sharp post earnings rally. That said, many analysts have started to raise their price targets for NFLX to over $1,100 a share.

Considering such, it wouldn’t be surprising if a Zacks buy rating is on the way given that earnings estimate revisions are likely to trend higher in the coming weeks.

More By This Author:

Johnson & Johnson Q4 Earnings And Revenues Top EstimatesEarnings Preview: AT&T Q4 Earnings Expected To Decline

Target Joins Five Below, Genesco, And Abercrombie & Fitch With Stellar Holiday Sales Performance

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more