Bull Of The Day: JAKKS Pacific, Inc.

Photo by Yuri Shirota on Unsplash

JAKKS Pacific (JAKK), a Zacks Rank #1 (Strong Buy), represents a great market turnaround story as the stock has surged more than 350% off the pandemic lows. After plunging as low as $3 per share during the March 2020 bottom, JAKK now trades at roughly $14/share and the bull run looks set to continue. A very low percentage of companies complete the journey from penny stock to mid-double digits. These companies all experience stellar growth in terms of both revenue and earnings, and JAKK is no exception.

The stock hit a 52-week high earlier this month before cooling off slightly as we head into month-end. JAKK is part of the Zacks Toys – Games – Hobbies industry group, which is currently ranked in the top 15% of all Zacks Ranked Industries. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market.

Quantitative research studies have shown that roughly half of a stock's price movement can be attributed to its industry group. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Also note the favorable valuation characteristics for this industry group:

(Click on image to enlarge)

Image Source: Zacks Investment Research

Company Description

JAKKS Pacific develops, produces, sells, and distributes toys and related products. JAKK is a multi-line, multi-brand company that also sells electronics and consumables. Its products include action figures, toy vehicles, dolls, inflatable tents, wagons, costumes, and other child-related accessories. JAKK sells its products through both in-house and independent sales teams to mass-market retail chain stores and department stores. The toy company was incorporated in 1995 and is headquartered in Santa Monica, CA.

JAKK has been benefiting from strategic, innovative collaborations with popular brands and movie franchises. The company has collaborations with Disney, Skechers, Nickelodeon, Cabbage Patch Kids, and Chico to manufacture toys and related merchandise. JAKK has realized the importance of online retailing and shifted its focus to boosting online sales.

The multi-brand company is optimistic about its robust consumer demand and has implemented a multi-tier development program focused on designing and developing products specific to certain retail channels. This includes the likes of Walmart, Target, Amazon, TJ Maxx, Ross, GameStop, and others.

Earnings Trends and Future Estimates

JAKK has built up an impressive earnings history, surpassing earnings estimates in each of the last six quarters. Back in February, the company reported Q4 EPS of $0.14, a +115.73% surprise over the $-0.89 consensus estimate. JAKK has delivered a +63.13% average earnings surprise over the last four quarters. Notice the turnaround trend in earnings over the past several years:

Image Source: Zacks Investment Research

Analysts covering the toy company have increased their full-year EPS estimates by +24.89% in the past 60 days. The 2022 Zacks Consensus EPS Estimate now stands at $2.81, reflecting potential growth of 8.49% relative to last year. Sales are anticipated to climb 4.41% to $648.5 million.

Let’s Get Technical

JAKK shares have advanced over 86% in the past year. Only stocks that are in extremely powerful uptrends are able to make this type of price move. The stock is up nearly 40% this year alone, widely outperforming the major indices. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how the 50-day and 200-day moving averages are sloping up as evidenced by the blue and red lines, respectively. The stock had been making a series of higher highs through early March, and the recent pullback represents a solid buying opportunity. With both strong fundamentals and technicals, JAKK is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, JAKKS Pacific has recently witnessed positive revisions. As long as this trend remains intact (and JAKK continues to deliver earnings beats), the stock will likely continue its bullish run this year.

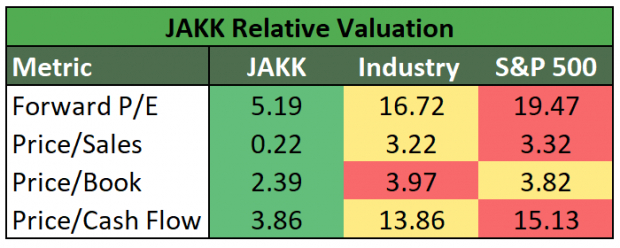

Despite the impressive performance, JAKK is still relatively undervalued, irrespective of the metric used:

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

With top-ranked ‘A’ marks in our Zacks Growth and Value Style Score categories, JAKK is well-positioned to gain market share. Backed by a leading industry group and robust history of earnings beats, it’s not difficult to see why this company is a compelling investment.

A strong technical trend along with relative undervaluation certainly justify adding shares to the mix. Recent positive earnings estimate revisions should also serve to create a ‘floor’ regarding any sudden or unexpected downside moves. If you haven’t already done so, make sure to put JAKK on your shortlist.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more