Bull Of The Day - MercadoLibre

MercadoLibre (MELI) is one of the largest e-commerce platforms in South America. The company is a market leader in e-commerce in Brazil, Argentina, Colombia, Chile, Ecuador, Costa Rica, Peru, Mexico, and Uruguay based on unique visitors and page views.

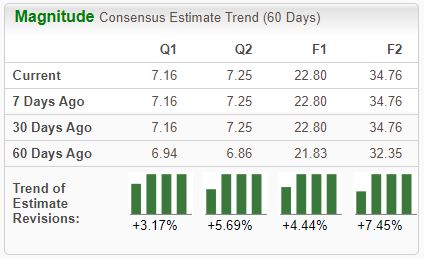

The stock is currently a Zacks Rank #1 (Strong Buy), with analysts raising their outlooks across all timeframes.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In addition, the company is part of the Zacks Internet - Commerce industry, currently ranked in the top 28% of all Zacks industries. Aside from the improved earnings outlook and favorable industry standing, let’s take a closer look at a few other aspects of the company.

MercadoLibre

MELI shares have been red-hot over the last three months, adding more than 25% in value and widely outperforming relative to the S&P 500. Shares got a notable boost following its latest quarterly release, with buyers stepping up in a big way.

(Click on image to enlarge)

Image Source: Zacks Investment Research

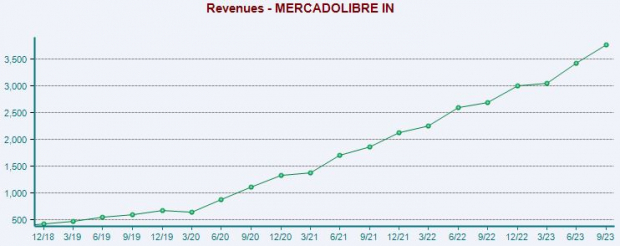

Concerning the release mentioned above, MELI posted a sizable 22.4% beat relative to the Zacks Consensus EPS Estimate and reported revenue 5% ahead of expectations, reflecting growth rates of 180% and 70%, respectively.

In addition, the company posted $685 million in income from operations, reflecting a quarterly record. Consumers continue to flock to the platform in a big way, with total items sold growing an impressive 26% from the year-ago period.

As shown below, the company’s top line remains visually healthy.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shares presently trade at a 4.4X forward price-to-sales (F1), a fraction of the 10.3X five-year median and highs of 22.1X in 2020. While the multiple is undoubtedly rich, the company’s high-growth nature helps explain, with earnings forecasted to climb 140% in its current year on 36% higher sales.

The stock sports a Style Score of “D” for Value.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Keep an eye out for MercadoLibre’s upcoming release expected on February 22nd, as the Zacks Consensus EPS Estimate of $7.16 reflects growth of 120% from the year-ago period. Our consensus revenue estimate stands at $4.1 billion, suggesting an improvement of 40% year-over-year.

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

MercadoLibre (MELI Quick QuoteMELI - Free Report) would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

More By This Author:

5 ETF Zones Scaling New Highs At The Start Of 20243 Oil & Gas Pipeline Stocks To Gain From The Prospering Industry

Ford Sells 2M Vehicles In The US In 2023, Gains 7.1% Y/Y

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more