Bull Of The Day: Taiwan Semiconductor

Taiwan Semiconductor (TSM) is the world's largest and most advanced contract semiconductor manufacturer, or "foundry." Founded in 1987 and headquartered in Hsinchu, Taiwan, TSM produces chips for a wide range of industries, including consumer electronics, automotive, and now the Artificial Intelligence industries.

The company is known for its cutting-edge technology and innovation, especially in advanced process nodes like 5nm and 3nm, making it a crucial supplier for tech giants such as Apple, AMD, and Nvidia. TSM's dominant position in the semiconductor industry makes it a key player in the global tech supply chain and a premier asset for investors.

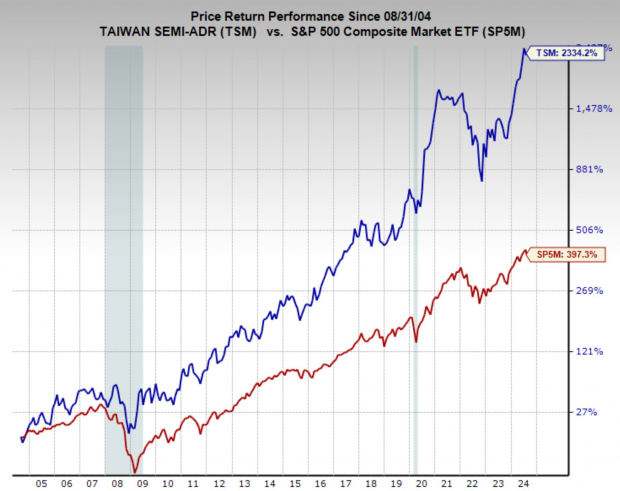

Not only does Taiwan Semiconductor play a critical role in the technology sector, but it also boasts a top Zacks Rank, strong earnings growth forecasts and a reasonable valuation. Furthermore, its stock has compounded at an impressive 17.1% annualized over the last 20 years, more than double the market average, and seems likely that it will continue to outperform based on current estimates.

Start Trading With The Best Trading Platform Now!

Image Source: Zacks Investment Research

AI Expansion Continues to Boost Sales at TSM

Taiwan Semiconductor, who shares monthly updates on its revenues, announced that in July revenues grew an incredible 44.7% year-on-year (YoY) to $7.9 billion. This growth outpaces the previous month (32.9%) and suggests strong ongoing demand for AI chips, particularly from major clients like Nvidia and Apple.

At its most recent quarterly meeting, TSM’s CEO, C.C. Wei, indicated the company could potentially raise prices as customers shift to its most advanced technologies. Despite investor concerns over the AI boom's sustainability, TSM remains well-positioned for robust performance, particularly with its involvement in high-performance computing led by AI, which accounted for 52% of its recent revenue.

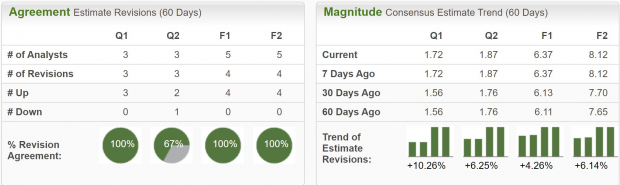

Analysts Raise Earnings Forecasts at Taiwan Semiconductor

Over the last month, analysts have near unanimously raised earnings estimates across timeframes, giving TSM a Zacks Rank #1 (Strong Buy) rating. This top rank significantly increases the odds of a near-term rally and confirms the continued strength of the underlying business.

Over the next three to five years, earnings are forecast to grow 26.5% annually, which is an incredible pace for such a mammoth company.

Image Source: Zacks Investment Research

Taiwan Semiconductor Shares Trade at a Fair Valuation

Today, Taiwan Semiconductor is trading at a one year forward earnings multiple of 25.8x. This is above the broad market average and above its five-year median of 21x. However, it should be noted that the tremendous tailwind from AI is a reasonable cause for this elevated earnings multiple as TSM and the industry as a whole may be growing faster than recent history.

Additionally, with earnings expected to grow 26.5% annually, TSM actually has a PEG ratio below 1, which is a discount based on the metric. At the very least, TSM is trading near fair value, with expectations of both sales and earnings to grow above 20% annually.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Should Investors Buy Taiwan Semiconductor Stock?

Given the impressive growth trajectory and strong financial outlook, Taiwan Semiconductor presents a compelling investment opportunity. The company’s dominant position in the semiconductor industry, coupled with its critical role in AI and high-performance computing, supports a robust long-term growth narrative.

For investors seeking exposure to the rapidly expanding AI sector and a key player in the global tech supply chain, Taiwan Semiconductor is well-positioned to deliver strong returns. Despite the slightly elevated valuation, the company’s growth prospects, and critical industry role make it a worthy consideration for any growth-oriented portfolio.

More By This Author:

3 Wood Stocks Worth Watching Despite A Challenging IndustryNvidia Despite Market Gains: Important Facts To Note

3 Reasons Growth Investors Will Love UMH

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more