Bull Of The Day: Novo Nordisk

Image Source: Pixabay

Novo Nordisk (NVO - Free Report), a global healthcare company, is a leader in the worldwide diabetes market. The company operates through two segments: Diabetes and obesity care and Biopharmaceuticals.

Analysts have recently taken a bullish stance on the company’s earnings outlook, helping land the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

(Click on image to enlarge)

Image Source: Zacks Investment Research

Aside from the improved earnings outlook, let’s look at several other aspects of NVO shares.

Current Standing

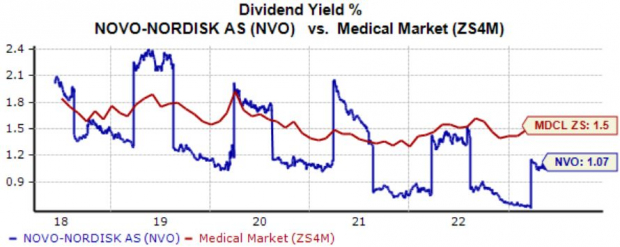

For those seeking dividends, Novo Nordisk has that covered; NVO shares currently yield 1.1% annually, with the company’s payout sitting at a sustainable 45% of earnings.

While the current yield is below the Zacks Medical sector average, the company’s 9.4% five-year annualized dividend growth rate helps bridge the gap.

Image Source: Zacks Investment Research

Shares may not entice value-focused investors, with the current 31.1X forward earnings multiple sitting on the higher end of the spectrum and well above the 24.5X five-year median. The stock carries a Style Score of “D” for Value.

Image Source: Zacks Investment Research

Still, investors have had little issue forking up the premium for NVO shares given the company’s growth profile, with earnings forecasted to climb nearly 50% in its current fiscal year (FY23) and an additional 17% in FY24.

The stock carries a Style Score of “A” for Growth.

Image Source: Zacks Investment Research

Keep an eye out for the company’s upcoming quarterly report expected on August 2nd; the Zacks Consensus EPS Estimate of $1.29 indicates a sizable 53% uptick in earnings year-over-year. In addition, it’s worth noting that the quarterly EPS estimate has been revised nearly 12% higher just since March.

Further, the company is forecasted to post $8.3 billion in quarterly revenue, reflecting more than 40% improvement from the year-ago period. The quarterly sales estimate has been revised nearly 15% higher since March.

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provide a massive edge.

Additionally, the top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Novo Nordisk (NVO - Free Report) would be an excellent stock for investors to keep on their watchlists, as displayed by its Zack Rank #1 (Strong Buy).

More By This Author:

Campbell Soup Q3 Earnings And Revenues Surpass EstimatesTime To Buy Broadcom Or Dell Technologies Stock After Earnings

These Stocks Led The End Of The Week Rally - Is It Time To Buy?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more