Bull Of The Day: The Andersons

The Andersons, Inc. (ANDE) easily exceeded earnings expectations in the second quarter. It has jumped back to a Zacks Rank #1 (Strong Buy) as earnings estimates for 2023 and 2024 were revised higher.

The Andersons is an agribusiness company which has grown, over the last 76 years, from a single grain elevator to a diverse company with commodity merchandising (trade), renewables, and nutrient and industrial specialties.

Big Beat in the Second Quarter

On Aug 1, 2023, The Andersons reported second quarter results and blew by the Zacks Consensus by $0.46. Earnings were $1.52 versus the Zacks Consensus of $1.06. It was the fifth earnings beat in a row.

Business improved in several segments. After a slow first quarter, Nutrient & Industrial saw improved volumes during the 2023 planting period, driving a 21% increase in tons sold from the second quarter of 2022.

Trade results were mixed with an overall decline in gross profit from a year ago, but that included certain margin impacts from the Russian invasion of Ukraine that the company is not expecting to see repeated. Recent investments in food and pet food ingredients also contributed to earnings in the quarter.

Renewables saw solid earnings as ethanol crush margins strengthened over the quarter.

Analyst is Bullish

Zacks only has one earnings estimate on The Andersons as it is lightly covered given that it's a small cap company with a market cap of just $1.7 billion.

But that analyst has raised full year 2023 and 2024 earnings estimates. The 2023 Zacks Consensus has jumped to $2.90 from $2.38 in the last 30 days. That's still a decline of 28.4% from last year when The Andersons made $4.05 due to the impacts on the agriculture industry due to the Ukraine War.

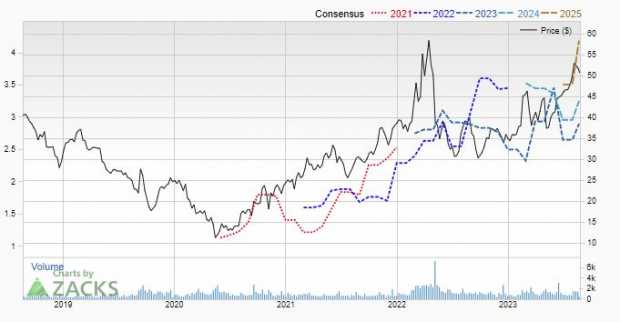

But 2024 is looking bullish as well, with the earnings estimate rising to $3.26 from $2.96 over the last month. That's earnings growth of 12.2%. Here's what it looks like on the chart.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The Andersons is Still Cheap

Shares have staged a big rally in 2023, adding 46.9% year-to-date.

But it's not expensive. The Andersons has a forward P/E of 17.5 and a P/S ratio of just 0.1. A P/S ratio under 1.0 indicates a company is undervalued.

It's also shareholder friendly. The Andersons pays a dividend, currently yielding 1.5%. On Oct 20, 2023, it will pay its fourth quarter dividend to shareholders. It will be the 108th consecutive quarterly dividend. The company has paid it every quarter since listing on the NASDAQ in Feb 1996.

For investors looking for an agribusiness investment, The Andersons is one to keep on your short list.

More By This Author:

Investing Lessons From Rich RetireesGold, Copper, Energy And Cocoa: Hot Or Not?

How To Invest In Commodity Stocks

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more