Bull Of The Day: Mercadolibre

Many analysts are bullish on e-commerce giant MercadoLibre’s (MELI) stock at the moment with the company’s top and bottom-line continuing to expand at a monstrous rate.

Earnings estimates are beginning to soar after impressive Q2 results earlier in the month and MercadoLibre’s stock currently covets a Zacks Rank #1 (Strong Buy) and the Bull of the Day.

Stellar Q2 Results

Based in Argentina, MercardoLibre operates one of the largest e-commerce platforms in South America. Thinking MercardoLibre’s well-documented and renowned growth can’t continue would be a mistake.

To that point, Q2 earnings of $5.16 per share easily surpassed estimates of $4.13 a share by 25%. This also soared 112% from earnings of $2.43 a share in Q2 2022. Second-quarter sales of $3.41 billion beat expectations by 4% and climbed 31% from $2.59 billion in the prior-year quarter.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Furthermore, MercadoLibre had a 16.3% profit margin on income from operations which nearly doubled to $558 million.

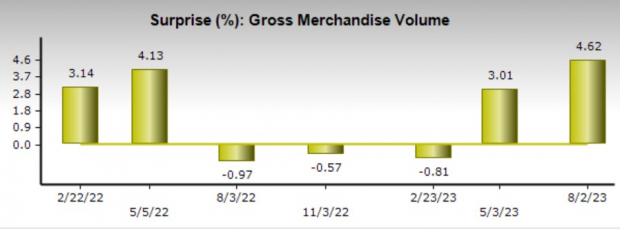

It’s also noteworthy that the company’s gross merchandise value (GMV) hit the $10 billion mark for the first time driven by strength in Brazil and Mexico. MercadoLibre's GMV came in at $10.5 billion also beating Zacks estiamtes by 4%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Robust Growth Continues

Consumers in South America are more accustomed to economic headwinds so inflation did not slow MercadoLibre’s growth like one might think. Still, as inflation begins to ease MercadoLibre’s presence in many South American countries along with Mexico and Spain is expected to accelerate its growth.

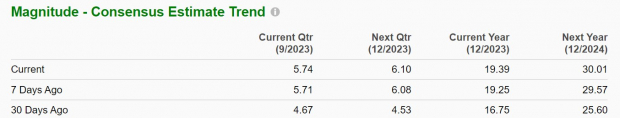

Fiscal 2023 earnings estimates have now risen 16% over the last month after MercardoLibre’s Q2 report helped reconfirm this. Even better, FY24 earnings estimates have soared 17% in the last 30 days.

Image Source: Zacks Investment Research

MercadoLibre’s annual earnings are now forecasted to skyrocket 103% this year to $19.39 per share compared to $9.53 a share in 2022. Fiscal 2024 earnings are anticipated to leap another 55% to $30.01 per share.

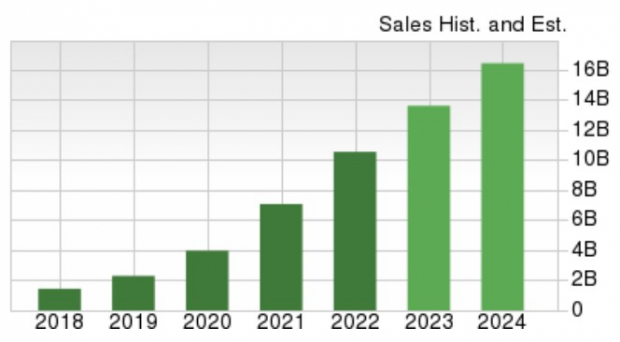

This will be accompanied by robust top-line expansion as well with sales projected to climb 31% this year to $13.86 billion compared to $10.54 billion in 2022. More impressive, FY24 sales are expected to soar another 24% and projections of $17.22 billion would represent an astonishing 652% growth from pre-pandemic levels with 2019 sales at $2.29 billion.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Simply put, now looks like a great time to buy MercadoLibre stock as the company is strategically set up for growth with e-commerce operations in lucrative economic hubs throughout Latin America.

Easing inflation will only fuel the company’s growth potential and with MercadoLibre’s stock up 42% this year it’s notable that the Average Zacks Price Target of $1,634.50 per share still suggests 36% upside from current levels.

More By This Author:

Bear Of The Day: Churchill Downs2 Foreign Auto Stocks To Tap Into The Industry's Continued Positivity

5 Insurance Brokerage Stocks To Benefit From Higher Demand

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more