Bull Of The Day: Workday

Image Source: Unsplash

Company Overview

Zacks Rank #1 (Strong Buy) stock Workday ((WDAY - Free Report) ) is a software platform provider that enables enterprise cloud solutions and a one-stop shop for human resources, finances, and business operations. Medium size and large businesses use Workday’s platform to handle tasks like payroll, employee scheduling, benefits administration, and financial reporting more efficiently.

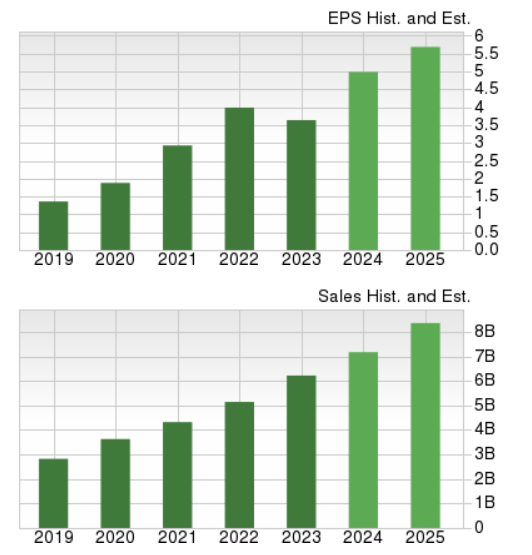

Consistent Growth Despite Economic Instability

Workday’s revenue growth continues to be driven by high demand for its human capital management (HCM) and financial management solutions. Like many enterprise software companies, the COVID-19 pandemic became a windfall for WDAY. However, unlike its peers, WDAY has sustained consistent and robust growth. Last quarter EPS jumped 58% while revenue shot higher by 17% year-over-year.

Image Source: Zacks Investment Research

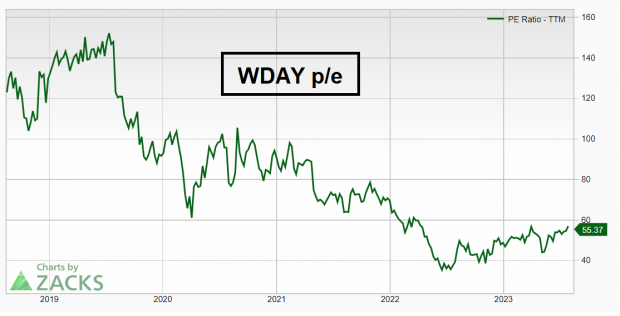

Attractive Valuation

The 2022 tech bear market reset the deck of cards for WDAY. While earnings continued to grow, WDAY stock continued to fall. Now, WDAY’s price-to-earnings ratio is at multi-year lows.

(Click on image to enlarge)

Image Source: Zacks Investment Research

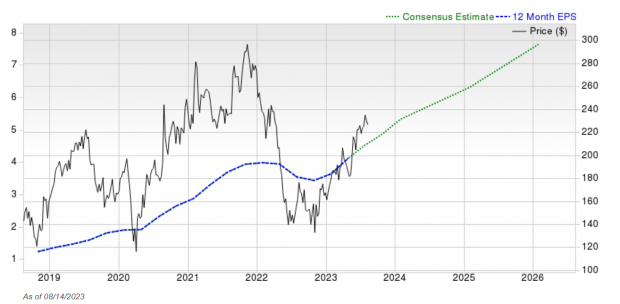

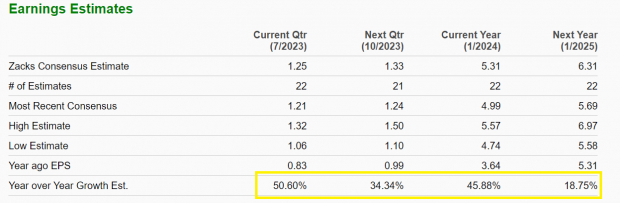

Meanwhile, earnings are expected to hit all-time highs, with the stock still well off its highs – a bullish sign.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bullish Chart Pattern

WDAY shares are retreating to the 50-day moving average for the first time in months. Typically, the first pullback to the 50-day moving average is an area of attractive reward-to-risk.

(Click on image to enlarge)

Image Source: TradingView

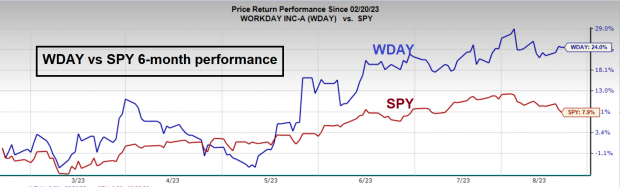

Relative Strength

Relative price strength measures the performance of a particular stock in relation to a benchmark (most commonly the S&P 500 Index). During market pullbacks, relative strength can be an especially powerful tool. Because three in four stocks follow the market’s direction, most stocks will fall in tandem with the market during peak periods. However, a good clue that a stock may be ready to lead occurs when the stock bucks the market weakness and goes against the tide. The thinking is that if the stock can go up in a down market, then it is likely to outperform when the market regains its footing.

(Click on image to enlarge)

Image Source: Zacks Investment Research

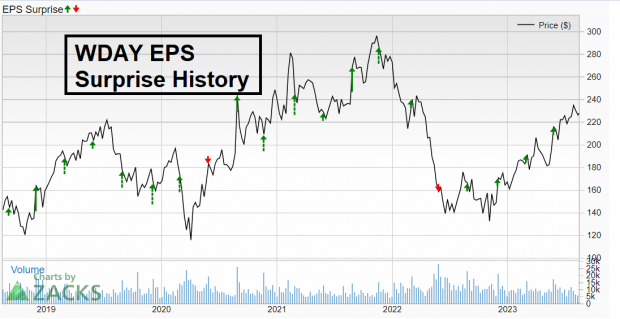

Strong Earnings History & Expectations

WDAY is a consistent eps expectation breaker. The company has delivered positive surprises in the past four quarters that beat analyst expectations.

(Click on image to enlarge)

Image Source: Zacks Investment Research

WDAY’s positive Earnings ESP score suggests that the company will again deliver an earnings beat when it reports on August 24th.

Momentum Going Forward

Solid momentum in Workday’s human capital and financial management portfolio drives top-line growth.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In addition, the company’s cloud-based business model is increasingly gaining traction. Strong emphasis on integrating generative AI in Workday products and unique new AI-driven applications in development by the company looks to be a long-term tailwind.

More By This Author:

Eli Lilly (LLY) Stock Up Almost 50% Year to Date: Here's WhyBull Of The Day: Paccar Inc.

Bear Of The Day: Ashland Inc.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more