Bullish Reversals, But Markets Not Out Of The Woods

Just as the selling meant indices were not as weak as headlines suggested. Likewise, today's buying was not as good as the media would suggest either. However, it did at least stall the break of the most recent swing low.

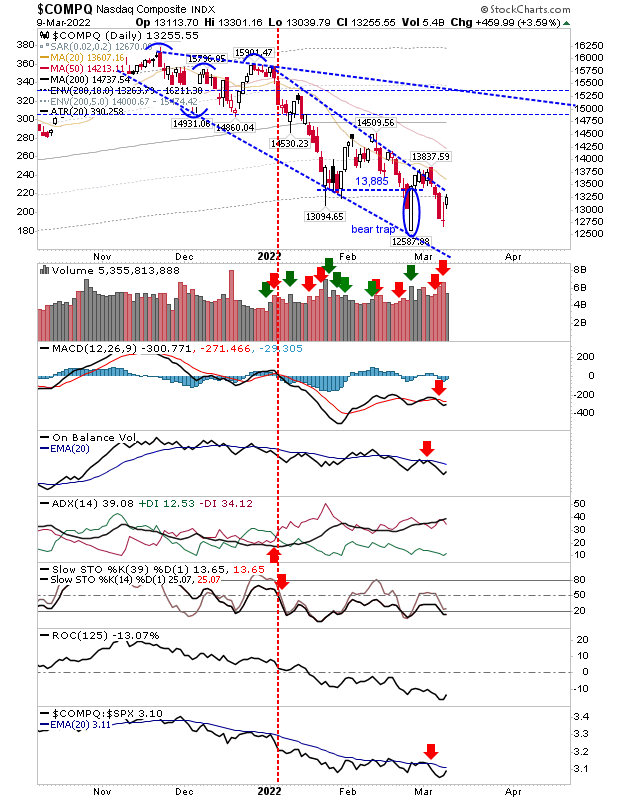

The Nasdaq has made its way back to declining resistance of the slow forming wedge, but technicals are all bearish and it remains some way from a bullish 'buy' in relative performance to peer indices.

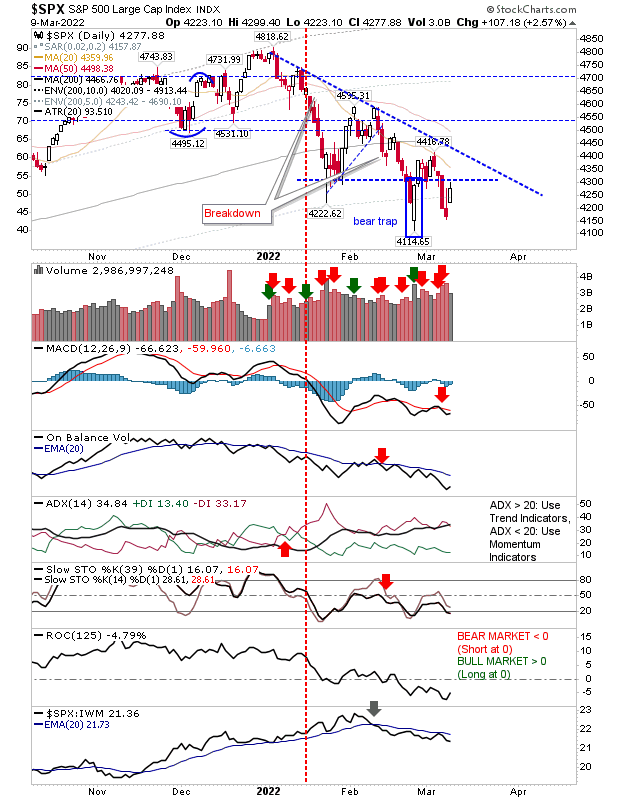

The S&P has also bounced off yesterday's modest selling, but it's a long way from breaking the downward trend. Technicals are net negative along with relative underperformance.

The Russell 2000 returned to its trading range after a gentle nudge into a 'bear trap' challenge, before it rallied back to its 20-day MA. Today's buying volume was light, but there is a strong relative outperformance along with the MACD 'buy', along with a pending 'buy' in On-Balance-Volume.

I remain of the opinion markets are shaping a trade-worthy swing low, the Russell 2000 in particular, but today's buying didn't do enough to challenge pre-existing resistance. There is still a chance we will see such a challenge before the week is out, but there is much work to do.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more