Buy Lululemon Stock At A Big Discount And Hold For Years?

Image Source: Pixabay

Lululemon (LULU - Free Report) is down 40% from its records as it heads into its first quarter FY22 earnings release on Thursday, June 2.

00:01:00

LULU shares popped 10% earlier this week as Wall Street sees signs of strong consumer spending from higher-income shoppers. Investors might want to consider buying Lululemon as a long-term retail play because its growth outlook is impressive, as are many of its other fundamentals.

Far Beyond Yoga

Lululemon helped change the way millions of people dress and inspired the likes of Target (TGT - Free Report) and others to start their own athleisure brands. The firm knew it couldn’t stay stagnant, and it’s spent years expanding its offerings to include attire people can wear at the gym, the office, a date night, the golf course, and beyond.

LULU has an outwear segment, and it’s rolled out self-care products. The company also purchased at-home fitness company Mirror and it’s prepared to introduce other digital fitness offerings.

On top of that, it introduced its own women’s footwear segment. And its newest expansion effort is its very own resale shop that allows users to sell and buy used Lululemon apparel. Other major higher-end brands with loyal consumers such as Patagonia have found success with their own resale sites, as the segment gains traction overall.

Image Source: Zacks Investment Research

Other Fundamentals

Lululemon grew its 2021 sales by 42% to $6.3 billion to help its adjusted earnings climb by 66%. And this growth wasn’t artificially boosted by easy comparisons, since LULU posted 11% revenue growth in the pandemic-hit 2020 and it averaged 17% sales growth between FY20 and FY16.

Zacks estimates call for its revenue to climb 21% in 2022 and 15% in 2023 to reach $8.7 billion. Meanwhile, its adjusted earnings are projected to surge 20% both this year and next.

Better still, the athleisure superstar in April announced its five-year growth plan to double revenue to $12.6 billion by 2026. The company said it hopes to double its men’s segment, double digital, and quadruple international revenues, “while continuing to grow core areas of the business.”

Lululemon’s higher price tags, such as $90 shorts and $120 leggings, help it post strong margins. Plus, it operates a mainly direct-to-consumer business from its own stores—finished 2021 with 574 locations—and its digital segments, which also helps boost margins. And it has expanded for years without having to spend heavily on marketing.

Lululemon’s earnings outlook has improved in the face of economic headwinds to help it grab a Zacks Rank #2 (Buy), and it lands an “A” grade for Growth and a “B” for Momentum in our Style Scores system. And the company is very well-run, boasting a balance sheet that features zero debt, alongside $1.3 billion in cash and equivalents, $4.9 billion in total assets, and $2.2 billion in total liabilities.

Image Source: Zacks Investment Research

Bottom Line

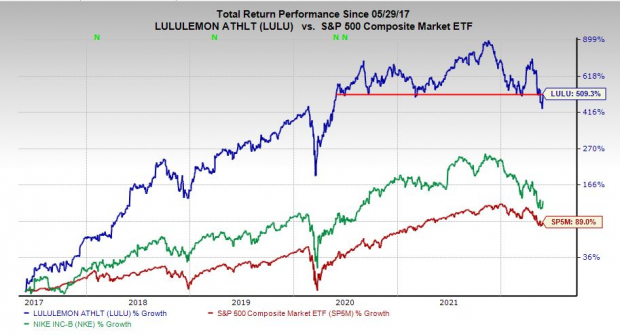

Lululemon stock has soared 509% in the last five years to crush Nike (NKE - Free Report), its industry, and the S&P 500. As we mentioned, the stock is down 40% from its November peaks to trade around where it was in May 2020. And its $430 per share Zacks consensus price target represents 47% upside to Friday’s levels.

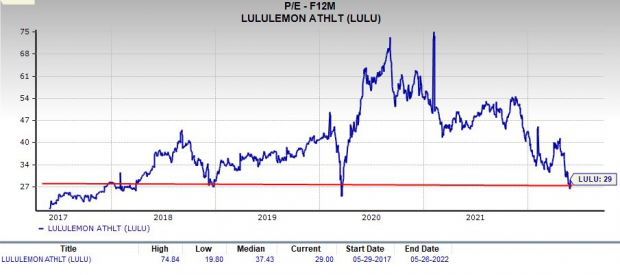

The apparel firm’s valuation has been recalibrated along with the entire market. And its current P/E ratio is looking rather enticing, with Lululemon trading at a 21% discount to its five-year median and 61% below its highs at 29X forward earnings. In fact, it’s traded at far higher forward earnings multiples for most of the past four years.

Wall Street is high on Lululemon, with 70% of the 20 brokerage recommendations Zacks has at “Strong Buys.” Some might want to wait for its report, given how wild of single-day moves stocks have made in the past few months amid the market downturn. Yet investors with long-term outlooks might consider buying Lululemon at these levels and holding for years to come.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more