Bull Of The Day: Sunoco

Making its way onto the coveted Zacks Rank #1 (Strong Buy) list this week, Sunoco (SUN) lands the Bull of the Day. This comes as the year-to-date dip in the leading energy infrastructure and fuel distributors' stock is starting to look like a pleasant buying opportunity.

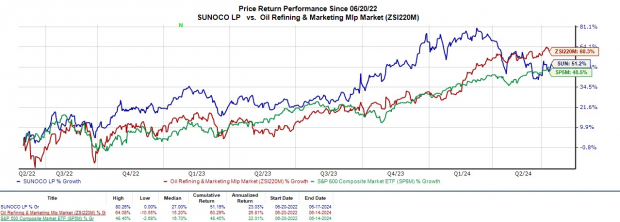

Although Sunoco’s stock is down -10% YTD, SUN is still sitting on +20% gains over the last year and is up +50% in the last two years. More importantly, here are some key viewpoints as to why now is an ideal time to invest in Sunoco.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Industry Leadership

As one of the largest refined product terminal operators in the United States, Sunoco has valuable assets that position it well in various energy transition scenarios. Operating as a Master Limited Partnership (MLP), Sunoco’s primary business comprises the distribution of motor fuel to roughly 10,000 customers across 40 states including independent dealers, commercial customers, convenience stores, and other distributors.

Additionally, Sunoco owns refined product transportation and terminalling assets. Enhancing Sunoco’s financial base and distribution pipeline was the recent acquisition of NuStar Energy for $7.3 billion in May. With that being said, NuStar produced revenues of $1.68 billion and $1.63 billion in 2022 and 2023 respectively with net income spiking 23% last year to $274 million.

The acquisition will expand Sunoco’s domestic dominance and introduce the company’s presence in Mexico while further diversifying its assets. To that point, NuStar has approximately 9,500 miles of pipeline and 63 terminal and storage facilities that store and distribute crude oil, refined products, renewable fuels, ammonia, and specialty liquids.

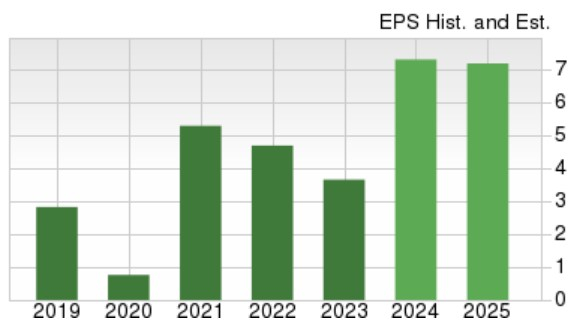

(Click on image to enlarge)

Image Source: Zacks Investment Research

Earnings Estimate Revisions: Seeing that Sunoco’s diversification has strengthened its market position and operational performance, it's noteworthy that earnings estimate revisions for fiscal 2024 have soared 10% over the last 30 days upon the completion of the NuStar acquisition. Plus, FY25 EPS estimates have spiked 7% in the last month.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Overall, Sunoco's increased profitability is very compelling to investors with FY24 earnings now expected to soar 100% to $7.29 per share versus $3.65 a share last year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Cheap P/E Valuation: With rising EPS estimates offering support, Sunoco’s stock is starting to look cheap trading at 7.1X forward earnings which is well below the S&P 500’s 22.7X and a noticable discount to its Zacks Oil and Gas-Refining and Marketing-Master Limited Partnerships Industry average of 13.2X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

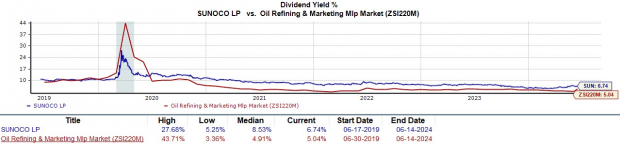

Tax Fee Distribution (Dividend): Since MLPs are structured as pass-through entities, they don’t pay corporate taxes and in turn distribute most of their free cash flow to shareholders in the form of tax-deferred distributions/dividends.

This makes Sunoco's stock very appealing to income seeking investors with SUN currently having a 6.74% annual dividend yield that towers over the S&P 500’s 1.29% average and impressively tops its industry average of 5.04%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Following the recent acquisition of NuStar Energy now looks like an ideal time to invest in Sunoco’s stock which in addition to its strong buy rating has an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

More By This Author:

Clean Energy ETFs Soar On Global Investment Surge3 Energy Stocks To Gain From Seismic Imaging Technologies

3 Financial Transaction Services Stocks To Buy Now

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more