Bull Of The Day: Skechers

The remarkable expansion of footwear and apparel provider Skechers (SKX) shouldn’t be overlooked at the moment with its stock sporting a Zacks Rank #1 (Strong Buy) and landing the Bull of the Day.

Skechers stock also stands out in terms of value and the company is well-positioned to continue expaniding as its products are now available in over 170 countries with more than 4,000 stores and distribution centers worldwide.

Performance Overview

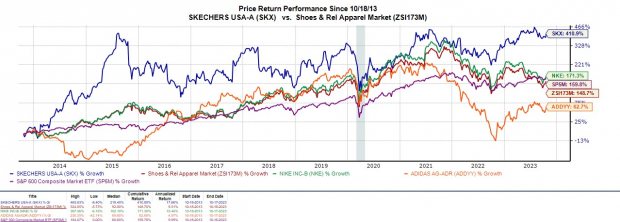

While Nike (NKE) and Adidas (ADDYY) usually come to mind when most think of dominant shoe and apparel companies, Skechers has created quite a niche centered around the comfortability and affordability of its footwear.

This has also transcended to Skechers stock with SKX shares up +21% this year to trail Adidas’+39% but easily top Nike and the broader Zacks Shoes and Retail Apparel Markets' -11% while outperforming the S&P 500’s +17%.

More impressive, over the last three years, Skechers stock has now risen +47% to largely outperform its Zacks Subindustry including Nike and Adidas shares while topping the benchmark as well.

(Click on image to enlarge)

Image Source: Zacks Investment Research

What may be more astonishing to investors is that over the last decade, Skechers stock has skyrocketed over +400% also towering over the performance of its peers and the broader market.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Undervalued Growth & Expansion

As indicated in the recent performance of its stock, demand for Skechers' products has been impressive over the last few years which has helped the company avoid much of the inflationary headwinds that led to slower spending on consumer discretionary items.

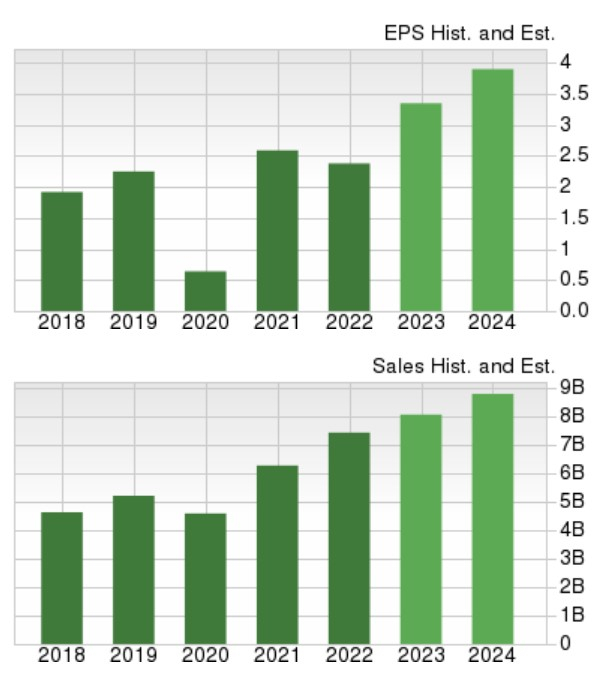

Skechers stock currently has an “A” Zacks Style Scores grade for Growth with annual earnings now forecasted to soar 42% in fiscal 2023 at $3.39 per share compared to EPS of $2.38 last year. Plus, FY24 earnings are projected to climb another 17%. More importantly, earnings estimate revisions have continued to trend higher over the last 60 days.

(Click on image to enlarge)

Image Source: Zacks Investment Research

On the top line, Skechers' sales are anticipated to rise 9% this year and jump another 10% in FY24 to $8.91 billion. Even better, FY24 projections would represent 94% growth over the last five years with sales at $4.59 billion in 2020.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Attractive Valuation

Notably, Skechers stock currently has a “B” Style Scores grade for Value. Making Skechers expansion look more attractive is that SKX trades at a 14.5X forward earnings multiple which is a nice discount to the industry average of 25.9X and the S&P 500’s 20.5X.

Furthermore, this is nicely below the historical industry leader in Nike’s 27.2X. It’s also notable that despite outperforming Nike’s stock and many other industry peers, SKX still trades 82% below its decade-long high of 85.4X forward earnings and at a slight discount to the median of 16.8X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Takeaway

Investors that missed out or overlooked Skechers' growth and expansion in recent years may have the opportunity again with now looking like a great time to buy SKX shares. Those who are contemplating adding positions may continue to be rewarded by doing so as Skechers' impressive stock performance looks set to continue.

To that point, in addition to its Zacks Rank #1 (Strong Buy), Skechers stock also has an overall “A” VGM Zacks Styles Scores grade for the combination of Value, Growth, and Momentum.

More By This Author:

Nvidia Stock Takes A Hit Amid China Restriction News - Time To Buy The Dip?Bull Of The Day: Nu Holdings Ltd.

Three Small-Cap Growth Mutual Funds For Fantastic Returns

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more