Buy Dillard's Stock After Crushing Q2 EPS Expectations?

Image Source: Pexels

Reporting favorable Q2 results on Thursday, Dillard’s (DDS - Free Report) has remained a standout among regional department store retailers. To that point, Dillard’s was able to crush Q2 EPS expectations thanks to its operational efficiency, modest sales growth, and shareholder-friendly capital allocation.

Furthermore, Dillard’s emphasis on exclusive merchandise and private label brands in regard to fashion apparel and home furnishings has helped differentiate the large department store chain from its competitors, such as Macy’s (M - Free Report) and Kohl’s (KSS - Free Report).

Considering such, let’s see if now is an ideal time to buy Dillard’s stock, with DDS up a respectable +18% year to date to over $500 a share, and now sitting on gains of more than +40% over the last year.

Dillard’s Strong Q2 Results

Reporting Q2 sales of $1.51 billion, Dillard’s top line increased 2% from the prior year quarter and slightly edged estimates by 0.19%. This comes as Dillard’s saw improved sales trends in July, particularly for adolescent apparel, ladies' accessories, and lingerie. Dillard’s also maintained a strong digital presence and loyalty initiatives.

Most impressive, Dillard’s reported Q2 earnings of $4.66 per share, which crushed EPS expectations of $3.79 by nearly 23% and was up 1% from a year ago in what was a tough to compete against operating period. Notably, Dillard’s received a $4.8 million pre-tax gain from the sale of three properties, which contributed $0.24 to its quarterly EPS and also boosted its per-share earnings by reducing its share count through stock buybacks.

More intriguing, Dillard’s has now exceeded the Zacks EPS Consensus in each of its last four quarterly reports with a very impressive average earnings surprise of 24.04%.

Image Source: Zacks Investment Research

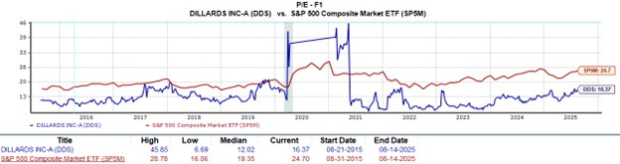

Dillard’s Attractive Valuation

While Dillard’s doesn’t provide formal guidance, the company’s valuation is hard to overlook, even with its robust earnings expected to contract after hitting record peaks in recent years during the post-pandemic retail rebound.

Trading at 16.3X forward earnings, DDS still trades at a noticeable discount to the benchmark S&P 500. It’s also noteworthy that DDS is well below Kohl’s 39X forward earnings multiple, and is enticingly closer to Macy’s 7.1X, although Dillard’s robust bottom line largely suggests it should trade at a significant premium to these peers.

Image Source: Zacks Investment Research

As a leader in the retail-regional department store space, Dillard’s stock is also attractively beneath the optimum level of less than 2X sales, at 1.2X.

Image Source: Zacks Investment Research

DDS EPS Revisions

Making Dillard’s attractive valuation more enticing is that earnings estimate revisions for fiscal 2025 and FY26 are nicely up in the last 30 days. Over the last month, FY25 EPS estimates are up 2% from projections of $29.84 to $30.47. Plus, FY26 EPS estimates have spiked 9% from projections of $25.25 to $27.50.

Image Source: Zacks Investment Research

Bottom Line

Following its favorable Q2 report, Dillard’s stock currently boasts a Zacks Rank #1 (Strong Buy). Considering the impressive Q2 earnings beat, EPS revisions may continue to rise for Dillard’s in the coming weeks, and in addition to its strong buy rating, DDS checks an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

More By This Author:

3 Funds To Buy On Solid Surge In Semiconductor Sales In Q2Buy Or Avoid The Drop In Chipotle & Cava Group's Stock?

Time To Buy JPMorgan & Citigroup Stock For Potential Rate Cuts

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more