Buy The Drop In Broadcom Or Oracle Stock After Earnings?

Image Source: Unsplash

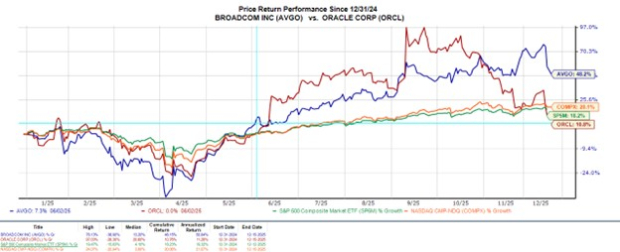

Despite exceeding earnings expectations, Broadcom (AVGO - Free Report) and Oracle (ORCL - Free Report) stock have now fallen more than 15% since their much-anticipated quarterly results last week.

The selloff comes as investors have been spooked by rising costs, margin pressures, and concerns about their AI-related spending, although these tech giants have solid balance sheets.

While both companies are deeply tied to AI infrastructure, which has been the hottest trade of the year, the market is now scrutinizing whether their increased spending on data centers and AI clusters will actually deliver profitable returns.

Image Source: Zacks Investment Research

Broadcom’s Margin Warning & Lofty Expectations

Reporting blockbuster results for its fiscal fourth quarter last Thursday, Broadcom’s quarterly sales were up 28% to $18.01 billion, with EPS soaring 37% to $1.95 compared to $1.42 per share in the comparative quarter. Broadcom also beat consensus sales and earnings estimates by 2.94% and 4.28% respectively.

However, considering Broadcom stock had vastly outperformed the broader market going into its Q4 report, this wasn’t enough to satisfy investors' lofty appetite, especially with the chip giant warning that costly infrastructure buildouts would lower gross margins despite its surging AI sales. It’s noteworthy that AI now accounts for more than half of Broadcom’s semiconductor revenue, with the company highlighting that AI semiconductor revenue spiked 74% year over year.

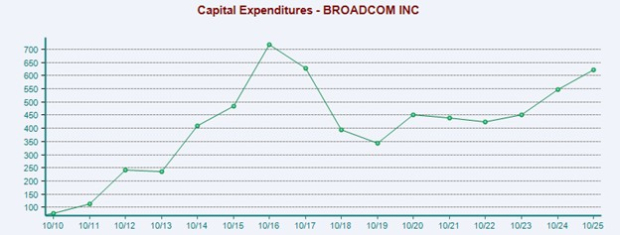

Broadcom has not disclosed a specific amount for its anticipated capital expenditures on AI infrastructure, and its trailing 12-month CapEx of $623 million has been relatively consistent with historical averages while being far below the tens of billions that Oracle and Nvidia (NVDA - Free Report) plan to spend. Still, the lack of CapEx guidance also led to the market’s disappointment, even with Broadcom having lucrative multi-billion dollar contracts with AI research and development companies Anthropic and OpenAI.

Image Source: Zacks Investment Research

Oracle’s Revenue Miss & Debt-Fueled AI Spending

Posting mixed results for its fiscal second quarter last Wednesday, Oracle’s earnings climbed 54% year over year to $2.26 per share and blasted expectations of $1.63 by 38%. That said, Q2 sales of $16.05 billion missed estimates of $16.14 billion despite increasing 14% from $14.05 billion a year ago.

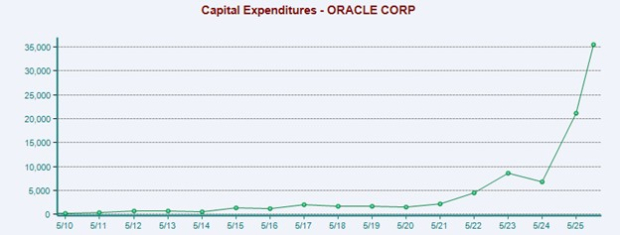

Oracle’s revenue shortfall has raised some doubts about execution, and this was compounded by the announcement that its CapEx will be about $15 billion higher than initially expected next year at around $50 billion. Although Oracle has strong cloud and AI deal pipelines, investors are starting to question whether the spending spree is sustainable and if the debt financing will have a future impact on profitability.

Image Source: Zacks Investment Research

Monitoring Broadcom & Oracle’s Valuation

With Broadcom’s margin pressure warning and Oracle’s aggressive spending overshadowing their favorable near-term revenue guidance and expansive growth trajectories, valuations are once again the focus as investor sentiment shifts.

Bubble fears are not overly concerning regarding their forward P/E multiples, and the pullback has perhaps served as a healthy correction. To that point, Broadcom’s 39X and Oracle’s 27X are roughly on par with their respective Zacks industry averages after recently hitting decade-long highs of 68X and 57X forward earnings, respectively.

In terms of price-to-forward sales, their valuations are more worrisome, especially for Broadcom at 26X compared to its Zacks Electronics-Semiconductors Industry average of 5X. In comparison, Oracle’s forward P/S multiple of 8X is not a far stretch from its Zacks Computer-Software Industry average of 4X.

Image Source: Zacks Investment Research

Optimistically, AVGO and ORCL have hovered near the preferred PEG ratio of less than 1, which still suggests they are on the cusp of being undervalued relative to their growth rates, with Broadcom currently beneath this mark.

Image Source: Zacks Investment Research

Bottom Line

In the grand scheme of things, investors will still be compelled at how AI is fueling Broadcom and Oracle’s growth. At the same time, concerns about whether they will be able to sustain their operational efficiency are understandable, considering the high cost of AI infrastructure expansion. For now, Broadcom and Oracle stock both land a Zacks Rank #3 (Hold).

More By This Author:

Is Cameco Prepared To Offset McArthur River Losses With Cigar Lake Gains?Is Coinbase Setting The Stage For A Strong And Strategic 2026?

Accenture Q1 Earnings Preview: Buy Now Or Wait For The Results?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more