Buy AT&T Or Verizon Stock If Market Volatility Resurges?

Image Source: Unsplash

Benefiting from strong demand for their wireless and broadband services, AT&T (T - Free Report) and Verizon (VZ - Free Report) stock have provided a pleasant hedge against market volatility this year.

Not too far off their 52-week highs, AT&T’s stock is up +20% year to date, with Verizon shares sitting on respectable gains of +9% compared to the S&P 500 and the Nasdaq's declines of -1%.

Image Source: Zacks Investment Research

AT&T & Verizon’s 5G Growth

Sparking investor interest in AT&T and Verizon stock is their continued expansion of 5G networks, the fifth generation of cellular network technology, providing peak speeds of up to 10 gigabits per second, lower latency, and greater connectivity.

Thanks to its 5G customer base, AT&T added 324,000 postpaid wireless subscribers during Q1 and 181,000 fixed wireless access (FWA) subscribers. Furthermore, AT&T added 600,000 new locations to its fiber-optic network coverage, with plans to reach 30 million fiber locations by the end of Q2. More intriguing, AT&T has added 200,000 or more fiber optic internet subscribers for 21 consecutive quarters.

Meanwhile, Verizon reported industry-leading wireless service revenue of $20.8 billion during Q1. Notably, Verizon added 308,000 new 5G Home Internet customers with a total FWA subscriber base of over 4.8 million, which is second in the national market behind T-Mobile (TMUS - Free Report) ).

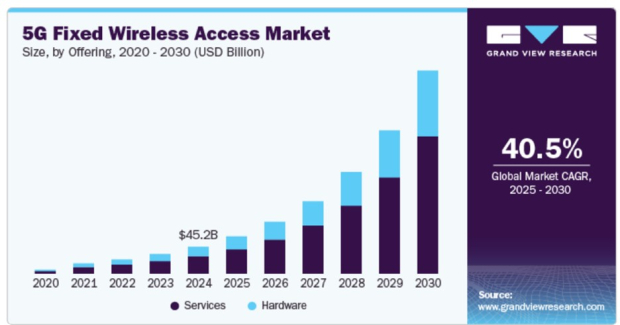

It’s also noteworthy that the 5G FWA market was valued at over $45 billion last year and is expected to reach a value of more than $238 billion by 2030, with an eye-catching CAGR projection of 40.5%.

Image Source: Grand View Research

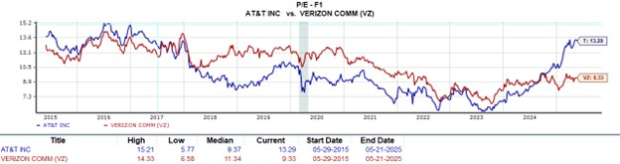

Valuation Comparison

With 5G expansion starting to lift AT&T and Verizon’s growth prospects, their affordable price tags may be more attractive to retail investors compared to T-Mobile’s stock, with TMUS trading over $240 a share.

In terms of valuation, AT&T and Verizon are more enticing as well and have made the case for being undervalued at 13.2X and 9.3X forward earnings, respectively. This is a noticeable discount from T-Mobile’s 22.8X forward earnings multiple and their Zacks Wireless National Industry average of 21.4X. Plus, unlike T-Mobile, AT&T and Verizon shares trade under the optimum level of less than 2X sales.

Image Source: Zacks Investment Research

Enticing Dividends

Adding icing to the cake are AT&T and Verizon’s generous dividends with annual yields of over 4% and 6%, respectively, to impressively top T-Mobile’s 1.46%.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

For now, AT&T and Verizon stock both land a Zacks Rank #3 (Hold). Holding positions in these telecom giants has proven to be beneficial when tariff concerns and broader economic uncertainty have arisen this year. To that point, AT&T and Verizon’s wireless services are somewhat essential despite the industry’s competitive landscape.

That said, there could be better buying opportunities ahead, although long-term shareholders in AT&T and Verizon may still be rewarded, considering their lofty dividends and 5G expansion.

More By This Author:

These Top-Rated Stocks Are Surging After Earnings: GDS, GOOSTariffs, Prices, And Pain: What's Next For Oilfield Service?

Will Housing & Construction Related Stocks Surge This Summer?