Bulls Take It To The Bank

Image Source: Unsplash

There’s a saying in life that goes, “Don’t judge a book by its cover.” Well, as it turns out, we shouldn’t judge the market solely by the indices either.

It amazes me how, after just one week of selling, I’m already starting to see calls for a “Trump slump”, and for stocks to experience a pull back here.

Listen, I was bullish well before we knew the outcome of the presidential election, and to be very clear, the market’s bull trend was established before Trump was elected.

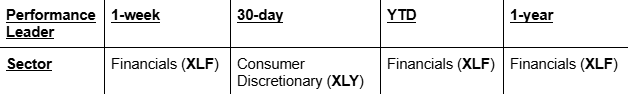

Once again, the Tale of the Tape never fails to provide answers to the questions on everyone’s mind. Check this out…

Banks Buying Themselves

The main reason why we look at the sector performance rankings each week is because markets don’t just turn on a dime without any warning.

I know the news likes to pretend like nobody ever saw anything coming when it comes to financial markets, but it’s not all that different from weather forecasting.

Obviously, there are models that are better than others. And the only way to know how good a model performs is to judge it by its results.

If you go back and look at history, I doubt you’ll find many examples - if any - of a market that’s about to crash when financials are the top-performing sector. The irony behind this move is that it’s become clear that banks are buying up each others’ shares - sounds good, right?

At some point, this will probably turn into a problem. We know that banks like to give each other the “wink, wink, nod, nod” in markets.

In any event, the only other sector on the scoreboard is consumer discretionary. As it turns out, consumers are spending due to confidence, and they’re borrowing money to do so. This may be a good signal near-term, but eventually, it will become a problem.

More By This Author:

You Need To Take This Selloff Seriously

Here’s What DOGE Means For Interest Rates

How The Trump Bump Could End In A Slump

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more