Bull Of The Day: The Progressive

The Progressive (PGR) has been a standout stock in the market leading insurance sector, delivering exceptional performance both in the short term and over the long haul. With a strong growth outlook, a top Zacks Rank, and a discounted valuation, Progressive stock is well-positioned to continue its impressive run.

Investors seeking a reliable, growth-oriented stock might consider Progressive as a key component of their portfolios.

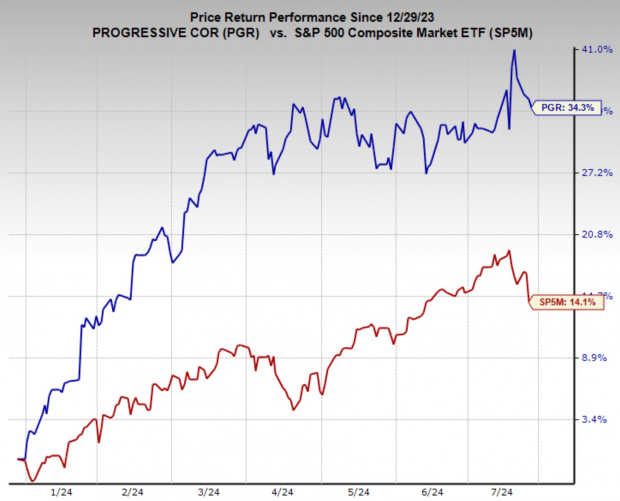

The Progressive Stock Relative Strength

Progressive stock has exhibited remarkable strength throughout the year, significantly outperforming the broader market.

This robust performance is not a recent phenomenon; Progressive has consistently delivered outstanding returns over the long term. Over the past 15 years, the stock has compounded at an annual rate of 18.8%, nearly 13xing investors' money during that period.

This track record of consistent growth underscores Progressive's resilience and its ability to thrive in various market conditions.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Steadily Rising Earnings Revisions Trend

Progressive's impressive business performance is reflected in its Zacks Rank #1 (Strong Buy) rating. The company's earnings estimates have seen steady upward revisions over the past year, with analysts unanimously raising their forecasts across timeframes. This positive trend highlights the confidence analysts have in Progressive's growth prospects and increases the odds of a near-term rally.

The company's earnings per share (EPS) are projected to grow at an impressive annual rate of 23.8% over the next three to five years. This robust growth forecast is driven by Progressive's strong underwriting performance, innovative product offerings, and efficient cost management. As the company continues to capitalize on its competitive advantages, investors can expect sustained earnings growth.

(Click on image to enlarge)

Image Source: Zacks Investment Research

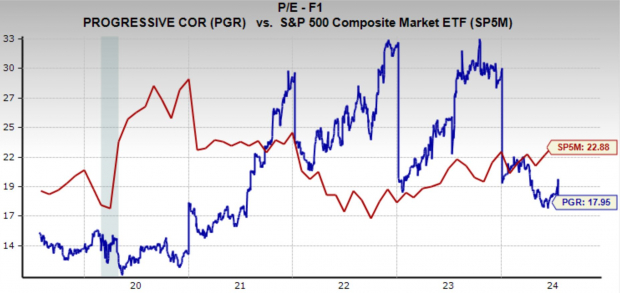

Discounted Valuation at Progressive

Despite its strong performance and promising growth outlook, Progressive is currently trading at a relatively discounted valuation. The stock's one-year forward earnings multiple stands at 17.9x, which is below the market average of 22.9x and below its five-year median of 20.6x. This attractive valuation provides a margin of safety for investors, reducing downside risk while offering substantial upside potential.

Additionally, Progressive's PEG ratio is a mere 0.75, indicating that the stock is undervalued relative to its expected growth. This low PEG ratio suggests that Progressive offers exceptional value for growth-oriented investors, making it an appealing choice in today's market.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

The Progressive Corporation stands out as a top-performing stock with a strong growth outlook, favorable earnings revisions, and a discounted valuation. Its track record of consistent long-term growth, combined with its impressive short-term performance, makes it a compelling investment opportunity.

As the company continues to execute its growth strategy and capitalize on its competitive advantages, investors can expect Progressive to deliver sustained returns. For those looking to add a reliable, growth-oriented stock to their portfolios, Progressive should be at the top of the list.

More By This Author:

Bear of the Day: KohlsBull Of The Day: Amplify Energy

Time To Buy Chipotle's Stock As Much Anticipated Q2 Earnings Approach?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more