Bull Of The Day: The Gap, Inc.

The Gap (GPS) , a Zacks Rank #1 (Strong Buy), operates as an apparel retail company. GPS shares are widely outperforming the market over the past six months thanks to improved margins, resulting in a bevy of brokerage upgrades and price target hikes. The stock is hitting a series of higher highs and displaying relative strength as buying pressure accumulates in this top-ranked stock.

GPS stock is part of the Zacks Retail – Apparel and Shoes industry group, which ranks in the top 33% out of more than 250 Zacks Ranked Industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform the market over the next 3 to 6 months. Also note the favorable valuation characteristics for this group below:

(Click on image to enlarge)

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

With more than 3,800 stores worldwide, The Gap is a premier international specialty retailer that offers a diverse range of clothing, accessories, and personal care products. The company tailors to both men and women with products under well-established brands such as Old Navy, Gap, Banana Republic, and Athleta. Gap’s main offerings include denim and khakis; eyewear, jewelry, shoes, handbags, and fragrances; and fitness and lifestyle products for use in yoga, training, sports, and travel.

The Gap provides its products through company-operated stores, franchise stores, websites, and third-party arrangements. The company has franchise agreements to operate its portfolio of brands in stores and websites across Asia, Europe, Latin America, the Middle East, and Africa.

Earnings Trends and Future Estimates

The apparel retailer has put together an impressive earnings history, surpassing earnings estimates in three of the last four quarters. Back in August, the company reported second-quarter earnings of $0.34/share, a 277.8% surprise over the $0.09/share consensus estimate. The Gap has delivered a trailing four-quarter average earnings surprise of 1,001.6%.

GPS shares have received a boost on the back of lower airfreight and improved promotions, which aided margins during the second quarter. Management expects gross margins to expand in the current fiscal year. Lower advertising expenses and other cost-saving actions bode well for future quarters and are projected to generate $300 million in annualized savings.

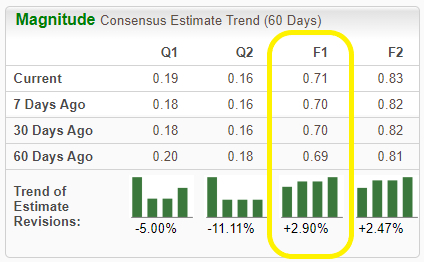

Analysts covering GPS are in agreement and have been increasing their full-year earnings estimates as of late. For the current fiscal year, analysts have increased earnings estimates by 2.9% in the past 60 days. The Zacks Consensus EPS Estimate now stands at $0.71/share, reflecting a staggering potential growth rate of 277.5% relative to the prior year.

Image Source: Zacks Investment Research

Let’s Get Technical

GPS shares have advanced nearly 38% in the past 6 months. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

(Click on image to enlarge)

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been making a series of higher highs and recently experienced a ‘golden cross’, whereby the 50-day moving average crosses above the longer-term 200-day average. With both strong fundamentals and technicals, GPS is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, The Gap has recently witnessed positive revisions. As long as this trend remains intact (and GPS continues to deliver earnings beats), the stock will likely continue its bullish run into the end of this year and beyond.

Bottom Line

Backed by a leading industry group and impressive history of earnings beats, it’s not difficult to see why this company is a compelling investment. Robust fundamentals combined with an appealing technical trend certainly justify adding shares to the mix.

The Gap is ranked favorably by our Zacks Style Scores, with top marks in our Value, Growth, and Momentum categories. A resurgence in apparel stocks bodes well for GPS shares. The future looks bright for this highly-ranked, leading stock.

More By This Author:

Top-Rated Stocks To Buy From A Variety Of Sectors After EarningsWill Dow Jones ETFs Show The Halloween Effect?

Bear Of The Day: Polaris

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more