Bull Of The Day: Emcor Group, Inc.

EMCOR Group, Inc. (EME) is a leader in mechanical and electrical construction, industrial and energy infrastructure, and building services. The company serves commercial, industrial, utility, and institutional clients.

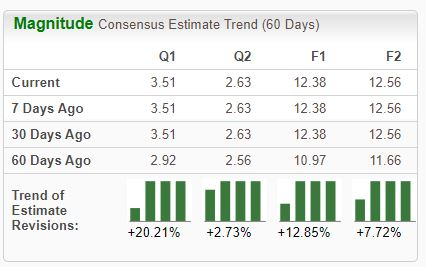

Analysts have taken a bullish stance on the company’s outlook across the board, pushing it into a favorable Zacks Rank #1 (Strong Buy). As shown below, the revisions trend has been particularly positive for the company’s current quarter, up more than 20% over the last several months.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In addition, the company is part of the Zacks Building Products – Heavy Construction industry, currently ranked in the top 34% of all Zacks industries. Aside from the improved earnings outlook and favorable industry standing, let’s take a closer look at a few other aspects of the company.

EMCOR Group

EMCOR shares have delivered a notably strong performance in 2023, up nearly 50% and outperforming the general market handily on the back of better-than-expected quarterly results. Concerning its latest release, the company posted a 33% beat relative to the Zacks Consensus EPS Estimate and reported sales 2% ahead of expectations, with revenue of $3.2 billion reflecting a quarterly record.

The company’s top line remains in good shape, recovering nicely from pandemic lows in 2020.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The better-than-expected quarterly results were driven by continued strength within its U.S. Construction segments, with sales increasing 16% year-over-year on a combined basis. The company continued to see resilient demand for its services, particularly in semiconductors, data centers, manufacturing re-shoring, healthcare, and across the EV value chain.

EMCOR lifted its current year revenue and EPS guidance following the strong quarter, now expecting full-year revenues of $12.5 billion and EPS in a band of $12.25 - $12.65 per share ($10.75 – $11.25 per share previously).

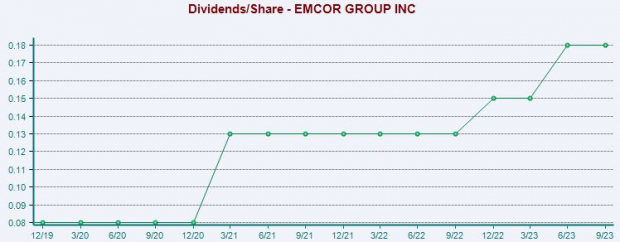

Investors also stand to reap a passive income from EME shares, presently yielding a modest 0.3% annually paired with a sustainable payout ratio sitting at 6% of its earnings. While the yield may be on the lower end, the company’s 21% five-year annualized dividend growth rate helps pick up the slack.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shares currently trade at a 17.4X forward 12-month earnings multiple, above the five-year median by a fair margin but well off the 20.1X high earlier in 2023. The stock carries a Style Score of “C” for Value.

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

EMCOR Group, Inc would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

More By This Author:

Bear Of The Day: The Walt Disney Co.Time to Buy These Highly Ranked Growth Stocks

2023 Rewind: 5 Valuable Lessons

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more