Buy The Dip In GE Aerospace Or Netflix Stock After Q3 Earnings?

Image Source: Pixabay

As two of the market’s top-performing stocks in recent years, the discussion of buying the post-earnings dip in GE Aerospace (GE - Free Report) or Netflix (NFLX - Free Report) shares is a worthy topic after their Q3 reports on Tuesday.

Having impressive stock gains of around +300% in the last three years, respectively, GE shares were down 3% in today’s trading session with NFLX down 10%. More intriguing is that both of these respective industry leaders raised their guidance, adding steam to a buy-the-dip scenario.

Image Source: Zacks Investment Research

LEAP Engine Sales Drive GE Aerospace’s Strong Q3 Results

Reflecting a broader recovery in global air travel and fleet modernization, GE Aerospace’s Q3 sales surged 26% to $11.3 billion from $8.94 billion in the comparative quarter. Propelling GE in particular was its LEAP engines, which are known for their reliability and efficiency and are growing in popularity due to their use in various modern aircraft such as Airbus’s (EADSY - Free Report) A320neo and Boeing’s (BA - Free Report) 737 MAX. GE Aerospace’s earnings soared 44% to $1.66 per share, versus EPS of $1.15 in Q3 2024. Furthermore, this impressively topped the Zacks EPS Consensus of $1.46 by 14%.

Brazilian Tax Dispute Dampens Netflix’s Q3 Results

Excluding a one-time charge related to a tax dispute in Brazil, Netflix’s core business performance was strong during Q3, highlighted by increased ad sales and new content partnerships. However, Netflix’s operations in Brazil were challenged by local authorities in regard to how the streaming king classifies and reports certain revenues and expenses. This resulted in a $400 million non-recurring tax expense that dented Netflix’s net income, as Q3 EPS of $5.87 was up 9% YoY but noticeably missed expectations of $6.89 by 15%. Netflix’s Q3 sales of $11.51 billion spiked 17% from $9.82 billion a year ago but slightly missed estimates of $11.52 billion.

GE Aerospace & Netflix’s Raised Guidance

Raising its full-year 2025 guidance, GE Aerospace now expects adjusted EPS between $6.00-$6.20, up from a previous forecast of $5.90. GE Aerospace now projects full-year revenue growth in the mid-teens, up from its previous estimate of low double-digit growth.

Pivoting to Netflix, the company now expects full-year revenue growth at approximately 16% from a previous forecast of 14%. Notably, Netflix also raised its operating margin forecast from 21% to 22%.

Monitoring GE Aerospace & Netflix’s Valuation

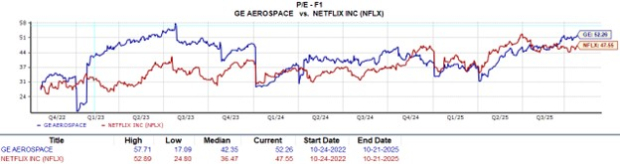

Correlating with their high growth prospects, GE Aerospace and Netflix stock are trading at notable premiums to the broader market at 52X and 47X forward earnings, respectively. Keeping their blazing stock performances over the last three years in mind, GE and NFLX trade below their forward P/E highs during this period but are above their medians as shown below.

Image Source: Zacks Investment Research

Other traditional metrics, like price to sales, also point to GE and NFLX trading at stretched valuations, although the bright spot to their value has been through cash flow. Netflix especially stands out with a very high cash flow per share ratio of 59X, with GE Aerospace’s 8X being pleasantly above the S&P 500’s average of 6X as well.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

It’s hard to overlook the idea of buying the post-earnings dip in GE Aerospace and Netflix stock but for now, both land a Zacks Rank #3 (Hold). In terms of their valuations, more appealing opportunities could certainly come on a further drop, and the real indicator of more upside will be the trend of earnings estimate revisions (EPS) following their Q3 reports.

That said, given that these high-growth companies raised their guidance, the revision trend should be positive, especially for GE, considering its impressive earnings beat.

More By This Author:

Apple At All-Time High On IPhone 17 Boom: ETFs To ConsiderRide The Rare Earth Stock's Trade Wave?

Should You Buy, Sell Or Hold J&J Stock After Robust Q3 Earnings?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more