Buy E-Commerce Stock Chewy Down 35% Before Q1 Earnings?

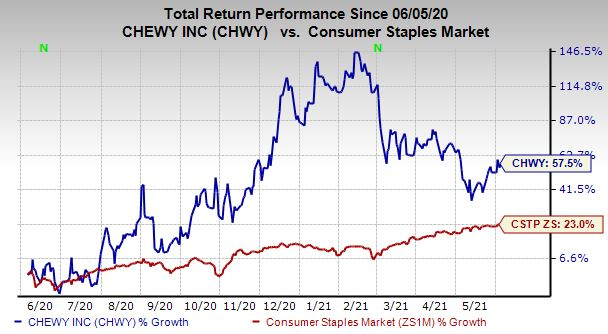

Chewy (CHWY - Free Report) shares soared over 300% from their March 2020 lows until Wall Street began to sell pandemic high-flyers in February. The e-commerce pet store stock currently sits about 35% below its records heading into its first quarter fiscal 2021 financial release on Thursday, June 10.

CHWY has regained some of its momentum since mid-May. So, let’s see if investors might want to consider buying the beaten-down e-commerce firm that still boasts a solid growth outlook.

Pet Lover Spending

Chewy, which was founded in 2011 and went public in 2019, is an e-commerce pet store with relatively speedy delivery. The firm sells pet food, supplies, treats, medications, and more for a variety of animals. Chewy has found success by adding loyal pet owners to its ranks, with 70% of revenue coming from its Autoship business that allows people to have food and more delivered at regular intervals.

Chewy added 43% more users in 2020 to close the year with 19.2 million and its Autoship unit creates consistent revenue. The company last October launched its telehealth service called Connect with a Vet. The telehealth service, only available to Autoship customers, could be a hit as people opt for convenience where they can.

Chewy has also boosted its pharmacy offerings and it announced on May 21 the expansion of its telehealth service to include free video consultations, extended hours, and more. All of this has helped established CHWY as a player poised to thrive in the e-commerce world dominated by Amazon (AMZN - Free Report) , Target (TGT - Free Report) , and Walmart (WMT - Free Report) .

Image Source: Zacks Investment Research

Other Fundamentals

Chewy’s 2020 revenue surged 47% to $7.15 billion to beat FY19’s 37% sales expansion. Plus, it reported its first quarterly profit in Q4, crushing our bottom-line estimates by 222% to extend its streak of impressive beats to three-straight quarters.

Zacks estimates call for its Q1 revenue to climb 31% to help it swing from an adjusted loss of -$0.12 in the year-ago period to +$0.03 a share. Peeking further down the line, CHWY’s full-year 2021 sales are projected to jump by 25% or $1.8 billion higher to reach roughly $9 billion, with FY22 projected to see it add another $1.7 billion, or 20% stronger revenue.

On the bottom line, Chewy’s adjusted earnings are expected to skyrocket 122% to $0.20 a share this year and soar another 150% in FY22. The stock’s stagnant earnings revisions activity helps it land a Zacks Rank #3 (Hold) at the moment, next to its “A” grade for Growth and “B” for Momentum in our Style Scores system.

As we touched on at the outset, Chewy shares had soared over 300% from their March 2020 lows to their February highs of around $120 a share. Since then, Chewy has fallen 35%, as Wall Street sold pandemic high-flyers.

Luckily, it has popped 17% since mid-May after it dipped into oversold RSI territory (30). CHWY currently sits right near neutral RSI levels. And it trades at its year-long median at 3.3X forward sales, which marks a huge discount to its Sector’s 10.5X average. All of this could give Chewy plenty of runway.

Bottom Line

The recent positivity that also saw the stock pop through morning trading Friday could mean Wall Street is expecting big things from Chewy’s Q1 results. And it’s worth noting that despite its fall, 10 of the 15 brokerage recommendations Zacks has are “Strong Buys” or “Buys,” while only one rating comes in below a “Hold.”

More importantly, e-commerce was booming long before the pandemic and people utilizing delivery, especially automated delivery for essentials like pet food, are unlikely to go back even as they return to their normal lives during the economic reopening.

(highlights and cute animals in this 58-second video:)

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more