Buy Taiwan Semi Stock After Ai Fuels Strong Q4 Results & Guidance?

Image Source: Pixabay

Hitting a new all-time high of $345 a share, Taiwan Semiconductor (TSM - Free Report) stock made headlines on Thursday after posting record Q4 results and providing bullish guidance and commentary on the outlook for AI.

As the world’s largest integrated circuit foundry provider, Taiwan Semi is seeing strong demand for its nanometer nodes in reference to the manufacturing technology it provides to help build advanced AI chips for Nvidia (NVDA - Free Report) and others.

Taiwan Semi’s Strong Q4 Results

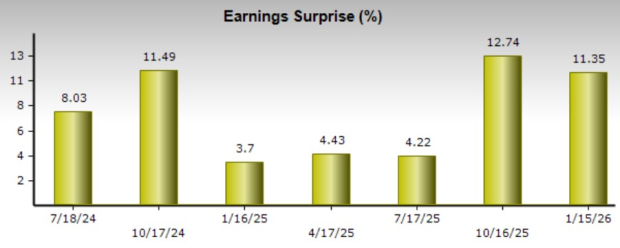

Posting record Q4 sales of $33.71 billion, Taiwan Semi’s top line stretched 25% from $26.88 billion in the prior year quarter and beat estimates of $33.26 billion by 1%. More impressive, Taiwan Semi’s Q4 EPS hit a peak of $3.14, beating expectations of $2.82 by 11% and soaring 35% from a year ago.

Image Source: Zacks Investment Research

Taiwan Semi’s Bullish Guidance & AI Outlook

The foundry giant didn’t provide full-year revenue guidance but projects Q1 revenue in the range of $34.6-$35.8 billion, which came in pleasantly above Wall Street’s expectations of $33.27 billion or 24% growth. This is one of the strongest revenue outlooks Taiwan Semi has ever issued, driven primarily by continued demand for AI and high-performance computing chips.

Taiwan Semi typically only provides full-year CapEx guidance, and issued one of the most aggressive capital-spending forecasts in semiconductor history at $52-$56 billion. Notably, this would be up more than 27% from CapEx of $40.9 billion in 2025.

CEO Che-Chia Wei emphasized that AI demand is real, massive, and driving record spending. Wei acknowledged that he is also very nervous about how much Taiwan Semi is investing in AI, but despite the caution, the company’s guidance indicated continued explosive AI chip demand.

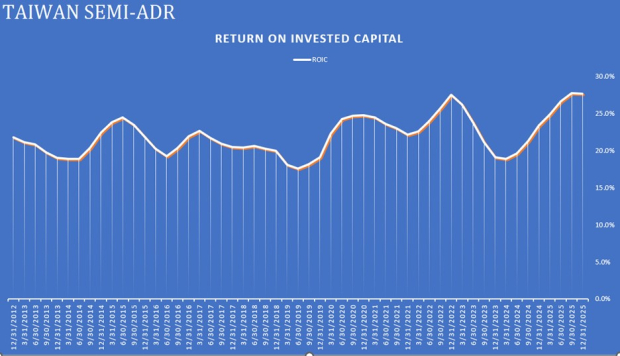

Taiwan Semi’s Reassuring ROIC

One of the clearest indicators of long-term shareholder value is the ability to turn invested capital into profits, and Taiwan Semi has a very impressive return on invested capital (ROIC) percentage of 27.6%, with the often admirable level being 20% or higher. It’s also noteworthy that analysts often view high ROIC and rising CapEx as a strong signal of competitive advantage.

Image Source: Zacks Investment Research

Monitoring Taiwan Semi’s Valuation

While Taiwan Semi does command a rather high price-to-forward sales premium of 14X compared to the benchmark S&P 500’s 5X, this has been normal for stocks with AI-driven growth catalysts, with Nvidia, for example, having a P/S ratio of 23X. That said, TSM has a forward P/E multiple of 26X, which is still near the benchmark’s 23X.

Image Source: Zacks Investment Research

Bottom Line

Trading at an all-time high, Taiwan Semi stock lands a Zacks Rank #3 (Hold) at the moment. However, a buy rating and the plausibility of higher highs could certainly be on the way, given that EPS revisions are likely to rise for TSM following the impressive Q4 results and bullish AI outlook.

More By This Author:

Buy The Dip In JPMorgan Or Delta Air Lines Stock After Q4 Earnings?Goldman Projects 46-Cent EPS Gain In Q4 From Apple Card Transition

2 Top-Ranked AI-Powered Tech Giants To Enhance Your Portfolio Returns

Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific securities ...

more