Buy General Motors Or Tesla Stock As Q4 Results Approach?

Image: Bigstock

Much-anticipated Q4 results from two of the major domestic automakers are on tap next week, with General Motors (GM - Free Report) and Tesla (TSLA - Free Report) reporting on Tuesday, Jan. 27, and Wednesday, Jan. 28, respectively.

Anticipation and mild concern are building as the expiration of the $7,500 federal tax credit on new EV purchases led to a broad decline in EV sales during Q4. Nevertheless, General Motors and Tesla have pumped out market-leading gains in recent years, making it a worthy topic of whether it’s time to buy stock in either of these auto leaders as Q4 earnings approach.

Image Source: Zacks Investment Research

General Motors Gains EV Market Share Despite a Q4 Decline

General Motors sold 25,219 EVs in Q4 2025, compared to 43,982 in Q4 2024, with Tesla selling 418,227 EVs compared to 495,570 a year ago.

Notably, General Motors still sold a record 169,887 EVs last year, a 48% increase from 2024, with the company ranking in the #2 spot in the domestic EV market ahead of Ford (F - Free Report). It’s also noteworthy that General Motors’ total vehicle sales were up 5.5% in 2025 to 2.8 million.

Exclusively focused on electric vehicles, Tesla remains the EV market leader in the U.S., although its total vehicle sales dropped 8% to 1.63 million from 1.78 million in 2024.

General Motors Q4 Expectations

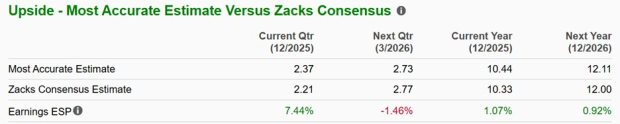

Based on Zacks estimates, General Motors’ Q4 sales are expected at $44.68 billion, a 6% decrease from $47.71 billion in the prior year quarter. That said, Q4 EPS is still projected to be up 15% to $2.21 from $1.92 per share in the comparative period.

More intriguing is that the Zacks ESP (Expected Surprise Prediction) indicates General Motors could surpass earnings expectations, with the Most Accurate and recent estimates among Wall Street having Q4 EPS pegged at $2.37, and 7% above the underlying Zacks Consensus Estimate (Current Qtr provided below).

Image Source: Zacks Investment Research

Tesla’s Q4 Expectations

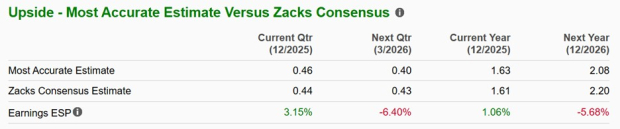

As for Tesla, Q4 sales are expected to fall 2% to $25.11 billion versus $25.71 billion in the prior year quarter. Tesla’s bottom line is also expected to contract, with EPS projected at $0.44, a 40% drop from $0.73 per share in Q4 2024.

The Zacks ESP does suggest Tesla could surpass earnings expectations, with the Most Accurate and recent estimates from Wall Street having Q4 EPS slated at $0.46, and 3% above the underlying Zacks Consensus Estimate.

Image Source: Zacks Investment Research

Tracking the EPS Revisions Trend

Although the Zacks ESP is favorable for Tesla, the underlying consensus for Q4 EPS was at $0.46 a month ago as well, and it has now dropped to $0.44 as mentioned.

Furthermore, Tesla’s FY25 and FY26 EPS estimates have fallen 2% and 8% in the last 60 days, respectively. Tesla is now expected to end FY25 with annual earnings falling 33% to $1.61 per share, although FY26 EPS is projected to stabilize and rise 37% to $2.20.

Image Source: Zacks Investment Research

In contrast, the overall consensus for General Motors’ Q4 EPS is up 2% in the last two months. Plus, full-year EPS revisions are up 1% during this period for FY25, with FY26 EPS estimates spiking 7%. General Motors is now expected to round out FY25 with annual earnings dipping 2% to $10.33 per share, but FY26 EPS is forecasted to rebound and rise 16% to $12.00.

Image Source: Zacks Investment Research

Bottom Line

Attributed to the positive trend of EPS revisions, General Motors stock currently sports a Zacks Rank #2 (Buy) rating when considering that the auto giant also looks undervalued at just 6X forward earnings. On the other hand, Tesla shares land the stock a Zacks Rank #4 (Sell) rating on a more concerning EPS revision trend and a stretched P/E valuation of 200X.

Despite market optimism for Tesla’s coinciding energy business and autonomous vehicle production, not to mention its AI and robotics endeavors, General Motors may be the safer investment for now, even with both automakers expected to beat Q4 earnings expectations.

More By This Author:

Is Nvidia The Most Capital-Efficient Stock To Invest In?Will Intel Stock Keep Soaring As Q4 Earnings Approach?

Buy Netflix Stock For A Rebound As Q4 Earnings Approach?

Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific securities ...

more