Bull Of The Day: Uber Technologies

Company Overview

Zacks Rank #1 stock (Strong Buy) Uber Technologies (UBER) is the worldwide leader in ridesharing services through its Uber mobile application.Uber is also a market leader in the food delivery business through its “Uber Eats” service and the freight business through its “Mobility” operations. Since going public in 2019, Uber investors have been subject to a wild, volatile ride. The company fell victim to COVID-19 restrictions, two brutal bear markets, and a market environment that has not been kind to IPOs. However, in 2023, the company has turned the corner.

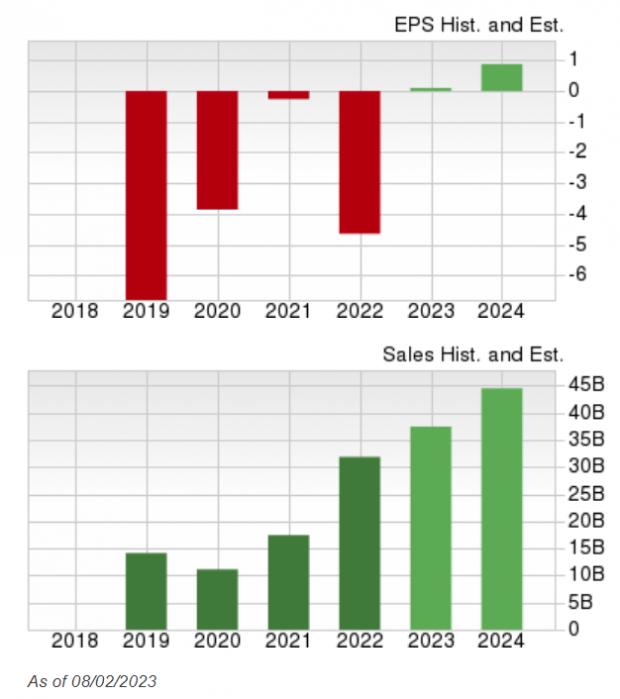

Finally, in the Green

Uber is slated to report an annual profit for the first time since going public. Meanwhile, revenues are on pace to grow for a third straight year.

Image Source: Zacks Investment Research

International Expansion

Perhaps behind Uber’s years of unprofitability lies its intentions to scale. International growth is a driving force for increased revenues. In 2021, Uber acquired freight company Transplace for $2.25 billion – allowing the freight business to expand its tentacles into Mexico.

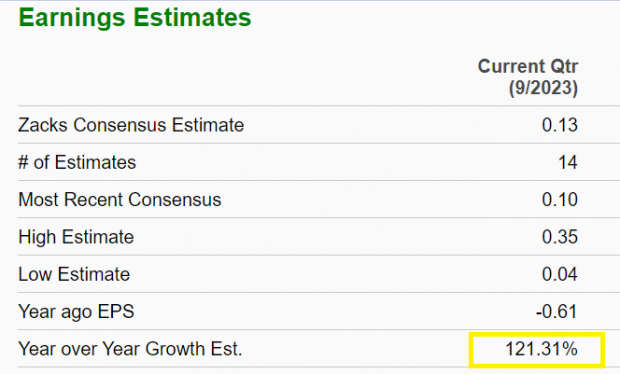

Uber Eats Business is Surging Due to Acquisitions

Uber’s management team has aggressively grown the company’s delivery business in the past three years through acquisitions. In December 2020, Uber purchased the popular food delivery app Postmates. Next, Uber expanded into the alcohol delivery business by acquiring Drizly. Most recently, the company inked a partnership with Domino’s ((DPZ Quick QuoteDPZ - Free Report) ), the largest pizza chain in the world. When Uber reports October 10th, Zacks Consensus Estimates suggest earnings will grow by a healthy 121.31% year-over-year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Liquid, Institutional Quality Leader

Wall Street was just briefed on the latest 13F reports. A Form 13F is a report that large institutional investors must file quarterly. 13Fs give investors a rare window into the kind of stocks that the world’s savviest investors are trafficking in. In the most recent 13F Filing, Third Point’s Dan Loeb, Appaloosa’s David Tepper, and Saudi Arabia’s Public Investment Fund all held shares of Uber. Because of their sheer size and longer-than-normal time frame, institutional investors are a large market and stock-moving force worth observing and studying. Institutional investors like the ones mentioned above gravitate toward stocks like Uber because they have a rare combination of growth, liquidity, and innovation.

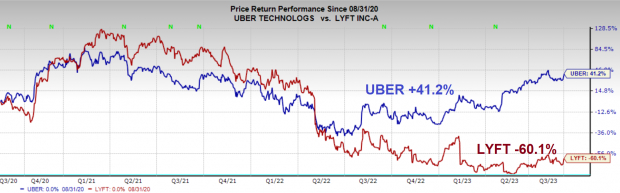

Uber is the Industry Leader

Uber and Lyft (LYFT ) are the undisputed leaders in the rideshare industry. However, just because they share a duopoly of sorts doesn’t mean that they are equal. For example, Uber grew revenue by 14% year-over-year last quarter, while Lyft grew at a lackluster pace of 3%.

Another sign that Uber is the dominant player in the industry is its robust relative strength. Lyft is below its IPO price, steeped in a downtrend, and is drastically underperforming Uber. Remember, price action and performance are directly correlated with supply and demand. Investors clearly favor Uber over Lyft.

(Click on image to enlarge)

Image Source: Zacks Investment Research

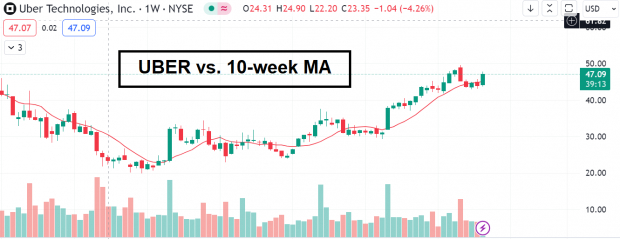

Technical View

After a solid start to 2023, Uber shares are finding support at the 10-week moving average – a bullish sign.

(Click on image to enlarge)

Image Source: TradingView

Bottom Line

International growth, acquisitions, and a post-pandemic return to normal have Uber firing on all cylinders. Adding to the bullish outlook over the next six to twelve months is strong institutional sponsorship, intriguing price and volume action, and robust relative price and fundamental strength versus its peers.

More By This Author:

Bear Of The Day: Paramount GlobalBeyond The Hype: Are Market Participants Underestimating The Role Of AI?

3 Top Ranked Dividend Stocks: A Smarter Way to Boost Your Retirement Income

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more