Buy The Dollar Store Stocks For The Holiday Shopping Season?

Image Source: Pixabay

Although retail sales are expected to be at record levels during the holiday shopping season, consumers have remained price sensitive, with Dollar General (DG - Free Report) and Dollar Tree (DLTR - Free Report) being prime beneficiaries thanks to their value-focused business models.

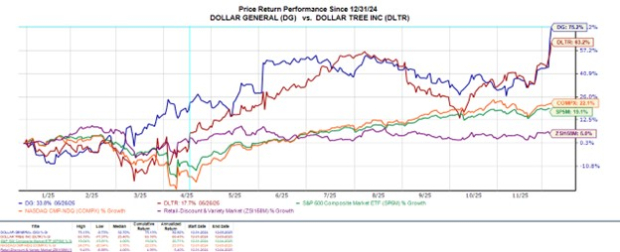

Seeing their stocks rally after beating Q3 expectations this week, both discount retail chains are exhibiting strong same-store sales growth, improved margins, and have raised their full-year EPS guidance. As two of the retail sector's top performers, Dollar General stock has spiked +75% this year, with Dollar Tree shares up over +60%.

Vastly outperforming the broader indexes and the Zacks Retail-Discount Market’s modest year-to-date return of +5%, let’s see if it’s still time to buy DG or DLTR for more upside.

Image Source: Zacks Investment Research

Strong Q3 Results

Posting Q3 sales of $10.64 billion, Dollar General’s top line increased 4% year over year and topped estimates of $10.61 billion. Attributed to stronger consumer traffic, Dollar General’s same-store sales increased 2.5% YoY. Most impressive, Q3 EPS of $1.28 surged 44% and blasted expectations of $0.92 by 39%. Outside of margin improvements, the impressive earnings beat was attributed to underlying operational improvements in regard to shrinkage (inventory losses).

Image Source: Zacks Investment Research

After divesting its ailing Family Dollar Store business earlier in the year, Dollar Tree’s Q3 sales fell to $4.74 billion versus $7.56 billion in the comparative quarter but slightly edged estimates. More importantly, alleviating Family Dollar-related overhead costs led to Dollar Tree’s Q3 EPS rising 8% to $1.21 and impressively exceeding expectations of $1.09 by 11%. Plus, Dollar Tree’s same-store sales increased 4%, driven by a higher average ticket size despite a small dip in traffic.

Image Source: Zacks Investment Research

Positive Guidance

Dollar General now expects full-year EPS between $6.30-$6.50, up from prior guidance of $5.80-$6.30. Furthermore, this came in above the current Zacks EPS Consensus of $6.17 or 4% growth. Full-year sales were guided at $42.52-$42.6 billion, slightly higher than the prior range of $42.36-$42.56 billion, with the consensus estimate currently at $42.5 billion or 4% growth.

As for Dollar Tree, it now expects full-year adjusted EPS of $5.60-$5.80, up from previous guidance of $5.32-$5.72 and above estimates of $5.61 or a 10% increase. Following the divestiture of Family Dollar, the consensus estimate currently calls for Dollar Tree’s annual sales to contract 37% to $19.39 billion compared to $30.82 billion a year ago, with the company narrowing its guidance to $19.35-$19.45 billion from $19.29-$19.49 billion.

DG & DLTR Valuation Comparison

Ironically, Dollar General and Dollar Tree stock are both trading at reasonable forward earnings multiples of 20X. While this may make it harder for investors to choose between them if need be, DG and DLTR are still at discounts to the benchmark S&P 500 and their Zacks-Retail Discount Stores Industry average of 26X forward earnings, respectively. DG and DLTR also trade beneath the industry’s average of 1.3X forward sales, with the S&P 500 at over 5X.

Image Source: Zacks Investment Research

Conclusion & Strategic Thoughts

Following such an extensive YTD rally, Dollar General and Dollar Tree stock both land a Zacks Rank #3 (Hold). To that point, at current levels, they are still making the argument for long-term value. In regard to distinguishing between the two, Dollar Tree may ultimatley be the better pick if consumer spending pressures persist, while Dollar General provides a wider and higher price range of items and could be the better option in terms of diversification.

Undoubtedly, DG and DLTR will be among the most appealing buy-the-dip candidates to consider if a sharp pullback is presented, and they may obtain a buy rating if a compelling trend of positive EPS revisions begins to emerge in correlation with their Q3 results and positive guidance.

More By This Author:

Is An Extended Rebound Ahead For Coinbase Or Strategy Stock?Is The Breakout In SoFi Stock Just Beginning?

Is It Time To Buy The Dip In Coreweave Stock?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more