Bull Of The Day: Owens Corning

Owens Corning (OC) develops and produces insulation, roofing, fiberglass composites, and related materials and products. The company has three reportable segments: Composites, Insulation, and Roofing.

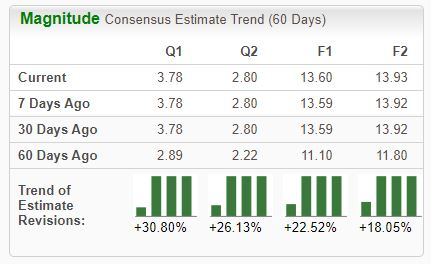

Analysts have taken a bullish stance on the company’s earnings outlook, helping land it into the highly-coveted Zacks Rank #1 (Strong Buy). As we can see below, positive revisions have hit across all timeframes.

Image Source: Zacks Investment Research

The company resides within the Zacks Building Products – Miscellaneous industry, which is currently ranked in the top 8% of all industries thanks to favorable earnings estimate revisions.

As many know, roughly half of a stock’s movement can be attributed to its group, helping to clarify the importance of targeting industries seeing improved outlooks.

Aside from the favorable earnings outlook, let’s take a closer look at a few other characteristics of Owens Corning.

Current Standing

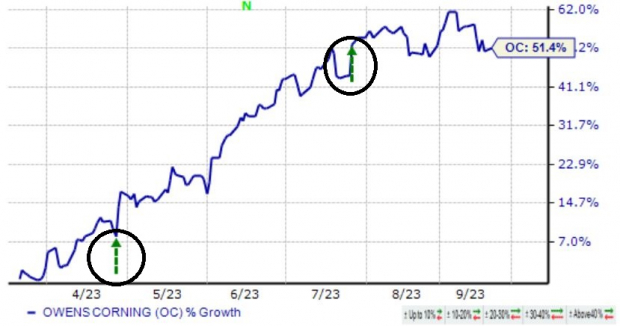

OC shares have been red-hot in 2023, up more than 50% and widely outperforming the S&P 500. As we can see below by the green arrows circled, shares have been boosted post-earnings following back-to-back quarterly releases.

Image Source: Zacks Investment Research

Regarding the most recent quarterly release, OC exceeded the Zacks Consensus EPS Estimate by more than 25% and posted revenue 2% ahead of expectations. Impressively, the company has exceeded bottom line expectations by an average of 18% across its last four releases.

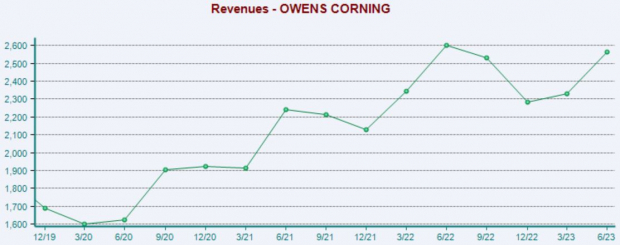

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

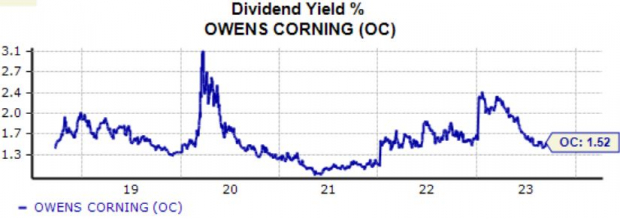

In addition, income-focused investors could be attracted to Owens Corning, with shares currently yielding 1.5% annually. And the company has been committed to increasingly rewarding its shareholders, boasting an 18% five-year annualized dividend growth rate.

Throughout its latest quarter, the company returned more than $160 million to shareholders via dividends and share buybacks.

Image Source: Zacks Investment Research

OC shares aren’t valuation stretched, further reflected by its Style Score of “A” for Value. Shares presently trade at a 10.1X forward earnings multiple, slightly beneath the five-year median and the respective Zacks industry average.

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Owens Corning (OC Quick QuoteOC - Free Report) would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

More By This Author:

Bear Of The Day: Labcorp3 Top Ranked Mutual Funds For Your Retirement

IPO Watch: Is It Time To Buy These Intriguing Stocks?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more