Buy Kroger Or Albertsons Stock Amid Recent Market Volatility?

Image Source: Unsplash

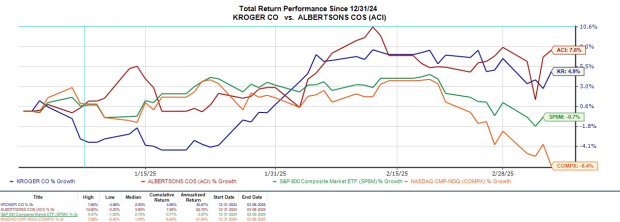

Markets hit another speed bump on Thursday, with the S&P 500 and Nasdaq down over 2% as ongoing tariff talks in the U.S. have sparked fears of a resurgence in inflationary pressures.

That said, Kroger (KR - Free Report) and Albertsons (ACI - Free Report) stock have hovered near 52-week highs, with both acting as a defensive hedge against recent market volatility.

Correlating with such, investors tend to shift to stocks of companies that offer essential goods or services during an economic downturn. Of course, Kroger and Albertsons are of interest as two of the largest grocery retailers.

YTD Performance & Valuation

The broader indexes have continued to decline over the last few weeks, with the tech-heavy Nasdaq taking the biggest hit and now down 6% in 2025 compared to the S&P 500’s -1%. Year to date, Albertsons stock has spiked +7% to $21 a share with Kroger shares trading at $63 and up a respectable +5%.

Image Source: Zacks Investment Research

Considering their essentiality, Kroger and Albertsons' attractive valuations are certainly catching investors' attention at the moment. Both trade well under the optimum level of less than 2X sales with KR at 0.3X and ACI at just 0.15X. Plus, KR trades at a 13.1X forward earnings multiple with ACI at 9X.

Image Source: Zacks Investment Research

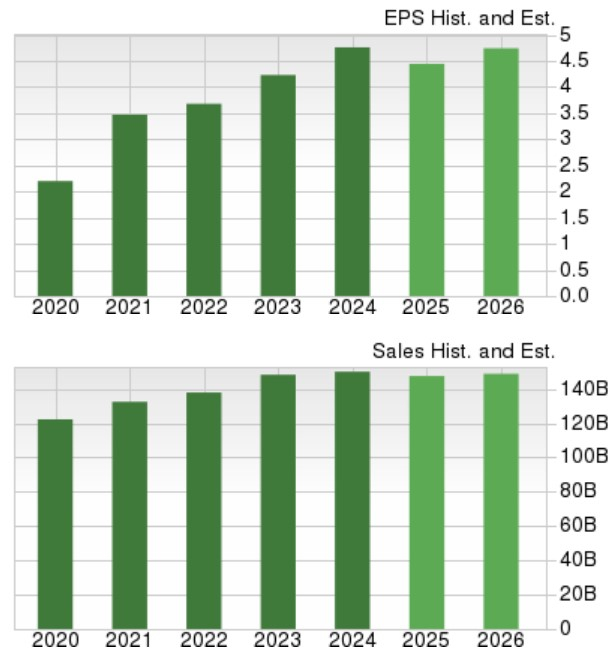

Kroger & Albertsons Outlook

Although their valuations appear to be cheap, Kroger and Albertsons' growth has somewhat stalled. This was supposed to be rectified by their proposed merger, but Kroger’s acquisition of Albertsons was officially denied in December as federal and state courts cited concerns of reduced competition and potential price increases for consumers.

Kroger’s total sales are now expected to dip 2% in fiscal 2025 but are projected to stabilize and rise 1% in FY26 to $148.78 billion. On the bottom line, Kroger’s annual earnings are currently slated to drop 6% this year to $4.46 per share compared to EPS of $4.76 in 2024. However, FY26 EPS is forecasted to rebound and increase 7% to $4.77.

Image Source: Zacks Investment Research

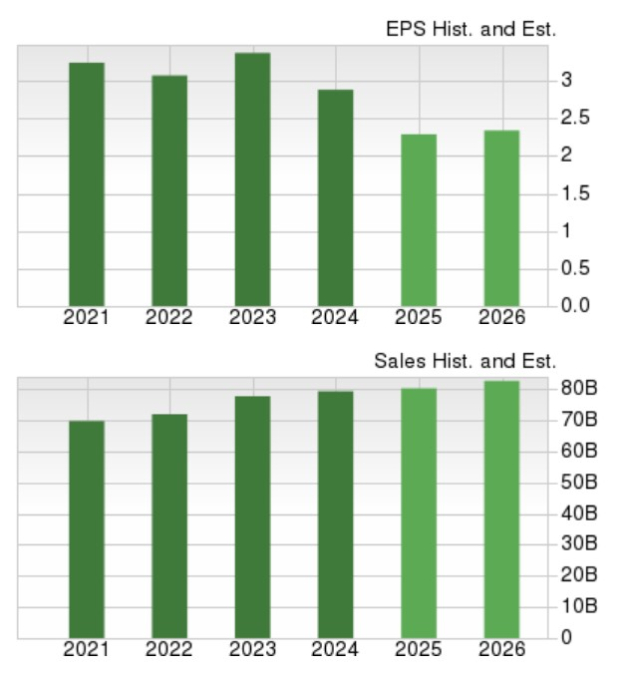

As for Albertsons', its top line is expected to increase 1% in FY25 and is projected to expand another 3% in FY26 to $82.58 billion. Still, Albertsons' annual earnings are slated to drop to $2.29 per share versus EPS of $2.88 last year. Optimistically, FY26 EPS is projected to stabilize and increase 2% to $2.34.

Image Source: Zacks Investment Research

Dividend Comparison

Despite their underwhelming growth, Kroger and Albertsons stock offer generous dividend yields. Topping the S&P 500’s 1.23% average, Albertsons' annual dividend is 2.89% with Kroger’s at 2.05%.

Image Source: Zacks Investment Research

Bottom Line

For now, Kroger and Albertsons stock both land a Zacks Rank #3 (Hold). They are certainly worth consideration in regards to defensive safety in the portfolio amid macroeconomic concerns. Keeping this in mind, there may be better hedge options in terms of stocks that also have essential operations but better growth prospects.

More By This Author:

3 Highly Ranked Medical Stocks To Buy Amid Recent Market Volatility: JAZZ, OPCH, PCRXDeepSeek Fuels China's Tech Resurgence: 3 Stocks Worth Watching

Meta Platforms Increases Yet Falls Behind Market: What Investors Need to Know

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more