Bull Of The Day: J. Jill

J.Jill, Inc. (JILL) is back on trend with women's apparel and has raised full year 2024 guidance. This Zacks Rank #1 (Strong Buy) also recently initiated a quarterly dividend.

J.Jill is a national women's retailer that provides apparel, footwear and accessories. It operates 244 stores in the United States and an e-commerce platform. It's a small cap company with a market cap of just $399 million.

Another Beat in Fiscal Q1 2024

On June 7, 2024, J. Jill reported its fiscal first quarter 2024 results and beat on the Zacks Consensus by $0.08, or 7%. Earnings were $1.22 versus the Zacks Consensus of $1.14.

J. Jill has put together an impressive earnings surprise track record the last few years. This was the 11th quarterly earnings beat in a row.

Sales rose 7.5% to $161.5 million from $150.2 million in the year ago period.

Comparable sales, which is a key metric in retail, rose 3.1% year-over-year.

The company also has its direct-to-consumer business humming as it represented 47% of total net sales, which was up 11.6% compared to the first quarter of last year.

Gross margin also expanded 80 basis points to 72.9% from 72.1% in the first quarter of fiscal 2023.

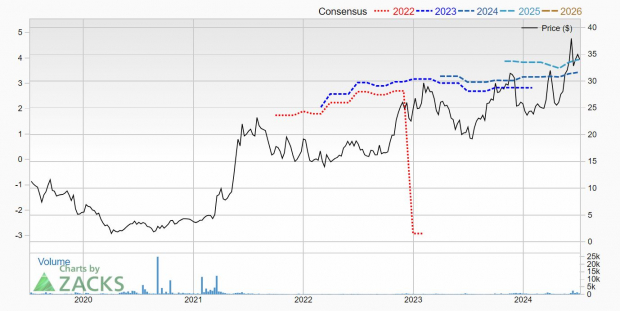

Analysts Bullish on F2024 and F2025

J.Jill is bullish. It now expects full year fiscal 2024 sales to grow between 1% and 3%.

The analysts are bullish too. They have been raising their earnings estimates over the past 60 days. That has pushed the Zacks Consensus for fiscal 2024 up to $3.43 from $3.25 just sixty days ago. That is earnings growth of 9.6% over fiscal 2023 as J.Jill made just $3.13 last year.

They are also bullish on fiscal 2025 with analysts expecting another 14.6% earnings growth, or $3.93.

Here's what it looks like on the price and consensus chart.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Reducing Debt and Interest Expense

J. Jill has also made a concerted effort to pay down its outstanding debt. On May 10, 2024, it made a voluntary debt prepayment of $58.2 million.

And on June 24, 2024, J.Jill announced it had executed another voluntary debt principal payment of $27.2 million, which reduced the amount outstanding under the Company's term loan to about $81 million.

In addition to the principal, accrued interest and a 3% voluntary premium were paid, which resulted in a total payment of $28.8 million.

For the June 24 payment, J.Jill used the proceeds from a $31 million primary equity offering completed on June 14, 2024.

Initiating a Dividend

Also on May 10, 2024, the company announced it was initiating a $0.07 per share quarterly dividend. It also said it intends to pay it quarterly, per Board approval, of course.

The dividend is currently yielding 0.8%.

Shares Hit 5-Year Highs in 2024

J.Jill is a small cap company so it's stock is subject to more volatility. But the shares have been rising the last 5 years and hit a new high earlier in 2024.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Year-to-date, shares are up 34%, which is beating the performance of the S&P 500, which is up 17.4% during that same time.

Yet, J.Jill shares are cheap. It trades with a forward P/E of just 9.9 and has a P/S ratio of only 0.6. A P/S ratio under 1.0 usually indicates a company is undervalued. An investor is getting the shares on sale.

For investors looking for a small cap retailer that is on the upswing, J.Jill should be on your short list.

More By This Author:

Bull Of The Day - Abercrombie & FitchBull Of The Day: Sharkninja

The Hottest Stocks To Buy In 2024

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more