Bull Of The Day: Interactive Brokers

Interactive Brokers (IBKR) is a leading online brokerage firm with an advanced trading platform and global reach. The firm offers trading in a wide range of investment products, including stocks, options, futures, currencies, and bonds. The platform caters to both individual investors and institutions.

Because of its low-cost trading, advanced trading tools, and access to markets around the world, Interactive Brokers is the preferred choice for active traders and investors, making it a premium brand in the industry.

Interactive Brokers has grown its top line at a compound annual growth rate of 17.9% annually over the last five years and currently boasts a Zacks Rank #1 (Strong Buy) rating.

Additionally, while rising interest rates have become an issue for many companies, high rates have been a boon to Interactive Brokers’ business. Because interest income is a major driver of revenue, the company welcomes the higher rates.

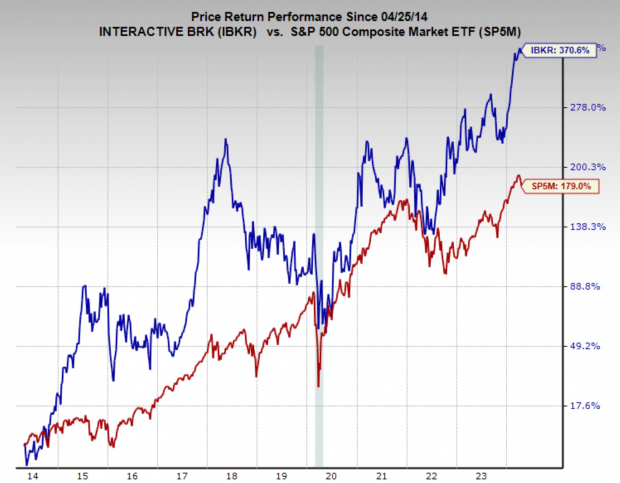

IBKR has been a market beating stock compounding at 16.7% annually over the last decade demonstrating its value generating abilities.

Image Source: Zacks Investment Research

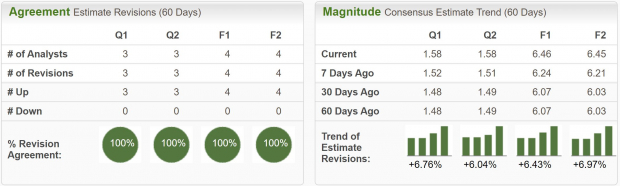

Analysts Raise Estimates

Reflecting its top Zacks Rank, analysts have unanimously raised earnings estimates across the timeframes.

Current quarter earnings estimates have been revised higher by 6.8% over the last two months and are projected to grow 19.7% YoY to $1.58 per share. FY24 earnings estimates have increased by 6.4% and are forecast to climb 12.4% YoY to $6.46 per share.

Over the next 3-5 years EPS are expected to grow at an annual rate of 15.2% annually.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Technical Breakout

IBKR stock has been forming a bullish technical pattern over the last two weeks. What is also notable is that on Thursday, equity markets were very heavy and trading lower, but Interactive Brokers showed considerable strength.

After trading above the $110 level, it signaled a technical breakout, and if it can hold above the level, should draw in buyers and continue to rally.

Image Source: TradingView

Historical Discount

Another welcome development is Interactive Brokers’ valuation. As of today, IBKR is trading at a one year forward earnings multiple of 17.5x, which is below the market average and below its 10-year median of 22.4x.

Image Source: Zacks Investment Research

Bottom Line

Interactive Brokers is a high-quality business, trading at a historical discount, with numerous bullish catalysts. For investors looking to add a quality compounder stock to their portfolios with a top Zacks Rank, IBKR is a very worthy consideration.

More By This Author:

3 Finance Stocks to Consider as Earnings ApproachChipotle Gears Up To Report Q1 Earnings: What To Expect?

Is A Beat In Store For American Airlines In Q1 Earnings?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more