Buy, Hold, Or Take Profits In Netflix Stock After Q2 Earnings?

Image Source: Unsplash

Investors appear to be a bit underwhelmed by Netflix’s (NFLX - Free Report) Q2 report, despite the streaming king posting favorable quarterly results after market hours on Thursday.

Some profit taking may also be attributed to the post-earnings dip in Netflix stock, as NFLX is still up more than +30% year to date and is sitting on monstrous gains of nearly +500% in the last three years.

This makes it a worthy topic of whether it's time to get in on the profit taking, buy the post-earnings dip, or hold Netflix stock.

Image Source: Zacks Investment Research

Netflix’s Favorable Q2 Results

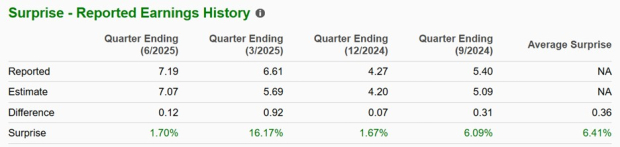

Exceeding earnings expectations, Netflix’s Q2 net income came in at $3.13 billion or $7.19 per share and above the Zacks EPS Consensus of $7.07. Year over year, Netflix’s Q2 EPS spiked 47% from $4.88 in Q2 2024. This came on Q2 sales of $11.07 billion, which increased 16% from the comparative quarter but slightly missed estimates of $11.08 billion.

Notably, Netflix’s operating margin during Q2 was 34.1%, up from 24% a year ago, with free cash flow soaring 91% to $2.3 billion.

Image Source: Zacks Investment Research

Netflix’s Q2 Subscriber Growth

Although Netflix no longer reports official quarterly subscriber numbers, the streaming giant is thought to have added 5.1 million new net subscribers during Q2. However, this fell below many analysts' forecast of 6 million and was down from 8.05 million new net subscribers in Q2 2024.

Still, Netflix’s total subscribers have risen to over 300 million thanks to its global reach, strong content pipeline, and the growth of its more affordable ad-tier, keeping the company firmly ahead of Disney’s (DIS - Free Report) streaming services and other platforms such as Amazon’s (AMZN - Free Report) Prime Video and Paramount Global (PARA - Free Report).

Netflix's Revenue Guidance & Margin Outlook

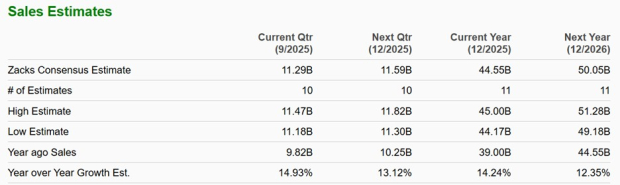

Optimistically, Netflix raised its full-year 2025 revenue guidance to $44.8-$45.2 billion from its previous forecast of $43.5-$44.5 billion. The current Zacks Consensus calls for Netflix’s top line to expand 14% this year to $44.55 billion, with fiscal 2026 sales projected to increase another 12% to $50.05 billion.

It’s also noteworthy that Netflix slightly increased its full-year operating margin guidance from 29% to 29.5%, although many analysts were looking for a margin range between 30-31%.

Image Source: Zacks Investment Research

Monitoring Netflix’s P/E Valuation

What may have dampened excitement for Netflix’s favorable Q2 report is that at 50X forward earnings, NFLX does trade at a noticeable premium to the broader market, with the S&P 500 at 24X. This is also well above Disney and Paramount at 21X and 9X forward earnings, respectively, and even Amazon at 35X.

Image Source: Zacks Investment Research

Bottom Line

For now, Netflix stock lands a Zacks Rank #3 (Hold). Enthusiasm for Netflix’s growth expectations appears to be already priced into its stock, as investors may have been looking for more exceptional upside surprises in its Q2 results.

That said, holding NFLX in the portfolio is still worthwhile considering Netflix’s market dominance, as more than 20% EPS growth is in the forecast for FY25 and FY26, and should help the streaming king grow into its somewhat stretched P/E valuation.

More By This Author:

D.R. Horton To Report Q3 Earnings: Buy, Sell Or Hold The Stock?

Coca-Cola's Q2 Earnings On The Deck: A Smart Buy Before The Release?

PNC & AIR Are 2 Top Stocks To Watch After Earnings

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more