Bull Of The Day: JP Morgan Chase & Co.

Company Overview

Newly ranked Zacks #1 (Strong Buy) stock JP Morgan Chase & Co., commonly known as JP Morgan (JPM), is one of the world’s largest and most influential institutions. The banking juggernaut operates as a multinational investment bank and financial services company, offering various services to individuals, businesses, and governments. JP Morgan provides services such as investment banking, asset management, commercial banking, private banking, securities trading, and treasury services. The company plays a significant role in global finance by facilitating capital raising, mergers and acquisitions (M&A), and trading in several unique markets. Additionally, the company offers retail banking services, including mortgages, credit cards, and personal loans, serving millions of consumers worldwide. With iconic CEO Jamie Dimon at the helm, the company is best known for its expertise in navigating complex financial environments like the one we’re experiencing now.

Tough Times Never Last. But Strong Banks Do

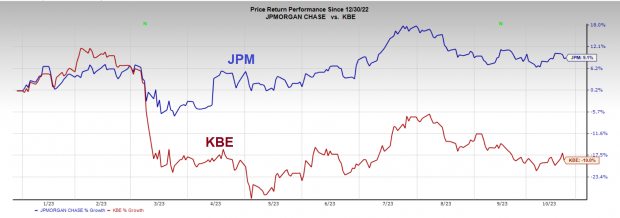

This March, three mid-size US banks failed in less than a week. Outside of the pandemic crash of 2020, banks are on pace for their worst year since the Global Financial Crisis of 2008. The SPDR S&P Bank ETF (KBE) is down nearly 20%, while the SPDR Regional Banking ETF (KRE) is down a staggering 29% year-to-date.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Deposits Are the Lifeblood of Banks

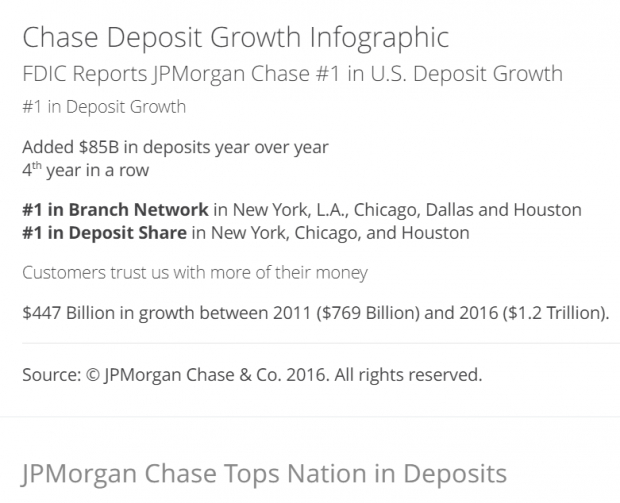

JP Morgan grew through acquisitions, both domestic and foreign. Most notably, the company acquired the failed First Republic Bank with generous assistance from the FDIC. Internationally, the company has grown through investments like the one in Brazil’s C6 Bank (JPM owns 46% now). All these acquisitions, combined with JPM’s reputation as a stable bank, have led to soaring deposits, while competitors like Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS) experience deposit droughts. In fact, JPM added $85 billion in deposits year-over-year and is ranked #1 in deposit growth.

(Click on image to enlarge)

Image Source: JPMorgan Chase

Deposits are the lifeblood of banks because they enable lending, generate income, and maintain liquidity. The ongoing banking crisis is only helping JPM further.

Benefitting from the Most Popular Credit Card Franchise

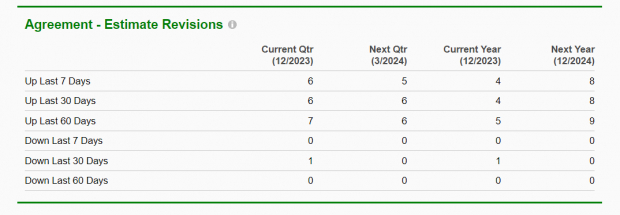

Though a potential economic slowdown and high rates will hamper wholesale loan demand, demand for consumer loans (specifically credit cards) will likely remain strong in the near term. Analysts tracked by Zacks are taking note – six analysts have revised estimates higher, while only one has revised estimates lower.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Strong Cash Position & Return on Equity

JPM has a solid balance sheet. Most of the company’s debt is long-term, and the company has ample money coming in to cover any obligations (even if the economy turns sour). JPM’s trailing return on equity (ROE) reflects its growth potential. The company’s trailing ROE of 17.97% compares favorably with the banking industry’s 12.56% ROE.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Despite a challenging banking landscape, with many banks facing significant declines, JP Morgan remains resilient. The company’s success is attributed to strategic acquisitions and substantial deposit growth, in contrast to competitors experiencing deposit shortages.

More By This Author:

Bull of the Day - Uber TechnologiesAT&T Beats Q3 Earnings Estimates On Higher Revenues

Netflix Q3 Earnings And Revenues Surpass Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more