Bull Of The Day: Enterprise Products Partners

Image Source: Pixabay

Enterprise Products Partners L.P. (EPD - Free Report) was recently added to Zacks #1 Rank (Strong Buy) list as analysts are raising full-year earnings estimates even before the company reports second quarter earnings results.

Enterprise Products Partners is a North American public partnership that provides midstream energy services to producers and consumers of natural gas, NGLs, crude oil, refined products, and petrochemicals.

The partnership owns 50,000 miles of pipelines, over 260 million barrels of storage capacity for NGLs, crude oil, petrochemicals, and refined products, and 14 billion cubic feet of natural gas storage capacity.

Its services include natural gas, crude oil, and petrochemical gathering, transportation, and storage as well as NGL transportation, fractionation storage, and marine terminals. It also has a marine transportation business that operates on key U.S. inland and Intracoastal waterway systems.

Raised the Dividend Again

On July 7, Enterprise Products Partners raised its second-quarter dividend 5.6% year-over-year to $0.475 per unit.

It was the 74th distribution increase since the company's IPO in 1998 and the 24th year of distribution growth.

The dividend is currently yielding a juicy 7.5%.

Enterprise Products Partners also repurchased $35 million of common units in the second quarter as part of its share buyback program.

It has utilized 26% of its $2 billion share buyback program.

Analysts Raise Full Year Earnings Estimates

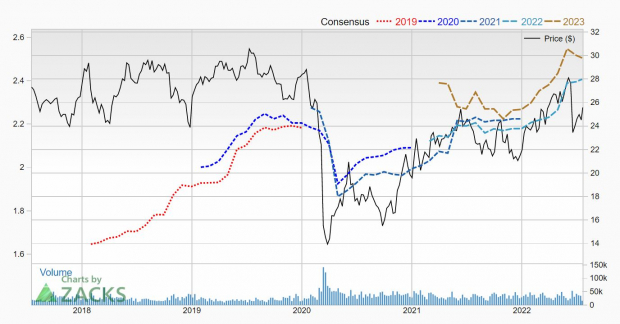

In the last week, the analysts have gotten bullish on Enterprise Products Partners even though it hasn't reported earnings yet. 3 estimates have been revised higher for 2022 in that time, which has pushed the Zacks Consensus Estimate up to $2.41 from $2.40.

That is an earnings growth of 14.8% as the company made $2.10 last year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Enterprise Products Partners will report second-quarter earnings on Aug 3, 2022, before the market opens.

Shares Fall From Highs

The energy stocks have pulled back from 2022 highs and Enterprise Products Partners is no exception. Shares have fallen 5.5% in the last 3 months.

(Click on image to enlarge)

Image Source: Zacks Investment Research

They are cheaper than earlier this year, with a forward P/E of just 10.6.

For investors looking for a big income payout and rising earnings estimates, Enterprise Products Partners is one to keep on your shortlist.

More By This Author:

5 Cheap Healthcare Stocks in 2022How To Be A Long-Term Stock Investor

What To Watch With The FAANG Stock Earnings Charts

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more