Buy Cheniere Energy Stock After Massive Q4 Earnings Beat?

Image: Bigstock

With market uncertainty resurfacing, investors will be looking for stocks that can weather a potential economic downturn.

One company that may be catching investors' attention after releasing its Q4 results on Thursday is Cheniere Energy (LNG - Free Report). While the company wasn’t able to shake off the volatility in Friday's trading session, Cheniere crushed its Q4 EPS expectations, making a trend of positive earnings estimate revisions likely to continue.

Cheniere’s Q4 Results

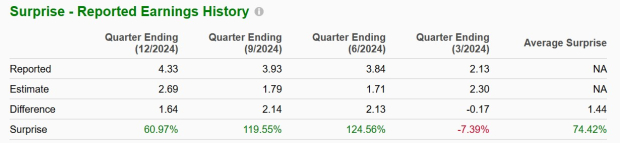

Engaged in liquified natural gas production, Cheniere’s earnings were expected to drop to $2.69 per share after a tougher-to-compete-against period that saw Q4 EPS at $5.76 a year ago. However, Cheniere reported Q4 EPS of $4.33, crushing expectations by 61%.

This came on sales of $4.43 billion, which was down from the $4.82 billion reading in the comparative quarter but was near estimates of $4.4 billion. Operating North America’s first large-scale liquified gas export facility, Cheniere has exceeded earnings expectations in three of its last four quarterly reports with a very impressive average EPS surprise of 74.42%.

Image Source: Zacks Investment Research

Positive EPS Revisions

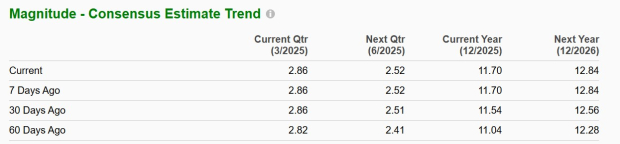

Most intriguing is that before Cheniere’s massive Q4 earnings beat, fiscal 2025 EPS estimates had already increased 6% over the last 60 days from $11.04 a share to $11.70 (Current Fiscal Year). It’s also noteworthy that FY26 EPS estimates are up 4% in the last two months, from $12.28 a share to $12.84.

Image Source: Zacks Investment Research

Tracking Cheniere's Stock Performance

With positive earnings estimate revisions being the biggest indicator of more upside in a stock, Cheniere is up a modest +3% year-to-date despite falling over 2% in Friday’s broader selloff. Furthermore, Cheniere’s stock has spiked over +40% in the last year, and it has been sitting on +90% gains in the last three years.

Image Source: Zacks Investment Research

Bottom Line

Known for its massive earnings potential, Cheniere Energy will be a stock to keep an eye on in the coming weeks, as it currently sports a Zacks Rank #2 (Buy) rating. Reassuringly, Cheniere is at a reasonable 19.4X forward earnings multiple, and it offers a 0.88% annual dividend yield.

More By This Author:

Walmart Vs. Target Stock: Which Is The Better Investment As Q4 Results Roll OutThree Top Ranked Dividend Stocks: A Smarter Way To Boost Your Retirement Income

Bull Of The Day: Palomar Holdings

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more