Bull Of The Day: Oxford Industries, Inc.

Oxford Industries, Inc. (OXM) is the apparel company behind Tommy Bahama and other popular clothing brands that are staples within higher income demographics. Oxford posted a blowout year in 2021 and its outlook remains strong despite all of the very real economic setbacks.

Better still, Oxford’s strong balance sheet helped it boost its dividend payout as it attempts to return more value to shareholders.

Niche Apparel

Oxford is an apparel firm that sells clothing under multiple brands that all have a beach/vacation vibe. The company’s flagship Tommy Bahama brand has helped lead a broader push in casual short-sleeve, button-up shirts and polos in the men’s fashion world for years.

The company’s men’s shirts are on the higher-cost side, ranging between $100 to $150, which helps with margins. Tommy Bahama is also in the women’s clothing business. Tommy Bahama is by far Oxford’s most well-established brand and the largest revenue generator, accounting for around 60% of 2021 revenue.

Beyond Tommy Bahama, Oxford owns women-focused brand Lilly Pulitzer that aims to represent the “resort lifestyle.” Lilly Pulitzer is the second-largest brand at Oxford.

Southern Tide, The Beaufort Bonnet Company, and Duck Head are also under Oxford’s umbrella. Outside of clothing, Oxford owns restaurants. The division’s revenue jumped 15% last year, driven by the operation of five additional Marlin Bar locations.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Great Year & A Strong Outlook

Oxford’s revenue surged 53% last year to come in above its pre-covid levels at $1.14 billion. The company also swung from an adjusted loss of -$1.81 per share to +$7.99 a share. OXM’s sales were up 9% compared to its pre-covid levels in 2019, when excluding Lanier Apparel that it exited in 2021.

Oxford operates a heavily direct-to-consumer business, driven by its stand-alone and mall-based brick-and-mortar location. Last year, OXM’s full-price DTC sales grew 21% to $723 million vs. 2019’s levels.

Like all retailers, the Tommy Bahama owner is working to improve its e-commerce segment. And its e-commerce improvements paid dividends last year as the segment drove tons of growth. All of this helped Oxford boost its gross margin by 4.4% vs. 2019 to 62%, which was offset by higher freight and other costs.

Zacks current estimates call for Oxford’s revenue to climb by 10% to $1.26 billion in 2022 and then another 4.5% in 2023. This compares favorably to the roughly 5% average revenue growth the firm posted between 2019 and 2014.

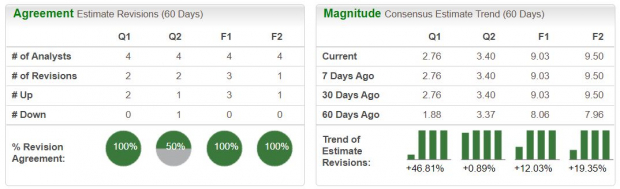

The vacation vibe retailer’s adjusted earnings are projected to climb by 13% and 5%, respectively during this stretch. Oxford’s consensus earnings estimates are up double digits since its last report to help it land a Zacks Rank #1 (Strong Buy). Plus, OXM has blown away Zacks EPS estimates in the trailing four periods, including a 24% beat in Q4 and a 310% beat in the third quarter.

What Else

Despite the ongoing supply chain bottlenecks and rising costs throughout the economy, Oxford’s Textile – Apparel industry is in the top third of over 250 Zacks industries. OXM also grabs a “B” grade for Value and an “A” for Growth in our Style Scores system.

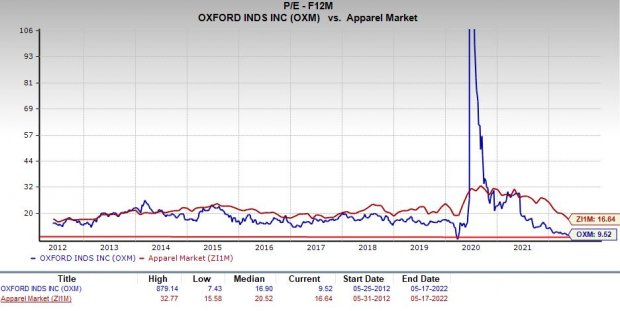

Speaking of value, the stock is currently trading near where it was at the covid lows at 9.5X forward 12-month earnings. This marks a 44% discount to its median over the past decade and 40% value vs. its industry’s current 16.6X average. The valuation chart looks a little out of whack during covid when its earnings dried up, but the red line in the nearby chart show how ‘cheap’ the stock appears at the moment compared to nearly every point in the last 10 years.

Oxford shares have been a bit more volatile than its industry in the last 10 years, but it’s still up 145%. The stock is also only down 3% in the last three months. This looks great next to its industry’s 17% drop and the market’s 7% fall. And Oxford’s current Zacks consensus price target marks 40% upside to Wednesday’s close of around $84 a share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Oxford is set to release its quarterly financial results in the early part of June. The recent string of retail reports from the likes of Target and Walmart might make many investors nervous. Some might want to stay away until after the report, given the huge moves Wall Street titans from have made following their Q1 reports.

But, as we quickly mentioned up top, Oxford raised its quarterly dividend by 31% to $0.55 per share. This payout helps OXM yield 2.65% at the moment, which easily tops the S&P 500, many of its peers, and is not too far off from the 10-year U.S. Treasury’s 2.89%.

Oxford has paid a quarterly dividend every year since it went public back in 1960. And it’s committed to continuing to buy back its own shares. The company can raise its dividend and repurchase shares during these uncertain economic conditions because of its strong balance sheet. OXM closed last year with $400 million in total current assets, including $210 million in cash and equivalents, and $960 million in total assets vs. $226 million in current liabilities and $450 in total.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more