Buy 5 High-Yielding Large-Caps Ahead Of Q3 Earnings Next Week

Image: Bigstock

Third-quarter 2021 earnings season has commenced this week with major banks releasing their quarterly financial numbers. Market participants have high expectations from this earnings season as overall earnings of corporate America are likely to remain robust after skyrocketing in the second quarter.

Good Start to Third-Quarter Earnings

As of Oct 13, 26 S&P 500 companies have reported third quarter results. Total earnings of these companies are up 32.6% year over year on 17.6% higher revenues with 80.8% beating EPS estimates and 65.4% surpassing revenue estimates.

Total third-quarter earnings of the market's benchmark — the S&P 500 Index — are projected to jump 27% from the same period last year on 14% higher revenues, following 95% year-over-year earnings growth on 25.3% higher revenues in the second quarter and 49.3% year-over-year earnings growth on 10.3% higher revenues in first-quarter 2021.

The first two quarters of this year were favorably impacted since the preceding quarters of last year were affected by the coronavirus pandemic induced lockdowns and restriction.

However, the U.S. economy started reopening partially albeit at a very slow pace since the beginning of the third quarter of 2020. Notwithstanding favorable comparisons with last year, third-quarter 2021 earnings estimates reflect genuine growth, climbing 16.9% from the pre-pandemic third-quarter 2019.

Q3 2021 At a Glance

The U.S. economy continued to witness a strong recovery from the pandemic-led havoc in the third quarter. Nationwide deployment of COVID-19 vaccines on a priority basis, massive fiscal stimulus and continuation of easy money policies by the Fed resulted in a faster-than-expected reopening of the economy.

Strong pent-up demand supported by record-high personal savings, labor shortage and supply-chain disruptions resulted in a spike in inflation. Although the Fed initially considered the inflation to be transitory, it did recognize in its September FOMC meeting that inflation will remain elevated longer than anticipated.

The rapid spread of the highly infectious Delta variant of the coronavirus also disrupted normal economic activities to some extent. As a result, the revisions trend for third-quarter earnings showed signs of deceleration after remaining positive for the last few quarters. The negative impacts of the Delta variant and supply-chain disruptions resulted in the unfavorable shift in the revisions trend.

Our Top Picks

Five large-cap (market capital >$10 billion) stocks are slated to release third-quarter earnings results next week. These companies are regular dividend payers, which is a valuable trait under volatile market conditions. All of these stocks have a Zacks Rank#2 (Buy) and a positive Earnings ESP.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after earnings releases. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

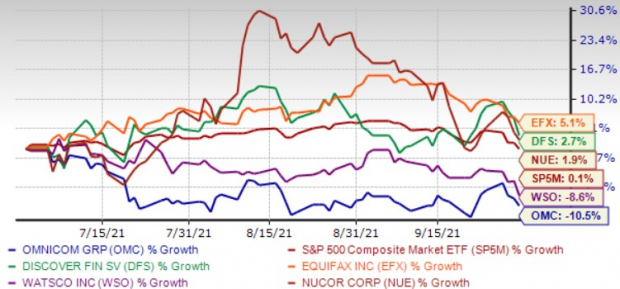

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

Omnicom Group Inc. (OMC Quick Quote OMC - Free Report) is one of the largest advertising, marketing and corporate communications companies in the world. The company’s agencies operate in all the major markets across the globe and provide an extensive range of services.

Consistency and diversity of operations and increased focus on delivering consumer-centric strategic business solutions ensure consistent profitability for Omnicom. Its bottom line has been gaining from ongoing operating efficiency initiatives in real estate, back-office services, procurement and IT areas. Change in business mix resulting from disposition of some non-core or underperforming agencies over the past year, may have contributed to the bottom line as well.

The company has an Earnings ESP of +8.5%. It has an expected earnings growth rate of 21.8% for the current year. The Zacks Consensus Estimate for current year-earnings improved 0.2% over the last 30 days. It beat earnings estimates in each of the last four] quarters, the average surprise being 12.2%. Omnicom is set to release earnings results on Oct 19, after the closing bell.

Watsco Inc. (WSO Quick Quote WSO - Free Report) is the largest distributor of heating, ventilation and air conditioning equipment, as well as related parts and supplies in the United States, Canada, Mexico, and Puerto Rico. The company has been benefiting from strong sales growth, a richer sales mix of high-efficiency systems, improved selling margins and operating efficiencies.

The company’s e-commerce business has been gaining traction in recent times owing to stay-at-home orders issued by the government. Also, its continues to invest in industry-leading technology for new customer acquisition, which aids it in enhancing shareholder value. Management is aggressively leveraging technology platforms to better serve, and protect customers and employees.

The company has an Earnings ESP of +5.83%. It has an expected earnings growth rate of 45.2% for the current year. The Zacks Consensus Estimate for current year-earnings improved 0.8% over the last seven days. It has a trailing four-quarter earnings surprise of 23.1%, on average. Watsco is set to release earnings results on Oct 20, before the opening bell.

Discover Financial Services (DFS Quick Quote DFS - Free Report) is a direct banking and payment services company in the United States. It operates in two segments, Direct Banking and Payment Services. Expansion in the global payments business and an attractive core business position the company well for growth.

A gradual economic recovery and improved consumer spending have been providing a boost to its sales volume. Its strong balance sheet is another positive, highlighted by its cash and investment securities being higher than long-term borrowings. Its banking business provides significant diversification benefits. A solid financial position enables it to deploy capital via buybacks and dividends.

The company has an Earnings ESP of +2.25%. It has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current year-earnings improved 0.1% over the last seven days. It beat earnings estimates in each of the trailing four quarters, the average surprise being 46.4%. Discover Financial is set to release earnings results on Oct 20, after the closing bell.

Equifax Inc. (EFX Quick Quote EFX - Free Report) provides information solutions and human resources business process outsourcing services for businesses, governments, and consumers. The company operates through four segments: U.S. Information Solutions, Workforce Solutions, International, and Global Consumer Solutions.

The company's offerings are of great importance to its customers as they use the credit information and related analytical services and data to process applications for new credit cards, automobile loans, home and equity loans, and other consumer loans. Acquisitions supplement core business and joint ventures help expand globally.

The company has an Earnings ESP of +0.47%. It has an expected earnings growth rate of 7% for the current year. The Zacks Consensus Estimate for current year-earnings improved 0.1% over the last seven days. It beat earnings estimates in each of the trailing four quarters, the average surprise being 17.7%. Equifax is set to release earnings results on Oct 20, after the closing bell.

Nucor Corp. (NUE Quick Quote NUE - Free Report) is a leading producer of structural steel, steel bars, steel joists, steel deck and cold-finished bars in the United States. It operates through three segments: Steel Mills, Steel Products, and Raw Materials.

The company has been seeing consistent momentum in the non-residential construction market. Demand in non-residential construction markets was strong in the most recent quarter. Nucor’s downstream products unit has been benefiting from continued strength in the non-residential construction markets.

The company has an Earnings ESP of +4.03%. It has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current year-earnings improved 10.1% over the last 30 days. It beat earnings estimates in each of the trailing four quarters, the average surprise being 8.1%. Nucor is set to release earnings results on Oct 21, before the opening bell.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more