Bull Of The Day: Li Auto

Company Overview

Zacks Rank #1 (Strong Buy) stock Li Autio (LI) is an electric vehicle (EV) manufacturer known for its innovative approach to sustainable transportation. Unlike traditional electric car companies, Li Auto specializes in extended-range electric vehicles (EREVs) that integrate a small gasoline engine to charge the battery, offering a solution to “range anxiety” commonly associated with pure electric cars. This unique design, coupled with advanced technology and a focus on luxury, has positioned Li Auto as a critical player in the rapidly growing EV market, catering to consumers’ desire for efficiency and convenience.

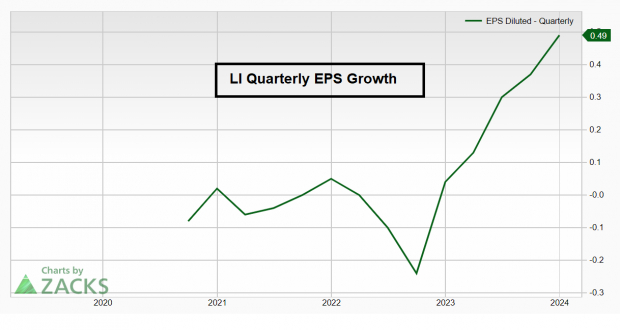

LI Reports a “Double Beat”

Late last month, Li Auto posted a double beat for the quarter. Revenue came in at $5.88 B for a year-over-year increase of 129.70% (beat Wall St. estimates by $398 M). Meanwhile, EPS of $0.30 was enough to beat Wall St. estimates by $0.01 to grow EPS by a robust 130.77% year-over-year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

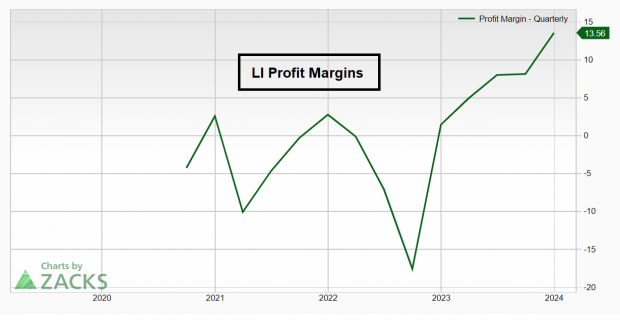

Digging Deeper into LI’s Electrifying Numbers

Apart from the headline figures of EPS and revenue, one standout metric is growing vehicle margins. While Tesla (TSLA ), the legacy EV leader, has been grappling with declining automotive gross margin, LI has seen vehicle margins expand notably by 150 basis points quarter-over-quarter to reach 22.7%. In fact, profit margins for the company reached new highs in the recent quarter.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The company attributes this improvement to its growing scale, supply chain optimization, and consistently enhanced efficiency. Despite an anticipated slowdown in Q1 deliveries due to the seasonal nature of auto sales in China, LI experienced robust demand, with deliveries nearly tripling year-over-year to 131,805 units. LI’s management team anticipates the momentum to continue and foresees a 90-96% increase in deliveries to 100,000-103,000 vehicles in Q1. Meanwhile, LI’s strong execution is not the only catalyst – the company is gearing up to launch its Mega MPV Minivan.

Survived “The Kitchen Sink”

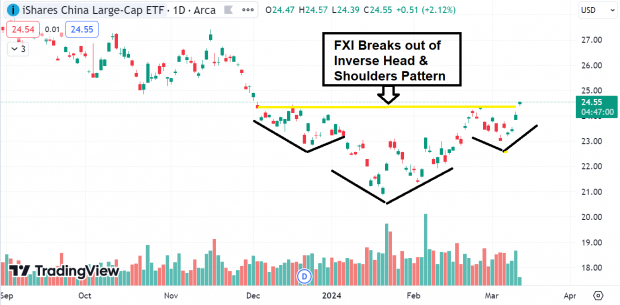

Even in a vacuum, LI Auto’s recent EPS report would be quite impressive. However, when you add context to the recent earnings report, the numbers are even more eye-popping. China’s economy and stock market have been in freefall for five years, losing some 44%. However, recent positive earnings reactions from Chinese equities like JD.com (JD) and Bilili (BILI) signal that the worst may be behind Chinese stocks.

The FXI ETF is probably the best proxy U.S.-based investors use to measure China. Currently, FXI is breaking out of a textbook inverse head-and-shoulders pattern. Inverse head-and-shoulders patterns are considered bullish and are one of the most reliable indications of a potential trend reversal from a downtrend to an uptrend.

(Click on image to enlarge)

Image Source: TradingView

If China’s equity market and economy stabilize, it will be yet another bullish catalyst for Li Auto.

Bull Flag Set Up

After Li’s positive EPS report, shares jumped 18% on massive volume – a sign of bullish accumulation. Now, shares are resetting in a picture-perfect bull flag pattern on the daily chart, allowing investors to take advantage of a strong reward-to-risk zone potentially.

(Click on image to enlarge)

Image Source: TradingView

Bottom Line

Li Auto is witnessing expanded EPS and margins due to its innovative extended-range electric vehicles (EREVs). Despite challenges in China’s equity market, LI remains resilient, with solid demand and plans for significant delivery increases.

More By This Author:

AI's Winning Duos: BBAI & PLTR, SOUN & NVDASmall but Mighty: Is the Russell 2000 Signaling a Comeback?

Beyond the "Mag 7": 3 Risk-On Market Forces

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more