Buy Intel Stock After Favorable CPI Data & Q3 Earnings Beat?

Image Source: Pexels

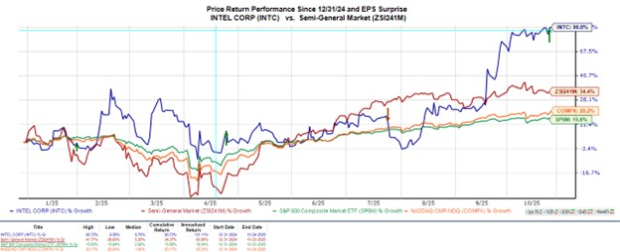

It was no surprise that stocks moved higher on Friday, as September’s cooler inflation readings sparked the rally. However, Intel (INTC - Free Report) stood out in particular after delivering pleasant Q3 results on Thursday evening that showed the chipmaker's turnaround is feasible.

Hitting a fresh one-year high of $41 a share in Friday’s trading session, Intel stock has continued an attention-getting rebound from a 52-week and multi-year low of $17.

The better-than-expected CPI data may also keep the Federal Reserve on track for another interest rate cut, which can be very beneficial to Intel and other chipmakers. That said, let’s see if it’s time to buy Intel stock or fade the rebound in INTC.

Image Source: Zacks Investment Research

Q3 Marked Intel’s Return to Profitability... For Now

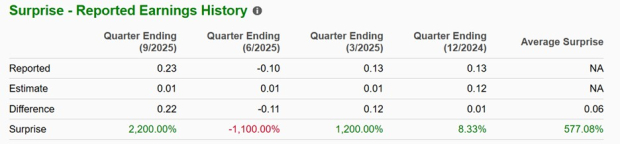

Marking a return to growth and profitability, Intel reported Q3 net income of $4.06 billion or $0.23 per share, compared to a concerning loss of $16.64 billion in the comparative quarter or -$0.43 a share. Fueling the early morning rally in INTC was that Intel crushed EPS expectations of $0.01.

However, it’s noteworthy that Intel’s profit was largely driven by one-time non-recurring operational gains. This included the divestiture of a majority stake in its programmable chip-unit business, Altera, along with favorable tax treatments and accounting reclassifications related to its restructuring and asset sales.

Notably, while Intel was able to post positive adjusted earnings per share in Q4 last year ($0.13) and Q1 2025 ($0.13) as shown below, the company’s net income for these quarters was -$129 million and -$887 million, respectively.

Image Source: Zacks Investment Research

Intel’s Key Growth Drivers

Intel did cite improved execution, with CEO Lip-Bu Tan emphasizing better operational discipline and strategic focus, especially in manufacturing and research and development (R&D). It’s also noteworthy that lower rates often fuel tech companies by reducing capital spending costs on R&D, hiring, and expansion into new or emerging markets.

Regarding AI, Intel saw strong momentum in AI-related products, such as its purpose-built application-specific integrated circuit (ASIC) chips, accelerators, and AI PCs. AI chips and compute infrastructure lifted Intel’s Data Center and AI (DCAI) division revenue by 5% year over year to $4.1 billion. Overall, Q3 sales rose 3% to $13.65 billion and topped estimates of $13.11 billion.

Strategic AI collaborations are also boosting Intel’s operations in regard to the $5 billion equity investment it received from Nvidia (NVDA - Free Report) and $2 billion from SoftBank (SFTBY - Free Report). While Intel now appears to have enough cash to fund capital expenses, a rate cut would also help if more external funding is needed in the form of borrowing and not equity. Of course, what has reshaped investor sentiment the most is that the U.S. Government became Intel’s largest shareholder after converting the $11.1 billion the company received from the CHIPS Act grants into equity.

Intel’s Guidance & Outlook

Intel expects Q4 revenue at $12.8 to $13.8 billion, which fell in range of Zacks' projections of $13.37 billion. Intel forecasts Q4 EPS at $0.08, in line with the Zacks Consensus. Additionally, Intel projects Q4 gross margins of approximately 36.5% and full-year approximate gross capital investments of $18 billion.

Attributed to the deconsolidation of Altera, Intel revised projections for its full-year adjusted operating expenses down to $16.8 billion from $17 billion.

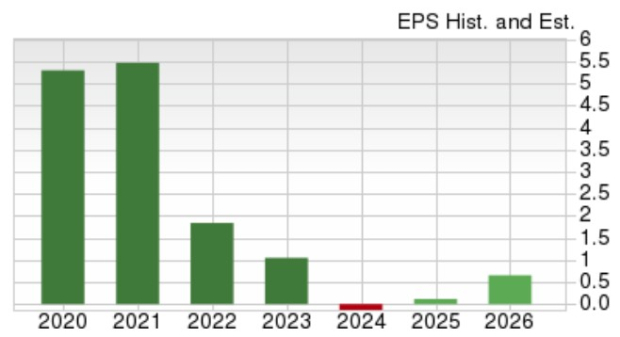

Based on Zacks' estimates, Intel’s total sales are now expected to dip 2% in fiscal 2025 but are projected to rebound and rise 3% in FY26 to $53.76 billion. Intel’s annual EPS is currently slated to swing to $0.12 in FY25 compared to an adjusted loss of 0.13 a share last year. Optimistically, FY26 EPS is projected to rebound to $0.64, although this is well away from Intel's past earnings potential.

Image Source: Zacks Investment Research

Summary & Final Thoughts

On the surface, Intel’s “strong” Q3 results may look appealing for hopes of a potential turnaround, but there is still much to see. To that point, the chip giant’s return to profitability was largely attributed to divesting Altera and not its core business operations. Still, the modest AI boost and echoes of disciplined cost management are reassuring amid the possibility of another interest rate cut and equity investments from the federal government, Nvidia, and SoftBank.

Given these prospects, it could be too soon to fade the rebound in INTC, although a significant uptick in EPS revisions may be needed for FY26 to ensure a buy rating. For now, Intel stock lands a Zacks Rank #3 (Hold).

More By This Author:

Buy The Post-Earnings Surge In Intuitive Surgical Stock?Be Concerned About Tesla's Q3 Earnings Miss?

Intel Tops Q3 Earnings And Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more