Bull Of The Day: Servicenow

ServiceNow (NOW), a current Zacks Rank #1 (Strong Buy), provides cloud computing services that automate digital workflows to accelerate enterprise IT operations. Its solutions address the needs of many departments within an enterprise, including IT, HR, facilities, field service, marketing, customer service, security, legal, and finance.

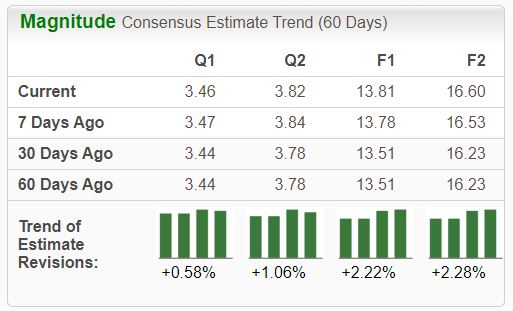

Analysts have raised their earnings expectations across the board.

Image Source: Zacks Investment Research

In addition to favorable earnings estimate revisions, the stock resides in the Zacks Computers – IT Services industry, currently ranked in the top 38% of all Zacks industries. Let’s take a closer look at how the company currently stacks up.

ServiceNow Raises Outlook

ServiceNow recently delivered its latest set of quarterly results, with the company posting its seventh consecutive double-beat. Growth was rock-solid, with earnings and revenue growing 80% and 22%, respectively.

Impressively, the company exceeded all its Q2 sales and profitability metrics, leading it to upgrade its FY24 subscription sales and operating margin guidance. NOW’s margins have been expanding nicely for some time now, as we can see illustrated below.

Please note that the below chart is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

The stock remains a prime selection for those seeking exposure to AI. Following the release, CEO Bill McDermott stated, “Our relevance as the AI platform for business transformation remains stronger than ever as CEOs are looking for new vectors of growth, simplification, and digitization. ServiceNow intends to reinvent every workflow, in every company, in every industry with GenAI at the core.”

The company’s sales growth has been remarkable, posting double-digit percentage year-over-year growth rates in ten consecutive releases. Sales growth is forecasted to remain strong, with expectations for its current fiscal year suggesting a 22% climb.

The stock carries a Style Score of ‘B’ for Growth.

Image Source: Zacks Investment Research

Valuation multiples remain elevated, reflective of investors’ high growth expectations. The current forward 12-month price-to-sales ratio stands at 13.8X, beneath five-year highs of 21.3X and nearly in line with the five-year median.

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

ServiceNow would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

More By This Author:

Will Cloud Results Boost Microsoft And Amazon?Why Did Alphabet Shares Fall Post-Earnings?

Mag 7 Earnings Loom: A Closer Look