Buy The Dip In JPMorgan Or Delta Air Lines Stock After Q4 Earnings?

Image Source: Pixabay

The Q4 earnings season got off to a positive start with JPMorgan (JPM - Free Report) and Delta Air Lines (DAL - Free Report) leading the way and delivering favorable quarterly results on Tuesday.

Despite exceeding Q4 expectations, both stocks fell over 2% after giving cautiously optimistic insights into the economy. After recently hitting 52-week highs earlier in the month, JPM and DAL are now more than 5% from their one-year highs of $337 and $73 a share, respectively.

JPMorgan & Delta’s Economic Insight

JPMorgan CEO Jamie Dimon praised the U.S. economy as resilient but warned that geopolitical tensions remain a serious threat that markets are not fully pricing in. Dimon also cautioned that inflation may not fall as smoothly as markets expect, even as December’s CPI report showed an easing in many consumer categories outside of food prices.

Meanwhile, Delta stated the consumer is splitting into two economies, noting that premium travel remains very strong, with high-income travelers continuing to spend freely, but price-sensitive consumers are weakening, showing “significant fatigue” in the broader market.

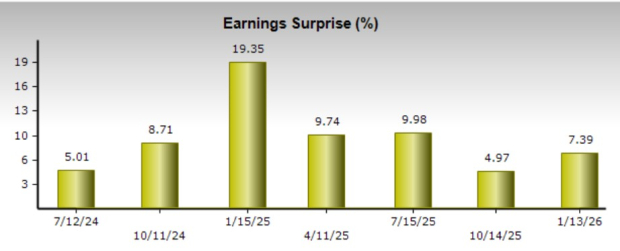

JPMorgan’s Q4 Results

Posting Q4 sales of $45.79 billion, JPMorgan’s top line stretched 7% from $42.76 billion in the prior year quarter and edged expectations of $45.69 billion. A 17% uptick in market revenue was the key driver, which includes activities across fixed income, currencies, commodities (FICC), and equities.

However, investment banking was softer, continuing a multi-quarter slump regarding capital and advisory services for M&A activity, equity issuance, and debt underwriting.

JPMorgan also absorbed a $2.2 billion credit loss tied to the Apple card “takeover,” in which it will replace Goldman Sachs (GS - Free Report) as the issuer of Apple’s (AAPL - Free Report) exclusive credit card that is designed to work primarily through the iPhone’s Wallet app.

When including the Apple card-related costs, JPMorgan’s net income came in at $13 billion or adjusted EPS of $5.23, beating Q4 earnings expectations of $4.87 per share by 7% and rising 9% from $4.81 a year ago. Regarding lending activities, JPMorgan’s net interest income (NII) was up 7% during Q4 to $25.1 billion.

Image Source: Zacks Investment Research

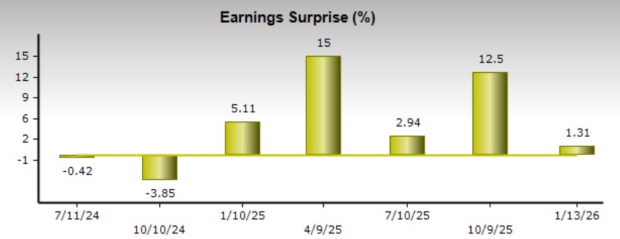

Delta’s Q4 Results

Although the Government shutdown in the U.S. between October and November reduced Delta’s domestic revenue by 2%, Q4 sales still rose 3% to $16 billion and comfortably exceeded estimates of $15.62 billion by 2%.

Benefiting from record holiday travel, Delta’s premium, cargo, and maintenance businesses grew 7% year over year, accounting for 60% of its total revenue. Delta reported Q4 net income of $1.22 billion or adjusted EPS of $1.55, which dropped from $1.85 per share in a tough to compete against comparative quarter but edged estimates of $1.53 by 1%.

Image Source: Zacks Investment Research

Full Year Results & Guidance

Overall, JP Morgan’s sales increased 3% in fiscal 2025 to $185.6 billion, with full-year EPS increasing 1% to $20.02. Full-year NII was up 3% YoY to $95.5 billion. While JPMorgan doesn’t typically provide formal guidance, the banking giant expects FY26 NII to increase to $103 billion with the $8 billion uptick attributed to lower funding costs from rate cuts. Based on the latest Zacks Consensus, JPMorgan’s FY26 sales are projected to increase 3% to $190.86 billion, with FY26 EPS expected to rise 5% to $20.97.

As for Delta, full-year sales were up 2% to a record $63.4 billion, with management emphasizing strong free cash flow generation of $4.6 billion and balance sheet improvement. Delta’s FY25 EPS dipped to $5.82 versus $6.16 in 2024 as fuel and operating costs remain elevated.

That said, Delta expects FY26 EPS at $6.50-$7.50, implying 20% or more growth with the current Zacks EPS Consensus at $7.24 or 24% growth. Delta forecasts Q1 EPS at $0.50-$0.90, anticipating a 5-7% increase in Q1 sales, but didn’t provide a specific full-year FY26 revenue guidance range. Zacks estimates call for Delta’s FY26 sales to rise 3% to $65.28 billion.

Conclusion & Strategic Thoughts

Making it tempting to buy the post-earnings selloff is that these industry leaders are attractively valued, with JPM trading at 15X forward earnings and DAL at 9X. Holding existing positions could be worthwhile, and for now, JPMorgan and Delta stock land a Zacks Rank #3 (Hold).

Adding to or starting a position in JPM or DAL could become attractive if analysts aren’t too deterred by their somewhat cautious economic outlook and FY26 EPS revisions don’t noticeably decrease in the coming weeks.

More By This Author:

Goldman Projects 46-Cent EPS Gain In Q4 From Apple Card Transition2 Top-Ranked AI-Powered Tech Giants To Enhance Your Portfolio Returns

Betting On A Boom: 3 Healthcare ETFs For 2026 And Beyond

Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific securities ...

more